Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Stellenbosch's property market is included in our pack

Buying property in Stellenbosch as a foreigner involves more than just the purchase price, and understanding the extra costs upfront will help you budget properly and avoid surprises.

This guide breaks down every tax, fee, and hidden cost you might face when buying residential property in Stellenbosch in 2026, from transfer duty and conveyancing fees to ongoing owner expenses and what happens when you sell.

We constantly update this blog post with the latest data from official sources to keep it accurate and useful for you.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Stellenbosch.

Overall, how much extra should I budget on top of the purchase price in Stellenbosch in 2026?

How much are total buyer closing costs in Stellenbosch in 2026?

As of early 2026, total buyer closing costs in Stellenbosch typically range from 3% to 10% of the purchase price, which translates to roughly R60,000 to R200,000 (about $3,300 to $11,000 USD or €3,000 to €10,000 EUR) on a mid-range R2 million property.

The minimum extra budget for closing costs in Stellenbosch is around 2% of the purchase price, or approximately R20,000 to R40,000 ($1,100 to $2,200 USD or €1,000 to €2,000 EUR), which applies if you buy a property below the R1,210,000 transfer duty threshold and pay cash without a mortgage.

The maximum extra budget buyers should plan for in Stellenbosch reaches 10% to 12% of the purchase price, or R500,000 to R1,200,000 ($27,500 to $66,000 USD or €25,000 to €61,000 EUR) on higher-value properties where transfer duty scales steeply.

The main factors that push your closing costs toward the high end in Stellenbosch include purchasing above R3 million (where transfer duty jumps significantly), using a mortgage (which adds bond registration fees), and dealing with complex transactions requiring extra legal work.

What's the usual total % of fees and taxes over the purchase price in Stellenbosch?

The usual total percentage of fees and taxes over the purchase price in Stellenbosch ranges from 4% to 8% for most standard residential transactions in 2026.

A realistic low-to-high range covering most Stellenbosch property purchases runs from about 3% on lower-priced cash deals to 11% on higher-value financed purchases.

Government taxes, primarily transfer duty, typically account for 60% to 75% of the total percentage, while professional service fees such as conveyancing, deeds registration, and bond costs make up the remaining 25% to 40%.

By the way, you will find much more detailed data in our property pack covering the real estate market in Stellenbosch.

What costs are always mandatory when buying in Stellenbosch in 2026?

As of early 2026, the mandatory costs when buying property in Stellenbosch include transfer duty (for resale properties above R1,210,000) or VAT (for new builds from VAT-registered developers), conveyancing attorney fees plus VAT, Deeds Office registration fees, and bond registration costs if you use a mortgage.

Optional but highly recommended costs in Stellenbosch include a professional property inspection (especially for older homes in areas like Die Boord or Mostertsdrift), a tax advisor consultation if you plan to rent out the property, and translation services if you are not comfortable signing legal documents in English or Afrikaans.

Don't lose money on your property in Stellenbosch

100% of people who have lost money there have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What taxes do I pay when buying a property in Stellenbosch in 2026?

What is the property transfer tax rate in Stellenbosch in 2026?

As of early 2026, the property transfer tax (called transfer duty in South Africa) in Stellenbosch follows a national sliding scale starting at 0% for properties up to R1,210,000, then 3% on the portion between R1,210,001 and R1,663,800, 6% up to R2,329,300, 8% up to R2,994,800, 11% up to R13,307,800, and 13% on amounts above that threshold.

There are no extra transfer taxes specifically for foreigners buying property in Stellenbosch, as the SARS transfer duty table applies equally to South African citizens and foreign nationals based purely on property value.

Buyers pay VAT (currently 15%) instead of transfer duty when purchasing a new-build property from a VAT-registered developer in Stellenbosch, and SARS confirms that a sale is subject to either VAT or transfer duty but never both.

Stamp duty as a separate line item does not apply to residential property transfers in Stellenbosch; the main transaction tax you will encounter is transfer duty (or VAT for new builds), plus the deeds office fees which are statutory and scaled to property value.

