Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Johannesburg's property market is included in our pack

Whether you are looking to buy your first home, invest in rental property, or simply understand where Johannesburg's housing market stands today, this guide will walk you through everything you need to know.

We cover current housing prices in Johannesburg, market momentum, buyer sentiment, and what the data actually says about the months ahead.

This blog post is constantly updated as new data becomes available, so you always get the freshest insights.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Johannesburg.

How's the real estate market going in Johannesburg in 2026?

What's the average days-on-market in Johannesburg in 2026?

As of early 2026, residential properties in Johannesburg typically spend around 75 days on the market before selling, which works out to roughly 11 weeks from listing to signed contract.

The realistic range for most Johannesburg listings sits between 60 and 95 days, with sectional title units in high-demand suburbs like Sandton and Rosebank often moving faster, while freestanding homes in quieter areas tend to linger closer to the upper end.

Compared to 2024, when selling times were averaging closer to 10 weeks nationally, Johannesburg has seen a slight slowdown, reflecting cautious buyer behavior even as interest rates have come down from their 2023 peak.

Are properties selling above or below asking in Johannesburg in 2026?

As of early 2026, the average sale-to-asking price ratio in Johannesburg sits around 90 to 92%, meaning most properties close at an 8 to 10% discount from their listed price.

Roughly 75 to 80% of Johannesburg properties sell below asking, with only about 1% selling above asking, and this pattern has remained consistent throughout 2025, so we are confident it holds into early 2026.

The few bidding wars and above-asking sales that do occur in Johannesburg tend to cluster in high-demand nodes like Rosebank, Sandton CBD, and well-priced sectional title units in Bryanston, where correctly priced listings attract multiple offers quickly.

By the way, you will find much more detailed data in our property pack covering the real estate market in Johannesburg.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

What kinds of residential properties can I realistically buy in Johannesburg?

What property types dominate in Johannesburg right now?

In Johannesburg, the market splits roughly into 45% sectional title properties (apartments and townhouses), 40% freestanding houses, and 15% cluster homes and security estates, though this varies significantly by suburb.

Sectional title properties represent the largest and fastest-growing share of the Johannesburg market, particularly in northern suburbs like Sandton, Rosebank, Fourways, and Randburg.

This dominance emerged because affordability constraints, security concerns, and lifestyle shifts have pushed buyers toward lock-up-and-go living with shared maintenance costs, especially as electricity and water reliability became bigger factors in home-buying decisions.

If you want to know more, you should read our dedicated analyses:

- How much should you pay for a house in Johannesburg?

- How much should you pay for an apartment in Johannesburg?

- How much should you pay for a townhouse in Johannesburg?

Are new builds widely available in Johannesburg right now?

New-build properties make up roughly 10 to 15% of residential listings in Johannesburg, though availability is uneven and concentrated in specific growth corridors rather than spread across the city.

As of early 2026, the highest concentration of new-build developments in Johannesburg can be found in Midrand (particularly along the Gautrain corridor), the Fourways growth band (including Sunninghill and Lonehill edges), and pockets of Rosebank and Sandton where mixed-use projects have added apartment stock.

Get fresh and reliable information about the market in Johannesburg

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Which neighborhoods are improving fastest in Johannesburg in 2026?

Which areas in Johannesburg are gentrifying in 2026?

As of early 2026, the neighborhoods in Johannesburg showing the clearest signs of gentrification include Maboneng and Jeppestown (CBD-east fringe), Braamfontein (near Wits University), and parts of Melville and Auckland Park transitioning from student rentals to young professional ownership.

In these areas, you can see the changes happening through converted warehouse lofts becoming design studios, specialty coffee shops replacing traditional corner stores, co-working spaces opening in former industrial buildings, and a visible shift toward younger, higher-income residents walking the streets on weekends.

Price appreciation in Johannesburg's gentrifying neighborhoods has ranged from 25 to 45% over the past three to five years, with Braamfontein and Midrand leading the gains, though Maboneng's trajectory has been more volatile following the 2019 Propertuity liquidation.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Johannesburg.

Where are infrastructure projects boosting demand in Johannesburg in 2026?

As of early 2026, the top areas in Johannesburg where infrastructure projects are boosting housing demand include the Fourways-Sunninghill corridor (linked to Gautrain expansion planning), the Louis Botha Avenue corridor (part of the Corridors of Freedom transit-oriented development), and areas near existing Gautrain stations like Rosebank and Sandton.

