Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Johannesburg's property market is included in our pack

Johannesburg's residential property market in 2026 is showing clear signs of recovery, with prices rising steadily but selectively across the city's diverse neighborhoods.

This article breaks down the latest housing prices in Johannesburg, what's driving them, and where experts believe they're heading over the next decade.

We update this blog post regularly to keep our numbers fresh and our forecasts grounded in reality.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Johannesburg.

Insights

- The average property price in Johannesburg reached approximately R1.4 million in January 2026, representing a meaningful recovery from the R1.3 million recorded in 2024.

- Johannesburg property prices grew around 5% nominally over the past 12 months, but only 1% to 2% in real terms after adjusting for inflation running at about 3.5%.

- Townhouses and cluster homes in Johannesburg security estates are outperforming other property types because buyers prioritize safety and lock-up-and-go convenience.

- Suburbs like Parkhurst, Bryanston, and Douglasdale rank among Johannesburg's most liquid markets, with homes selling faster than in other areas.

- The South African Reserve Bank's repo rate sits at 6.75% in early 2026, with prime at 10.25%, making mortgages more affordable than in recent tighter periods.

- Ultra-luxury properties above R5 million in Johannesburg neighborhoods like Sandhurst and Hyde Park take significantly longer to sell, signaling potential overpricing.

- Johannesburg's 5-year property price forecast suggests cumulative growth of 30% to 45%, translating to roughly 5.5% to 7.5% annual appreciation.

- The Gautrain expansion project could boost property values along new corridors, though timing and delivery remain uncertain factors for investors.

What are the current property price trends in Johannesburg as of 2026?

What is the average house price in Johannesburg as of 2026?

As of early 2026, the average transacted residential property price in Johannesburg sits at approximately R1.4 million, which converts to around $78,000 USD or €72,000 EUR at current exchange rates.

When looking at price per square meter, Johannesburg properties average about R12,000 per square meter in 2026, equivalent to roughly $670 USD or €615 EUR per square meter, though this varies significantly by property type and location.

The realistic price range covering roughly 80% of property purchases in Johannesburg falls between R800,000 and R3.5 million (approximately $44,000 to $195,000 USD, or €41,000 to €180,000 EUR), with most activity concentrated in the mid-market segment where buyer demand is strongest.

How much have property prices increased in Johannesburg over the past 12 months?

Property prices in Johannesburg increased by approximately 5% in nominal terms over the 12 months leading to January 2026, though after accounting for inflation, real growth was more modest at around 1% to 2%.

Across different property types in Johannesburg, price increases ranged from about 3% for sectional title apartments to nearly 6% for freehold houses in sought-after suburbs during this period.

The single most significant factor driving this price movement in Johannesburg was the improved interest rate environment, with the South African Reserve Bank cutting the repo rate to 6.75%, which boosted buyer affordability and brought more qualified purchasers into the market.

Which neighborhoods have the fastest rising property prices in Johannesburg as of 2026?

As of early 2026, the three Johannesburg neighborhoods experiencing the fastest rising property prices are Parkhurst, Bryanston, and the Midrand/Waterfall corridor, each benefiting from strong buyer demand and limited quality stock.

Annual price growth in these top-performing Johannesburg neighborhoods ranges from approximately 7% to 10%, with Parkhurst leading due to its walkable lifestyle appeal, Bryanston driven by family demand for secure estates, and Midrand/Waterfall benefiting from commercial development spillover.

The main demand driver explaining why these Johannesburg neighborhoods are outperforming is the combination of security, good schools, proximity to employment nodes, and lifestyle amenities that buyers prioritize in today's market.

By the way, you will find much more detailed price ranges across neighborhoods in our property pack covering the real estate market in Johannesburg.