Are there tax exemptions or reduced rates for first-time buyers in Stellenbosch?

South Africa's main relief for first-time buyers in Stellenbosch is the 0% transfer duty band on properties up to R1,210,000 (about $67,000 USD or €61,500 EUR), which applies to all buyers regardless of citizenship and is not limited to first-time purchasers.

Buying property through a company in Stellenbosch means the same transfer duty or VAT logic applies at purchase, but your ongoing tax profile for rental income and your eventual capital gains tax treatment will differ, so this route typically requires professional advice.

There is a significant tax difference between new-build and resale properties in Stellenbosch: new builds from VAT-registered sellers attract 15% VAT (often included in the advertised price) and no transfer duty, while resale properties attract transfer duty on the sliding scale and no VAT.

To benefit from the 0% transfer duty band in Stellenbosch, no special documentation is required beyond the standard transaction process, as your conveyancing attorney will automatically calculate whether your purchase falls within the exempt threshold based on the property value.

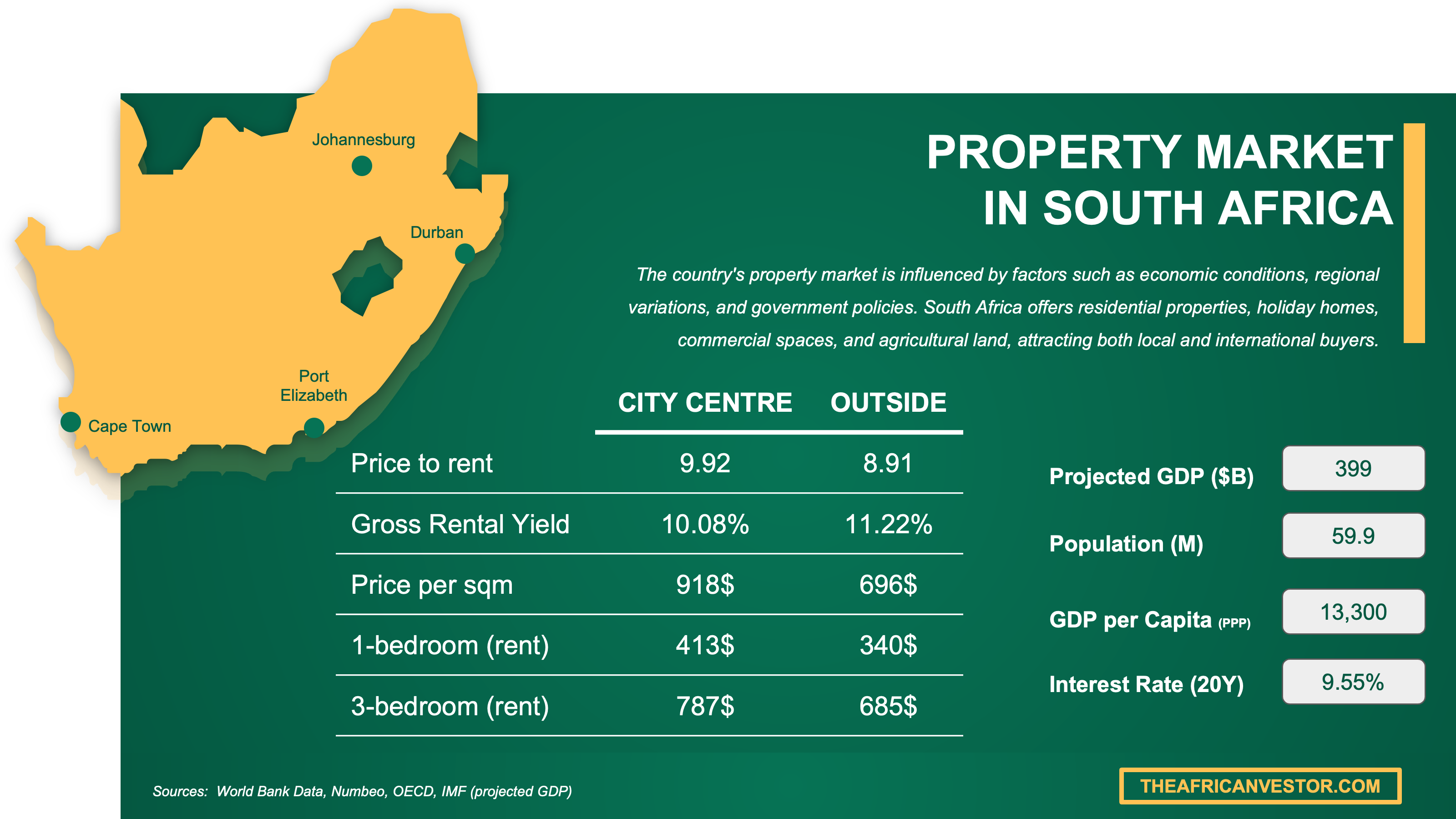

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Which professional fees will I pay as a buyer in Stellenbosch in 2026?

How much does a notary or conveyancing lawyer cost in Stellenbosch in 2026?

As of early 2026, conveyancing attorney fees in Stellenbosch range from approximately R15,000 to R50,000 ($830 to $2,750 USD or €760 to €2,540 EUR) depending on the property value, with fees calculated according to guidelines set by the Legal Practice Council.

Conveyancing fees in Stellenbosch are charged as a sliding scale percentage of the property price, starting higher for lower-value properties (around 1.5%) and decreasing for more expensive properties (to around 0.8%), plus 15% VAT on the professional fee component.

Translation or interpreter services for foreign buyers in Stellenbosch typically cost R1,000 to R3,000 ($55 to $165 USD or €51 to €152 EUR) for a session, and R300 to R600 per page for document translation, which is a small price compared to the risk of misunderstanding legal documents.