The specific projects driving demand include the proposed R120 billion Gautrain expansion with planned stations at Fourways, Sunninghill, and Olievenhoutbosch, as well as ongoing Rea Vaya BRT corridor improvements and the City of Johannesburg's transit-oriented development initiatives along key arterial routes.

The Gautrain expansion is currently in the route determination and environmental approval phase, with the current concession ending in March 2026 and construction potentially beginning in subsequent years if funding and approvals proceed.

In Johannesburg, property values near existing Gautrain stations have grown roughly 3% faster annually than surrounding areas, and rental rates in prime station-adjacent locations like Rosebank have appreciated by as much as 100% since the Gautrain opened, suggesting significant upside for areas along planned routes.

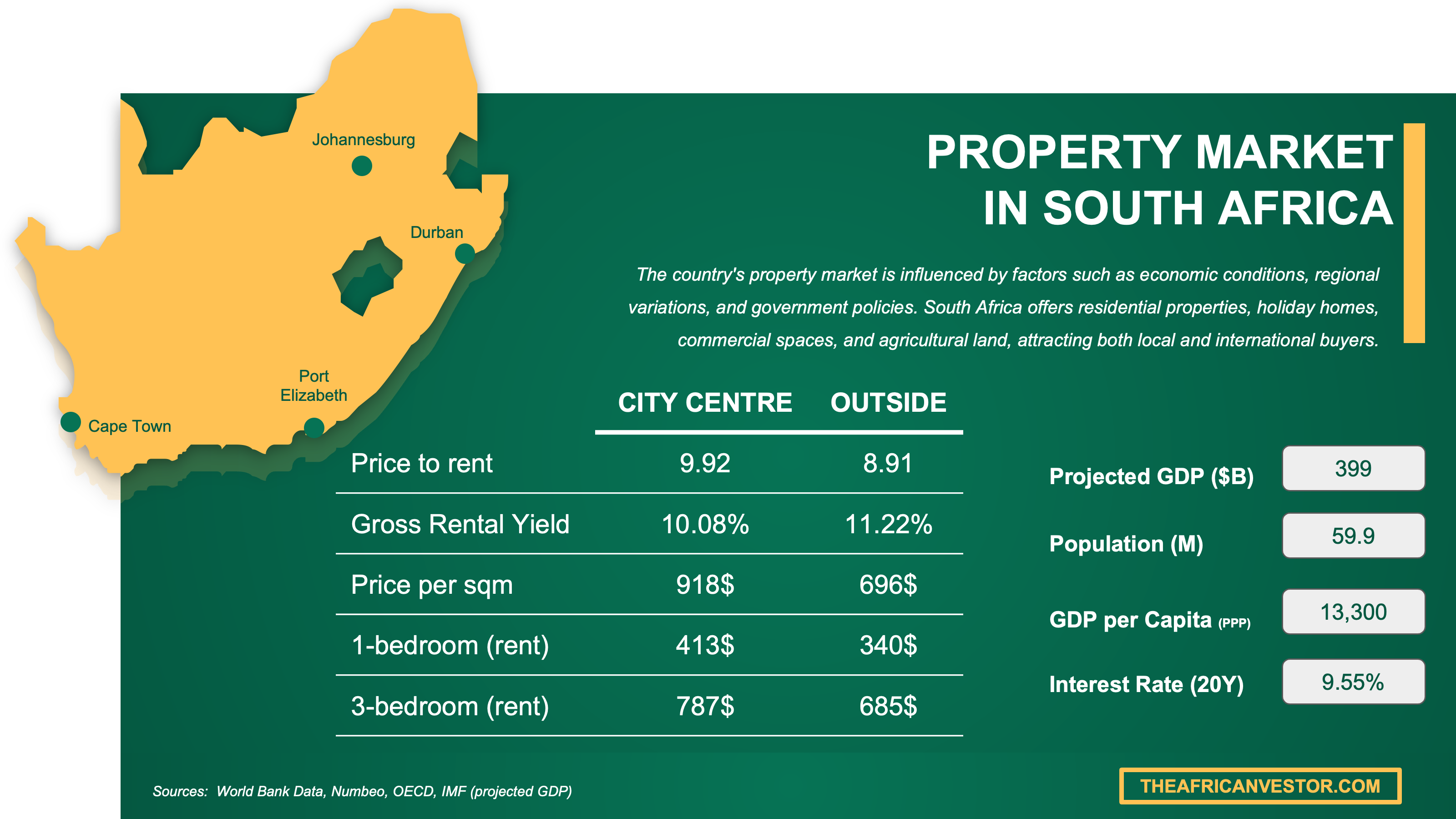

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

What do locals and insiders say the market feels like in Johannesburg?