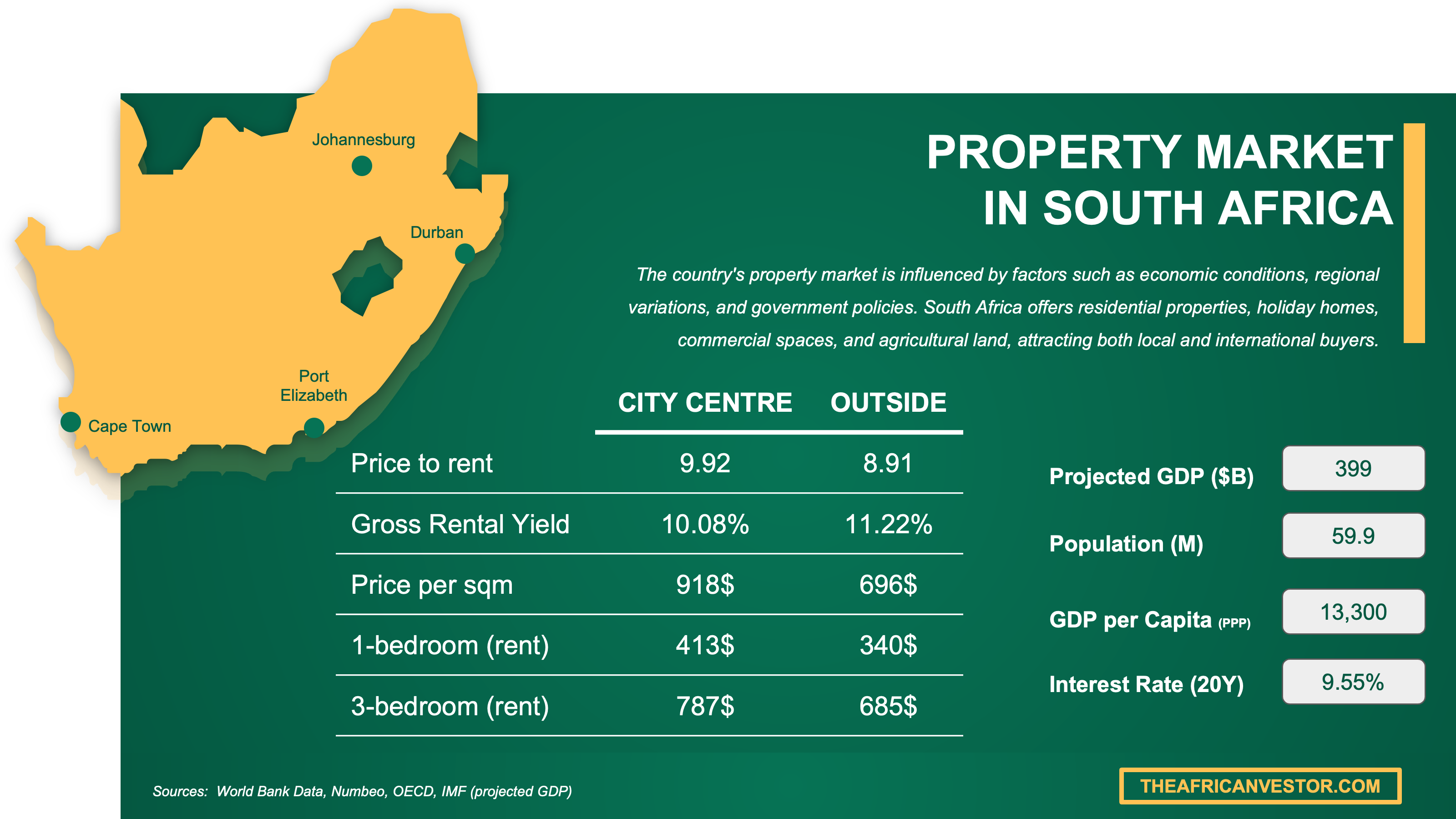

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which property types are increasing faster in value in Johannesburg as of 2026?

As of early 2026, the ranking of property types by value appreciation rate in Johannesburg places townhouses and cluster homes first, followed by well-located apartments in prime nodes, then freehold family houses in lifestyle suburbs, with standalone apartments in less central areas trailing behind.