A tax advisor in Stellenbosch is not mandatory but highly recommended if you plan to rent out the property or are unsure about non-resident tax obligations, with a focused consultation costing R2,500 to R8,000 ($140 to $440 USD or €127 to €406 EUR).

We have a whole part dedicated to these topics in our our real estate pack about Stellenbosch.

What's the typical real estate agent fee in Stellenbosch in 2026?

As of early 2026, the typical real estate agent fee in Stellenbosch is around 5% to 7% of the sale price plus 15% VAT, which on a R2.7 million average-priced property amounts to roughly R135,000 to R217,000 ($7,400 to $12,000 USD or €6,850 to €11,000 EUR).

In Stellenbosch, the seller almost always pays the real estate agent commission as part of standard South African practice, though buyers may feel the cost indirectly because it is factored into the asking price.

The realistic low-to-high range for agent fees in Stellenbosch runs from about 4% for high-value properties or negotiated deals up to 8% for harder-to-sell stock or exclusive mandates, with most transactions settling around 5% to 6%.

How much do legal checks cost (title, liens, permits) in Stellenbosch?

Legal checks including title search, liens verification, and permits review in Stellenbosch typically cost R2,000 to R8,000 ($110 to $440 USD or €101 to €406 EUR), with most of this work bundled into standard conveyancing services but sometimes charged separately for complex properties.

The property valuation fee in Stellenbosch, which banks usually require for mortgage applications, typically costs R1,500 to R4,500 ($83 to $248 USD or €76 to €229 EUR) depending on the provider and how quickly you need it.

The most critical legal check that should never be skipped in Stellenbosch is the title deed verification and clearance certificate confirmation, because these ensure the property is free from encumbrances, municipal debts, and outstanding levies that you could otherwise inherit.

Buying a property with hidden issues is something we mention in our list of risks and pitfalls people face when buying real estate in Stellenbosch.

Get the full checklist for your due diligence in Stellenbosch

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What hidden or surprise costs should I watch for in Stellenbosch right now?

What are the most common unexpected fees buyers discover in Stellenbosch?