Do people think homes are overpriced in Johannesburg in 2026?

As of early 2026, most locals and market insiders in Johannesburg believe that asking prices are often aspirational rather than realistic, which is why roughly 75% of properties sell below their listed price.

The evidence people typically cite includes the 8 to 10% average discount from asking price, the long selling times exceeding 10 weeks, and the fact that when adjusted for inflation, real property prices have actually declined since May 2021.

Those who argue prices are fair in Johannesburg point to the high cost of security upgrades, backup power systems (inverters and solar), and water solutions that many properties now include, as well as the shortage of well-located, well-managed sectional title stock.

The price-to-income ratio in Johannesburg remains stretched compared to national averages, with median home prices around R1.5 million requiring significant mortgage commitments for households earning around R50,000 monthly, which helps explain why first-time buyers cluster in the sub-R1.5 million segment.

What are common buyer mistakes people regret in Johannesburg right now?

The most frequently cited buyer mistake in Johannesburg is underestimating monthly running costs, particularly levies, municipal rates, security fees, and the ongoing maintenance of inverters, solar systems, and backup water supplies that have become essential for comfortable living.

The second most common regret is buying based on suburb reputation rather than micro-location, because in Johannesburg one street can be highly liquid and desirable while the next block over struggles with crime, poor building management, or infrastructure problems.

If you want to go deeper, you can check our list of risks and pitfalls people face when buying property in Johannesburg.

It's because of these mistakes that we have decided to build our pack covering the property buying process in Johannesburg.

Get the full checklist for your due diligence in Johannesburg

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

How easy is it for foreigners to buy in Johannesburg in 2026?

Do foreigners face extra challenges in Johannesburg right now?

Foreigners face a moderate level of additional difficulty when buying property in Johannesburg compared to local buyers, primarily in the form of operational friction around banking, documentation, and financing rather than legal barriers to ownership.

The specific requirements for foreign buyers include obtaining approval from the South African Reserve Bank for mortgage financing, providing proof of funds from abroad through an authorized dealer bank, and completing enhanced FICA (Financial Intelligence Centre Act) compliance checks that require more documentation than locals typically need.

The practical challenges most foreigners encounter in Johannesburg include navigating exchange control regulations for bringing money into the country, dealing with conveyancing timelines that can stretch due to Deeds Office capacity issues, and understanding body corporate rules and special levy risks in sectional title purchases without local knowledge to guide them.

We will tell you more in our blog article about foreigner property ownership in Johannesburg.

Do banks lend to foreigners in Johannesburg in 2026?

As of early 2026, mortgage financing is available to foreign buyers in Johannesburg from major banks including Standard Bank, ABSA, FNB, and Nedbank, though with stricter terms than those offered to South African residents.

Foreign buyers in Johannesburg can typically borrow a maximum of 50% of the property value (loan-to-value), meaning a 50% cash deposit is required, with interest rates usually 1 to 2% higher than resident rates, putting effective rates around 11.75% to 13.25% based on current prime lending rates.

Banks require foreign applicants to provide comprehensive documentation including three months of bank statements from their home country, proof of income and employment contracts, credit history verification, and evidence that the deposit funds originated from abroad and were transferred through proper exchange control channels.

You can also read our latest update about mortgage and interest rates in South Africa.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How risky is buying in Johannesburg compared to other nearby markets?

Is Johannesburg more volatile than nearby places in 2026?

As of early 2026, Johannesburg shows higher price volatility than Cape Town (which has more consistent demand from foreign buyers and lifestyle migrants) and roughly comparable volatility to other Gauteng metros like Pretoria/Tshwane and Ekurhuleni, but with sharper neighborhood-level divergence.

Over the past decade, Johannesburg has experienced periods of real price decline (when adjusted for inflation, prices fell roughly 19% between 2007 and 2021), followed by modest nominal recovery, while Cape Town saw more sustained real growth driven by its tourism appeal and international buyer base.

If you want to go into more details, we also have a blog article detailing the updated housing prices in Johannesburg.