The top-performing property type in Johannesburg, townhouses and cluster homes in security estates, is appreciating at approximately 6% to 8% annually, outpacing other categories by roughly 1 to 2 percentage points.

The main reason townhouses and cluster homes are outperforming other property types in Johannesburg is that they hit the sweet spot for today's buyers: they offer security, manageable maintenance, and appeal to both families trading space for safety and first-time buyers stepping up from renting.

Finally, if you're interested in a specific property type, you will find our latest analyses here:

- How much should you pay for a house in Johannesburg?

- How much should you pay for an apartment in Johannesburg?

- How much should you pay for a townhouse in Johannesburg?

What is driving property prices up or down in Johannesburg as of 2026?

As of early 2026, the top three factors driving property prices in Johannesburg are the improved interest rate environment making mortgages more affordable, a shortage of quality stock in desirable northern suburbs, and the broader economic recovery boosting buyer confidence.

The single factor with the strongest upward pressure on Johannesburg property prices is the interest rate relief from the South African Reserve Bank, with the repo rate at 6.75% and prime at 10.25%, which has meaningfully expanded the pool of buyers who can qualify for home loans.

If you want to understand these factors at a deeper level, you can read our latest property market analysis about Johannesburg here.

Get fresh and reliable information about the market in Johannesburg

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What is the property price forecast for Johannesburg in 2026?

How much are property prices expected to increase in Johannesburg in 2026?

As of early 2026, property prices in Johannesburg are expected to increase by approximately 4% to 7% in nominal terms over the full year, representing a continuation of the recovery trend that began in late 2025.

Forecasts from different analysts for Johannesburg property price growth in 2026 range from a conservative 1% to 3% in a downside scenario, to an optimistic 7% to 10% if economic conditions prove stronger than expected.

The main assumption underlying most price increase forecasts for Johannesburg is that interest rates will remain supportive or decline slightly further, keeping buyer affordability intact and maintaining healthy transaction volumes throughout the year.

We go deeper and try to understand how solid are these forecasts in our pack covering the property market in Johannesburg.

Which neighborhoods will see the highest price growth in Johannesburg in 2026?

As of early 2026, the Johannesburg neighborhoods expected to see the highest price growth are Rosebank, Parkhurst, Bryanston, Fourways, and the Midrand/Waterfall corridor, all of which combine strong amenities with robust buyer demand.

Projected price growth for these top Johannesburg neighborhoods ranges from 6% to 10% over 2026, with premium nodes like Rosebank at the higher end due to apartment demand, and family-focused areas like Bryanston benefiting from secure estate popularity.

The primary catalyst driving expected growth in these Johannesburg neighborhoods is the combination of rate-driven affordability improvements and persistent undersupply of quality, well-located homes that meet buyer expectations for security and lifestyle.

One emerging Johannesburg neighborhood that could surprise with higher-than-expected growth in 2026 is Bassonia in the south, where strong liquidity and quick selling times suggest demand is outpacing current price levels.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Johannesburg.

What property types will appreciate the most in Johannesburg in 2026?

As of early 2026, townhouses and cluster homes in security complexes are expected to appreciate the most in Johannesburg, followed closely by well-located two-bedroom apartments in established nodes like Rosebank and Sandton-adjacent suburbs.

The projected appreciation for top-performing townhouses and cluster homes in Johannesburg is approximately 6% to 8% over 2026, roughly 1 to 2 percentage points above the citywide average.

The main demand trend driving appreciation for townhouses and cluster homes in Johannesburg is the growing preference among buyers for secure, low-maintenance living that offers more space than apartments without the upkeep burden of freehold houses.

The property type expected to underperform in Johannesburg in 2026 is ultra-luxury freehold houses above R5 million, where longer selling times and thinner buyer pools limit price growth despite the premium locations.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How will interest rates affect property prices in Johannesburg in 2026?