The most common unexpected fees buyers discover in Stellenbosch include monthly body corporate levies and special levies for sectional title properties, municipal service charges that vary seasonally, and small administrative items like document generation, courier fees, and compliance certifications.

Unpaid property taxes or debts can potentially be inherited by buyers in Stellenbosch, but your conveyancing attorney is required to obtain municipal clearance certificates and levy statements before transfer, so any outstanding amounts should be settled from the seller's proceeds.

Scams involving fake listings or fake fees do occur in Stellenbosch, with the most common being requests for deposits before viewings or fraudulent bank details claiming to be from the attorney, so you should always verify trust account details by calling the conveyancing firm directly on a number you find independently.

Fees that are often not disclosed upfront in Stellenbosch include future special levies (which sectional title or estate owners can be hit with after purchase), variable utility costs during peak seasons, and the true cost of ongoing security or maintenance in managed estates.

In our property pack covering the property buying process in Stellenbosch, we go into details so you can avoid these pitfalls.

Are there extra fees if the property has a tenant in Stellenbosch?

Extra fees when buying a tenanted property in Stellenbosch typically range from R1,000 to R5,000 ($55 to $275 USD or €51 to €254 EUR) for additional administrative work, inspections, and deposit handling verification, plus potential legal advice costs if the lease terms are unclear or need renegotiation.

When purchasing a tenanted property in Stellenbosch, the buyer inherits all the legal obligations of the existing lease agreement, including honoring the rental amount, deposit management, and maintenance responsibilities until the lease naturally expires or is lawfully terminated.

Terminating an existing lease immediately after purchase in Stellenbosch is generally not possible unless the lease contains a specific clause allowing early termination on sale, because South African law protects tenants and the principle of "huur gaat voor koop" (lease goes before sale) applies.

A sitting tenant in Stellenbosch can affect the property's market value both ways: it may be discounted by 5% to 10% because owner-occupiers want vacant possession, but it can also be attractive to investors seeking immediate rental income with zero vacancy.

If you want to optimize your rental strategy, you can read our complete guide on how to buy and rent out in Stellenbosch.

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which fees are negotiable, and who really pays what in Stellenbosch?

Which closing costs are negotiable in Stellenbosch right now?

The negotiable closing costs in Stellenbosch include the conveyancing attorney's professional fee component (you can compare quotes and ask for discounts), the real estate agent's commission (negotiated by the seller but affects the overall deal), and some administrative disbursements.

The closing costs that are fixed by law or regulation in Stellenbosch and cannot be negotiated include transfer duty (set by SARS), VAT (currently 15%), and Deeds Office registration fees (set by government gazette).

Buyers in Stellenbosch can realistically achieve discounts of 10% to 20% on the negotiable portion of conveyancing fees by comparing quotes from multiple firms, especially for straightforward transactions, though the statutory costs will remain unchanged.

Can I ask the seller to cover some closing costs in Stellenbosch?

The likelihood that a seller will agree to cover some closing costs in Stellenbosch depends heavily on market conditions, but in general sellers prefer to reduce the price rather than directly pay buyer costs, and such arrangements are less common than in some other countries.

The specific closing costs sellers in Stellenbosch are most commonly willing to cover (or offset through price reduction) include outstanding municipal rates, body corporate levies up to transfer, and sometimes minor repair costs identified during inspection.

Sellers in Stellenbosch are more likely to accept covering closing costs when the market is slow, the property has been listed for over 90 days, there are motivated sellers (divorce, emigration, estate sales), or when the buyer is making a cash offer without financing delays.

Is price bargaining common in Stellenbosch in 2026?

As of early 2026, price bargaining is common in Stellenbosch, with most properties selling below the original asking price after negotiation, though the exact discount depends on how accurately the property was initially priced and current demand levels.

Buyers in Stellenbosch typically negotiate 5% to 10% below the asking price, which on a R2.7 million property amounts to savings of R135,000 to R270,000 ($7,400 to $14,900 USD or €6,850 to €13,700 EUR), with the average settled discount being around 7%.