Is Johannesburg resilient during downturns historically?

Johannesburg has shown selective resilience during past economic downturns, with prime, well-managed nodes maintaining liquidity while fringe or poorly serviced areas repriced faster and took longer to recover.

During the most significant recent downturn (the post-2008 period and subsequent stagnation through 2021), Johannesburg property prices in real terms declined by roughly 19%, with recovery taking nearly a decade and only gaining momentum in 2023-2025 as interest rates began falling.

The property types and neighborhoods that have historically held value best during downturns in Johannesburg include well-managed sectional title complexes in established northern suburbs like Sandton, Bryanston, and Rosebank, as well as security estates with strong governance and access to Gautrain stations.

Get to know the market before you buy a property in Johannesburg

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

How strong is rental demand behind the scenes in Johannesburg in 2026?

Is long-term rental demand growing in Johannesburg in 2026?

As of early 2026, long-term rental demand in Johannesburg is steady to growing, with rent growth running at approximately 4 to 6% year-over-year and vacancy rates sitting around 5% citywide.

The tenant demographics driving long-term rental demand in Johannesburg include young professionals working in Sandton's corporate offices, university students near Wits and UJ campuses, and a growing segment of middle-income households choosing to rent rather than buy due to affordability constraints and a preference for flexibility.

The neighborhoods with the strongest long-term rental demand in Johannesburg right now are Sandton (including Morningside and Atholl), Rosebank, Braamfontein, and the Fourways/Lonehill corridor, where proximity to offices, universities, shopping, and Gautrain access keeps vacancy tight and absorption strong.

You might want to check our latest analysis about rental yields in Johannesburg.

Is short-term rental demand growing in Johannesburg in 2026?

Johannesburg does not have strict city-wide regulations on short-term rentals like some European cities, but individual body corporates in sectional title schemes often restrict or prohibit Airbnb-style letting, so buyers must check conduct rules before assuming short-term rental income is possible.

As of early 2026, short-term rental demand in Johannesburg is stable but not booming, with average occupancy rates around 49% according to market data, which means most units sit empty more than half the year.

The current average occupancy rate of roughly 49% for Johannesburg short-term rentals means that only exceptionally well-located, well-furnished, and well-reviewed properties consistently outperform, while average listings struggle to beat long-term rental returns.

The guest demographics driving short-term rental demand in Johannesburg include business travelers visiting Sandton's corporate hub, regional African travelers transiting through OR Tambo, and domestic tourists attending events, conferences, or visiting family.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Johannesburg.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What are the realistic short-term and long-term projections for Johannesburg in 2026?

What's the 12-month outlook for demand in Johannesburg in 2026?

As of early 2026, the 12-month demand outlook for residential property in Johannesburg is mildly positive, with improving buyer sentiment driven by six consecutive interest rate cuts since September 2024 that have brought the prime rate down to 10.25%.

The key factors most likely to influence demand in Johannesburg over the next 12 months include the trajectory of further interest rate cuts (with forecasts suggesting another 25 to 50 basis points of easing possible), electricity supply stability from Eskom, and whether employment growth materializes in key sectors like financial services and technology.

The forecasted price movement for Johannesburg over the next 12 months sits in the range of 3 to 5% nominal growth, which may translate to roughly flat real prices after inflation, with stronger performance expected in well-located sectional title and prime suburban pockets.

By the way, we also have an update regarding price forecasts in South Africa.

What's the 3 to 5 year outlook for housing in Johannesburg in 2026?

As of early 2026, the 3 to 5 year outlook for Johannesburg housing points to a two-track outcome: well-located nodes with strong infrastructure and governance should see moderate price growth and solid rental absorption, while areas suffering from service delivery problems may remain flat or choppy.

The major development projects expected to shape Johannesburg over the next 3 to 5 years include the R120 billion Gautrain expansion (with new stations planned at Fourways, Sunninghill, and into Soweto), ongoing Corridors of Freedom transit-oriented development along Louis Botha Avenue, and mixed-use densification projects in Rosebank and Sandton.

The single biggest uncertainty that could alter the 3 to 5 year outlook for Johannesburg is municipal service delivery, particularly whether the city can maintain stable electricity distribution, water supply, and road infrastructure, because deterioration in any of these areas can rapidly shift suburb desirability and price trajectories.

Are demographics or other trends pushing prices up in Johannesburg in 2026?