As of early 2026, the supportive interest rate environment is expected to have a positive impact on Johannesburg property prices, as lower borrowing costs expand buyer affordability and increase the number of households that can qualify for home loans.

The current benchmark repo rate in South Africa stands at 6.75% with prime at approximately 10.25%, and most analysts expect rates to remain stable or edge slightly lower through 2026 if inflation stays contained in the 3% to 4% range.

A 1% change in interest rates typically affects Johannesburg property affordability by shifting monthly repayments by roughly 10% to 12%, which can add or remove tens of thousands of potential buyers from the market and move prices by 3% to 5% over the following 12 months.

You can also read our latest update about mortgage and interest rates in South Africa.

What are the biggest risks for property prices in Johannesburg in 2026?

As of early 2026, the three biggest risks for Johannesburg property prices are an unexpected inflation spike forcing rate hikes, weaker-than-projected economic growth limiting income gains, and persistent municipal service delivery challenges that erode buyer confidence in affected areas.

The single risk with the highest probability of materializing in Johannesburg is municipal and service delivery uncertainty, as buyers quickly price in areas with inconsistent electricity, water, or infrastructure, creating localized price pressure even when citywide trends are positive.

We actually cover all these risks and their likelihoods in our pack about the real estate market in Johannesburg.

Is it a good time to buy a rental property in Johannesburg in 2026?

As of early 2026, buying a rental property in Johannesburg is selectively attractive, with well-located two-bedroom apartments and townhouses in high-demand nodes offering reasonable entry points and gross rental yields of 7% to 10%.

The strongest argument in favor of buying a rental property in Johannesburg now is that interest rates are supportive, rental demand remains solid in established nodes, and prices have not yet fully recovered from the slower 2023-2024 period, leaving room for capital appreciation.

The strongest argument for waiting before buying a rental property in Johannesburg is that economic growth remains modest at around 1% to 2%, limiting how quickly rents can rise, and oversupplied apartment pockets could see yields compressed if too many similar units compete for tenants.

If you want to know our latest analysis (results may differ from what you just read), you can read our assessment on whether now is a good time to buy a property in Johannesburg.

You'll also find a dedicated document about this specific question in our pack about real estate in Johannesburg.

Buying real estate in Johannesburg can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Where will property prices be in 5 years in Johannesburg?

What is the 5-year property price forecast for Johannesburg as of 2026?

As of early 2026, cumulative property price growth in Johannesburg over the next 5 years is expected to reach approximately 30% to 45%, assuming a reasonably stable economic and rate environment.

The range of 5-year forecasts for Johannesburg spans from a conservative 15% to 25% cumulative growth if economic headwinds persist, to an optimistic 50% to 65% if reforms accelerate and service delivery improves meaningfully.

This base-case forecast translates to an average annual appreciation rate of roughly 5.5% to 7.5% per year for Johannesburg residential property over the 2026 to 2031 period.

The key assumption most forecasters rely on for their 5-year Johannesburg property price predictions is that South Africa will maintain inflation credibility, interest rates will remain broadly supportive, and economic growth will average 1.5% to 2% annually without major shocks.

Which areas in Johannesburg will have the best price growth over the next 5 years?

The top three Johannesburg areas expected to deliver the best price growth over the next 5 years are the Rosebank/Sandton corridor for apartments and mixed-use proximity, the Midrand/Waterfall growth corridor benefiting from commercial expansion, and the Parkhurst/Greenside/Linden lifestyle belt where renovated family homes attract premium buyers.

Projected 5-year cumulative price growth for these top-performing Johannesburg areas ranges from approximately 40% to 60%, representing meaningful outperformance versus the citywide average of 30% to 45%.

This longer-term outlook differs from the 1-year forecast primarily in how infrastructure projects and urban development compound over time, meaning areas like Midrand/Waterfall gain relative attractiveness as commercial nodes mature and connectivity improves.