Don't sign a document you don't understand in Stellenbosch

Buying a property over there? We have reviewed all the documents you need to know. Stay out of trouble - grab our comprehensive guide.

What monthly, quarterly or annual costs will I pay as an owner in Stellenbosch?

What's the realistic monthly owner budget in Stellenbosch right now?

The realistic monthly owner budget in Stellenbosch ranges from R4,500 to R15,000 ($248 to $825 USD or €229 to €762 EUR) depending on property type, covering municipal rates, utilities, levies (if applicable), and a maintenance reserve.

The main recurring expense categories that make up this monthly budget in Stellenbosch include municipal property rates, body corporate or estate levies, electricity and water charges, refuse removal, and building insurance.

The realistic low-to-high range for monthly owner costs in Stellenbosch runs from R3,500 ($193 USD or €178 EUR) for a modest freehold home with basic utilities to R20,000+ ($1,100 USD or €1,015 EUR) for a large estate property with high levies and lifestyle costs.

The monthly cost that tends to vary the most in Stellenbosch is electricity, because tariffs increase annually, usage fluctuates seasonally (especially with heating in winter or pool pumps in summer), and load-shedding may push owners toward backup power solutions.

You can see how this budget affect your gross and rental yields in Stellenbosch here.

What is the annual property tax amount in Stellenbosch in 2026?

As of early 2026, the annual property tax (municipal rates) in Stellenbosch is calculated at approximately R0.0044 per rand of municipal valuation for residential properties, which means a property valued at R3 million would pay roughly R13,200 per year ($725 USD or €670 EUR).

The realistic low-to-high range for annual property taxes in Stellenbosch runs from about R8,000 ($440 USD or €406 EUR) for a property valued at R2 million to R40,000+ ($2,200 USD or €2,030 EUR) for high-value estate homes valued above R10 million.

Property tax in Stellenbosch is calculated by applying the municipal rate-in-the-rand to the property's municipal valuation (not the purchase price), with valuations updated periodically through a General Valuation Roll and a R35,000 residential reduction applied before calculation.

Exemptions or reductions available for certain property owners in Stellenbosch include rebates for pensioners and indigent households, though these are means-tested and typically not available to foreign property investors.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

If I rent it out, what extra taxes and fees apply in Stellenbosch in 2026?

What tax rate applies to rental income in Stellenbosch in 2026?

As of early 2026, rental income in Stellenbosch is taxed at your marginal personal income tax rate, which ranges from 18% to 45% depending on your total taxable income bracket according to SARS individual tax tables.

Landlords in Stellenbosch can deduct allowable expenses from rental income before calculating tax, including municipal rates, body corporate levies, building insurance, bond interest (not capital repayments), agent fees, repairs, maintenance, and advertising costs.

The realistic effective tax rate after deductions for typical landlords in Stellenbosch ranges from 10% to 30% of net rental profit, depending on your income bracket and how well you document and claim your allowable expenses.

Foreign property owners in Stellenbosch pay the same rental income tax rates as South African residents, as rental income from South African property is taxable regardless of your residency status, though you should check for double taxation agreements with your home country.

Do I pay tax on short-term rentals in Stellenbosch in 2026?

As of early 2026, short-term rental income in Stellenbosch is taxable as ordinary income and must be declared to SARS, with the same marginal tax rates applying as for long-term rentals.

Short-term rental income is taxed the same way as long-term rental income in Stellenbosch at the individual level, though if your short-term rental activity becomes significant enough to meet VAT registration thresholds (turnover exceeding R1 million annually), you may also need to register for and charge VAT.

If you want to optimize your rental strategy, you can read our complete guide on how to buy and rent out in Stellenbosch.

Get to know the market before buying a property in Stellenbosch

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

If I sell later, what taxes and fees will I pay in Stellenbosch in 2026?

What's the total cost of selling as a % of price in Stellenbosch in 2026?