As of early 2026, demographic trends are exerting moderate upward pressure on Johannesburg housing prices, particularly through household formation among young professionals and affordability-driven downsizing from freestanding homes into sectional title units.

The specific demographic shifts most affecting Johannesburg prices include continued internal migration from other provinces to Gauteng for employment opportunities, the growth of single-person and small-household formations among millennials, and the expansion of the black middle class seeking quality housing in formerly exclusive suburbs.

Beyond demographics, the non-demographic trends pushing Johannesburg prices include the return-to-office movement (which has renewed demand near Sandton and Rosebank business nodes), the premium placed on properties with solar, inverter, and water backup, and increased investor activity following South Africa's removal from the FATF grey list in 2025.

These demographic and trend-driven pressures are expected to continue in Johannesburg for at least the next 3 to 5 years, as urbanization into Gauteng remains strong and the structural housing shortage (estimated at 2.3 million units nationally) shows no signs of rapid resolution.

What scenario would cause a downturn in Johannesburg in 2026?

As of early 2026, the most likely scenario that could trigger a housing downturn in Johannesburg would be interest rates staying higher for longer than expected or reversing course due to inflation spikes, which would directly hit affordability for the price-sensitive buyer base.

The early warning signs that would indicate a downturn is beginning in Johannesburg include a sharp increase in days-on-market beyond 100 days, mortgage application declines reported by originators like ooba and BetterBond, rising vacancy rates in rental data from TPN, and banks tightening lending criteria or increasing deposit requirements.

Based on historical patterns, a potential downturn in Johannesburg could realistically result in nominal price stagnation or 5 to 10% declines over 2 to 3 years, with fringe areas and overbuilt new developments experiencing steeper corrections while prime nodes hold relatively better.

Make a profitable investment in Johannesburg

Better information leads to better decisions. Save time and money. Download our guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Johannesburg, we always rely on the strongest methodology we can and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Statistics South Africa (Stats SA) - RPPI | Stats SA is South Africa's official statistics agency and publishes the country's authoritative house price inflation series. | We used it to anchor the most recent official price growth trends going into early 2026. We then validated private indices against it to avoid relying on a single source. |

| South African Reserve Bank (SARB) | SARB is the central bank and the definitive source for interest rates that directly affect mortgage affordability. | We used it to establish the interest rate environment buyers face in 2026. We also referenced SARB's Financial Stability Review for macro risk context. |

| FNB Estate Agents Survey | FNB is a major bank with a long-running, methodology-based survey covering selling times, pricing, and market sentiment. | We used it for hard metrics like average days-on-market and the percentage of properties selling below asking. We then adjusted national figures for Johannesburg's specific market characteristics. |

| ooba Oobarometer | ooba is one of South Africa's largest mortgage originators and publishes consistent quarterly data on applications and approvals. | We used it as a demand proxy to understand whether buyer activity is genuinely picking up. We also referenced their foreigner mortgage guidance. |

| PayProp Rental Index | PayProp is one of South Africa's best-known rent indices, based on large volumes of actual rental transactions. | We used it to ground long-term rental demand and rent growth signals. We also connected rental yields to buy-versus-rent logic for Johannesburg investors. |

| TPN Vacancy Survey | TPN is a specialist tenant credit bureau used by major industry players to track vacancy and tenant behavior. | We used it to gauge vacancy direction and tenant risk, which are behind-the-scenes indicators of rental demand health in Johannesburg. |

| AirDNA | AirDNA is a widely used short-term rental data provider with consistent market dashboards tracking occupancy and revenue. | We used it to estimate short-term rental demand and give buyers a reality check on Airbnb-style returns versus long-term letting. |

| Lightstone Property | Lightstone is a major South African property data firm known for deeds-linked analytics and suburb-level insights. | We used it to add grounded examples of where sales are moving and to cross-check bank-driven market narratives. |

| Moneyweb / Gautrain Management Agency | Moneyweb is a major South African financial publication, and GMA is the official body managing Gautrain expansion planning. | We used these sources to connect infrastructure planning to specific demand nodes in Johannesburg's north and to verify which growth stories have actual projects behind them. |

| City of Johannesburg - Corridors of Freedom | This is the city's own programme description of priority transit-oriented development zones. | We used it to identify where policy-led investment is concentrated and to choose specific neighborhood examples rather than vague claims about up-and-coming areas. |

Related blog posts