The currently undervalued Johannesburg area with the best potential for outperformance over 5 years is Bedfordview in the east, where established amenities, good schools, and relatively moderate prices create room for catch-up growth as buyers seek alternatives to pricier northern suburbs.

What property type will give the best return in Johannesburg over 5 years as of 2026?

As of early 2026, mid-market townhouses and cluster homes in secure estates are expected to give the best total return over 5 years in Johannesburg, combining solid capital appreciation with healthy rental income.

The projected 5-year total return for top-performing townhouses in Johannesburg is approximately 70% to 90% when combining capital appreciation of 40% to 55% with cumulative net rental income of 25% to 35% over the period.

The main structural trend favoring townhouses and cluster homes over the next 5 years in Johannesburg is the growing preference among households of all ages for secure, low-maintenance living, a trend that shows no sign of reversing given ongoing safety concerns.

For investors seeking the best balance of return and lower risk over 5 years in Johannesburg, well-located two-bedroom apartments in proven rental nodes like Rosebank or Sandton-adjacent areas offer slightly lower upside but greater liquidity and more predictable tenant demand.

How will new infrastructure projects affect property prices in Johannesburg over 5 years?

The top three major infrastructure projects expected to impact Johannesburg property prices over the next 5 years are the Gautrain expansion adding new stations and corridors, road network upgrades in the northern suburbs, and mixed-use development intensification around established transit nodes.

Properties near completed infrastructure projects in Johannesburg typically command a price premium of 10% to 20% compared to similar homes further away, though this premium often takes 2 to 3 years to fully materialize after project completion.

The specific Johannesburg neighborhoods expected to benefit most from infrastructure developments are Midrand and Waterfall along the Gautrain corridor, parts of Sandton near station expansions, and Rosebank where transit-oriented development continues to densify.

How will population growth and other factors impact property values in Johannesburg in 5 years?

Johannesburg's population is projected to grow at approximately 1.5% to 2% annually over the next 5 years, which should sustain baseline housing demand and support property values even if economic growth remains modest.

The demographic shift with the strongest influence on Johannesburg property demand will be the continued growth of smaller households, including young professionals and empty nesters, driving demand for compact, secure, and conveniently located housing options.

Migration patterns, including both domestic movement from other South African cities and some international arrivals, are expected to maintain pressure on housing supply in Johannesburg's most accessible and amenity-rich suburbs, supporting prices in well-connected areas.

The property types and areas that will benefit most from these demographic trends in Johannesburg are two-bedroom apartments and townhouses in northern nodes like Fourways, Sandton-adjacent areas, and the Rosebank corridor, where young professionals and downsizers concentrate.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What is the 10 year property price outlook in Johannesburg?

What is the 10-year property price prediction for Johannesburg as of 2026?

As of early 2026, cumulative property price growth in Johannesburg over the next 10 years is expected to reach approximately 80% to 120%, assuming South Africa maintains reasonable economic and policy stability.

The range of 10-year forecasts for Johannesburg spans from a conservative 50% to 70% cumulative growth if structural challenges persist, to an optimistic 140% to 180% if meaningful reforms drive sustained economic improvement.

This base-case forecast translates to an average annual appreciation rate of roughly 6% to 8% per year for Johannesburg residential property over the 2026 to 2036 period.

The biggest uncertainty factor in making 10-year property price predictions for Johannesburg is the trajectory of economic reforms and service delivery, as these structural issues will ultimately determine whether the city attracts investment and sustains middle-class growth.

What long-term economic factors will shape property prices in Johannesburg?

The top three long-term economic factors that will shape Johannesburg property prices over the next decade are interest rate and inflation stability maintained by the South African Reserve Bank, economic growth and job creation driven by reforms and investment, and infrastructure and service delivery quality at the municipal level.

The single long-term economic factor expected to have the most positive impact on Johannesburg property values is successful implementation of economic reforms that lift GDP growth above 2% annually, as this would expand the middle class and increase the pool of qualified buyers.