As of early 2026, the total cost of selling a property in Stellenbosch typically ranges from 6% to 10% of the sale price, depending on agent commission negotiations and whether capital gains tax applies.

The realistic low-to-high range for total selling costs in Stellenbosch runs from about 5% (if you negotiate a lower agent commission and have minimal tax liability) to 12% or more (if you face higher CGT and full commission rates).

The specific cost categories that typically make up selling expenses in Stellenbosch include real estate agent commission (5% to 7% plus VAT), conveyancing and legal fees for the seller, compliance certificates (electrical, beetle, gas, plumbing), outstanding municipal rates clearance, and capital gains tax if applicable.

The single largest contributor to selling expenses in Stellenbosch is almost always the real estate agent commission, which alone can account for 60% to 80% of total selling costs on a typical transaction.

What capital gains tax applies when selling in Stellenbosch in 2026?

As of early 2026, capital gains tax in Stellenbosch is calculated by including 40% of your net capital gain in your taxable income (for individuals), which then gets taxed at your marginal rate, resulting in a maximum effective CGT rate of 18%.

The main exemption from capital gains tax in Stellenbosch is the R2 million primary residence exclusion, which allows individuals to exclude up to R2 million of capital gain on a property that was their primary residence, though this typically does not apply to foreign investors using the property as a rental or holiday home.

Foreigners (non-residents for tax purposes) selling property in Stellenbosch face a withholding tax of 7.5% of the sale price (for individuals) that the buyer must pay to SARS as an advance toward the seller's final tax liability, with the actual CGT calculated and any excess refunded after filing a tax return.

Capital gain in Stellenbosch is calculated as the sale price minus the base cost (purchase price plus allowable costs like transfer duty, agent fees at purchase, and improvements), with an annual exclusion of R40,000 for individuals applied before the 40% inclusion rate.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Stellenbosch, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| South African Revenue Service (SARS) - Transfer Duty | Official tax authority that sets legally binding transfer duty rates. | We used the 2026 transfer duty brackets to calculate buyer costs at common price points. We anchored our minimum and maximum budget ranges on these official figures. |

| SARS - VAT Overview | Official source confirming the current VAT rate and rules. | We used this to explain when VAT applies instead of transfer duty. We referenced it for new-build versus resale cost comparisons. |

| SARS FAQ - VAT vs Transfer Duty | Direct official answer to a common property tax question. | We used this to clarify that buyers pay either VAT or transfer duty but not both. We reduced confusion for foreign buyers comparing new and resale properties. |

| SARS - Individual Income Tax Rates | Official tax brackets for individual taxpayers in South Africa. | We used this to explain how rental income is taxed. We gave realistic after-tax ranges for landlords at different income levels. |

| SARS - Non-Resident Seller Withholding | Official guideline on withholding tax for foreign sellers. | We used this to explain the 7.5% withholding tax non-residents face when selling. We clarified that this is an advance payment, not the final tax. |

| Government Gazette - Deeds Office Fees | Official government publication setting statutory registration fees. | We used this to explain that Deeds Office fees are non-negotiable and set by regulation. We justified why these fees scale with property value. |

| Stellenbosch Municipality - Tariff Book 2025/2026 | Official local tariff document for municipal rates and utilities. | We used this to quote the residential property rate for Stellenbosch. We built realistic monthly owner budgets using these official figures. |

| Legal Practice Council - Conveyancing Fee Guidelines | Official professional body setting recommended attorney fees. | We used this to estimate conveyancing costs at different price points. We explained that these fees are negotiable while statutory costs are not. |

| Private Property - Stellenbosch Listing Data | Major property portal showing real rates and levies on live listings. | We used this as a grounded example of actual monthly costs in Stellenbosch. We sanity-checked our owner budget ranges against real-world figures. |

| Seeff - Commission Guidance | Major national real estate brand reflecting market practice. | We used this to estimate typical commission percentages in Stellenbosch. We supported our explanation of fee negotiability with industry context. |

Get fresh and reliable information about the market in Stellenbosch

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Related blog posts