The single long-term economic factor posing the greatest structural risk to Johannesburg property values is persistent municipal service delivery challenges, including electricity, water, and infrastructure maintenance, which could accelerate the flight of buyers to better-serviced pockets or competing cities.

You'll also find a much more detailed analysis in our pack about real estate in Johannesburg.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Johannesburg, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Statistics South Africa (RPPI) | Official national statistics agency using deeds-based measurement. | We used the RPPI to anchor official residential price inflation rates for Johannesburg metro. We also used it to cross-check private indices and separate market heat from simple inflation. |

| South African Reserve Bank (SARB) | The country's central bank and definitive source for policy rates. | We used SARB's repo and prime levels to translate affordability into expected buyer demand. We also justified why the 2026 outlook is particularly rate-sensitive. |

| Statistics South Africa (CPI) | Official CPI publisher, essential for real price calculations. | We used CPI to convert nominal house price growth into real gains for homeowners. We also checked whether rising prices actually mean improving buying power. |

| Lightstone Property Data | Major SA property data provider built on deeds and valuation datasets. | We used Lightstone to pin down Johannesburg-specific transaction levels and average prices. We also grounded our suburb examples in real places people recognize. |

| Lightstone Methodology Report | Transparent documentation of how Lightstone cleans and structures data. | We used it to justify treating Lightstone as deeds-grade rather than anecdotal. We also explained our triangulation approach using this methodology disclosure. |

| FNB Property Barometer (Methodology) | Major bank index built from valuations using published repeat-sales methodology. | We used FNB to cross-check the direction and speed of the national property cycle. We also relied on its methodology disclosure as a quality signal. |

| FNB Property Barometer (Commentary) | Bank economist view tied to their index and updated frequently. | We used it to keep the January 2026 narrative current with late-2025 momentum. We treated it as a cycle indicator rather than a neighborhood price list. |

| Pam Golding Properties | Long-established national agency with a published house price index. | We used Pam Golding to triangulate where we are in the recovery cycle. We cross-checked their turning point and momentum calls against Stats SA and bank indices. |

| BetterBond Property Brief | Major mortgage originator with data anchored in financing applications. | We used BetterBond to cross-check buyer affordability and average purchase prices. We treated it as a reality check on what buyers are actually paying and borrowing. |

| ooba Home Loans (oobarometer) | Large mortgage comparison platform publishing periodic market stats. | We used ooba to validate lending appetite and buyer behavior including approval rates. We also supported rental investor and first-time buyer narratives with their data. |

| Rode Media (Rode & Associates) | Long-running SA property research firm widely used in the industry. | We used Rode for scenario framing including base, upside, and downside cases. We kept our forecast section grounded in research language rather than hype. |

| National Treasury (MTBPS) | Government's official macro and fiscal outlook document. | We used Treasury to anchor SA growth expectations feeding Johannesburg jobs and incomes. We kept forecasts realistic given the modestly improving macro picture. |

| International Monetary Fund (IMF) | Top-tier international organization with standardized macro projections. | We used IMF forecasts as an external check on Treasury and private-sector optimism. We built a conservative long-term base case using their GDP and inflation projections. |

| World Bank (Global Economic Prospects) | Leading international macro source useful for regional risk framing. | We used World Bank for external conditions affecting SA rates, capital flows, and confidence. We applied it mainly for downside risk framing rather than point forecasts. |

| Polity (Gautrain Expansion) | Widely used SA policy and infrastructure publisher citing formal notices. | We used Polity to explain why certain corridors can outperform over a 5-year horizon. We treated it as infrastructure plausibility rather than guaranteed price jumps. |

| ooba (Building Costs) | Practical benchmark data on construction and home sizes in South Africa. | We used ooba's typical home size data to calculate meaningful price-per-square-meter figures. We grounded our R12,000 per square meter estimate in real floor area benchmarks. |

Get the full checklist for your due diligence in Johannesburg

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

If you want to go deeper, you can read the following: