Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Johannesburg's property market is included in our pack

Johannesburg's property market is all about micro-location, where being just two kilometres away can mean completely different security costs, tenant profiles, and resale liquidity.

This guide breaks down the specific neighborhoods you should know about in Johannesburg as a foreign buyer looking at residential property in early 2026.

We constantly update this blog post to reflect the latest market data and developments in Johannesburg's real estate landscape.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Johannesburg.

What's the Current Real Estate Market Situation by Area in Johannesburg?

Which areas in Johannesburg have the highest property prices per square meter in 2026?

As of early 2026, the three areas in Johannesburg with the highest property prices per square meter are Sandton CBD/Sandown (particularly around the Gautrain station), Rosebank near Oxford Road, and the Melrose Arch precinct, where luxury apartments and secure complexes dominate the market.

In these premium Johannesburg neighborhoods, typical apartment prices range from R35,000 to R55,000 per square meter for modern, well-managed stock, though ultra-prime buildings in Sandhurst and Atholl can push even higher.

Each of these expensive Johannesburg areas commands top prices for distinct reasons:

- Sandton CBD/Sandown: Direct Gautrain access, Africa's richest square mile, and corporate headquarters cluster

- Rosebank (Oxford Road zone): Medical corridor, lifestyle retail at The Zone, and mixed business-leisure ecosystem

- Melrose Arch: Enclosed secure precinct with walkability, rare in Johannesburg, creating premium "bubble" demand

- Morningside (Sandton): Executive rental demand from gated complexes serving nearby corporate tenants

- Illovo: Strategic position between Rosebank and Sandton with strong apartment ecosystem

Which areas in Johannesburg have the most affordable property prices in 2026?

As of early 2026, the most affordable property prices per square meter in Johannesburg are found in Soweto neighborhoods like Protea Glen and Orlando East (R6,000 to R12,000/sqm), parts of Roodepoort such as Florida and Discovery (R10,000 to R15,000/sqm), and Randburg areas like Ferndale and Blairgowrie (R10,000 to R18,000/sqm).

In these more affordable Johannesburg neighborhoods, you can typically find apartments and townhouses ranging from R8,000 to R16,000 per square meter, with freestanding houses often sitting at the lower end of this range due to larger stand sizes.

The main trade-offs when buying in these lower-priced Johannesburg areas include longer commutes to the Sandton/Rosebank job nodes, potentially higher security costs for freestanding properties, and in some cases, weaker school catchment areas that affect family demand and resale liquidity.

You can also read our latest analysis regarding housing prices in Johannesburg.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Which Areas in Johannesburg Offer the Best Rental Yields?

Which neighborhoods in Johannesburg have the highest gross rental yields in 2026?

As of early 2026, the Johannesburg neighborhoods with the highest gross rental yields are Braamfontein (8% to 11% for student-focused apartments), Maboneng and Auckland Park (8% to 10%), and Randburg suburbs like Ferndale and Blairgowrie (7% to 9% for value-oriented townhouses and apartments).

Across Johannesburg as a whole, typical gross rental yields for investment properties range from 7% to 12%, with smaller units in high-demand areas consistently outperforming large family houses which typically yield only 4% to 6%.

Each of these high-yielding Johannesburg neighborhoods delivers strong returns for specific reasons:

- Braamfontein: Wits University proximity creates constant student demand for studios and one-beds

- Auckland Park: Student spillover from UJ campus plus young professional tenant pool

- Ferndale/Blairgowrie (Randburg): Affordable entry prices relative to rents, strong tenant depth from commuters

- Maboneng: Weekend leisure economy and creative tenant profile, though building-by-building quality varies

- Fourways (Douglasdale/Lonehill): Corporate tenant pool with moderate prices keeps yields competitive

Finally, please note that we cover the rental yields in Johannesburg here.

Make a profitable investment in Johannesburg

Better information leads to better decisions. Save time and money. Download our guide.

Which Areas in Johannesburg Are Best for Short-Term Vacation Rentals?

Which neighborhoods in Johannesburg perform best on Airbnb in 2026?

As of early 2026, the Johannesburg neighborhoods that perform best on Airbnb are Sandton CBD/Sandown (business travel demand), Rosebank near the Gautrain station (mixed corporate and lifestyle guests), Morningside for executive stays, and Maboneng for weekend leisure visitors seeking an urban experience.

Top-performing Airbnb properties in these Johannesburg neighborhoods typically generate R10,000 to R25,000 per month, with the best-in-class units achieving R15,000 to R30,000 monthly during peak conference seasons, based on average daily rates of R800 to R1,800 and occupancy rates of 45% to 60%.

Each of these Johannesburg short-term rental hotspots outperforms for distinct reasons:

- Sandton CBD/Sandown: Conference center proximity and corporate headquarters drive consistent business bookings

- Rosebank (Gautrain zone): Easy airport connection and walkable lifestyle precinct attract business-leisure travelers

- Melrose Arch: Secure precinct premium commands higher nightly rates from safety-conscious guests

- Maboneng: Arts district appeal draws weekend visitors, though occupancy swings with safety perception

- Houghton: Medical tourism and visiting family demand for quieter, higher-rate stays

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Johannesburg.

Which tourist areas in Johannesburg are becoming oversaturated with short-term rentals?

The three Johannesburg areas showing signs of short-term rental oversaturation are the Sandton CBD high-rise clusters (where identical one-bedroom units compete aggressively on price), parts of Rosebank near major mixed-use developments, and Maboneng where listing density is high relative to the small geographic "tourist bubble."

In Sandton CBD alone, there are approximately 300 to 400 active short-term rental listings concentrated in a handful of high-rise buildings, creating intense price competition that compresses returns for individual owners.

The main indicator of oversaturation in these Johannesburg areas is declining average daily rates despite stable or rising occupancy, meaning hosts are competing primarily on price rather than quality, which signals a supply-demand imbalance that affects profitability.

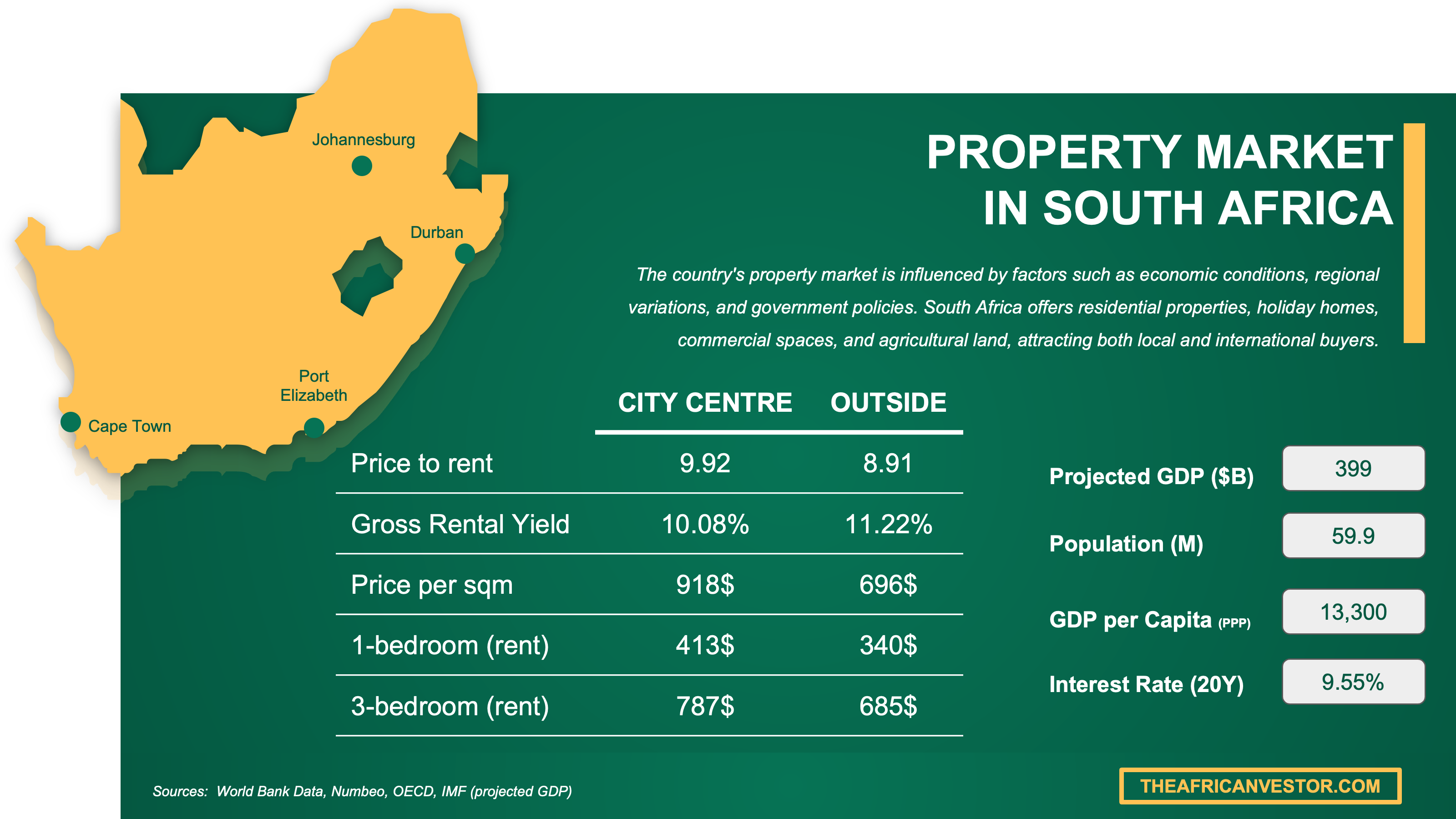

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which Areas in Johannesburg Are Best for Long-Term Rentals?

Which neighborhoods in Johannesburg have the strongest demand for long-term tenants?

The Johannesburg neighborhoods with the strongest demand for long-term tenants are Bryanston and Rivonia (corporate professionals), Fourways areas like Douglasdale and Lonehill (young families), Rosebank and Illovo (executives and embassy-related tenants), and Randburg's Ferndale and Blairgowrie (value-seeking professionals).

In these high-demand Johannesburg neighborhoods, vacancy rates typically range from 4% to 8%, with well-priced properties in Sandton and Rosebank letting within 2 to 4 weeks, while mid-market areas like Randburg may take 4 to 6 weeks for absorption.

Each of these Johannesburg neighborhoods attracts a distinct tenant profile:

- Bryanston/Rivonia: Middle-upper management families seeking school proximity and corporate access

- Fourways (Douglasdale/Lonehill): Young professionals and growing families wanting lifestyle amenities

- Rosebank/Illovo: Executives, medical professionals, and diplomatic community members

- Randburg (Ferndale/Blairgowrie): Budget-conscious professionals commuting to northern job nodes

- Braamfontein/Auckland Park: Students and young professionals prioritizing proximity over space

The key characteristic that makes these Johannesburg neighborhoods attractive to long-term tenants is the combination of Gautrain accessibility or major arterial road connections, proximity to Sandton/Rosebank employment centers, and well-managed sectional title complexes with reliable security and backup utilities.

Finally, please note that we provide a very granular rental analysis in our property pack about Johannesburg.

What are the average long-term monthly rents by neighborhood in Johannesburg in 2026?

As of early 2026, average long-term monthly rents in Johannesburg vary significantly by neighborhood, with Sandton CBD apartments ranging from R11,000 to R26,000, Rosebank from R11,000 to R28,000, Bryanston/Rivonia from R9,000 to R20,000 for apartments, and Randburg's Ferndale area from R6,500 to R13,000.

For entry-level apartments in Johannesburg's most affordable rental neighborhoods like Randburg (Ferndale/Blairgowrie) and Auckland Park, typical monthly rents range from R6,500 to R10,000 for a one-bedroom and R9,000 to R14,000 for a two-bedroom unit.

In mid-range Johannesburg neighborhoods like Fourways (Douglasdale/Lonehill) and Bryanston, monthly rents typically range from R8,000 to R11,000 for a one-bedroom apartment, R11,000 to R16,000 for a two-bedroom, and R18,000 to R28,000 for a three-bedroom townhouse.

In Johannesburg's most expensive rental neighborhoods like Sandton CBD, Morningside, and Rosebank, high-end apartments command R11,000 to R17,000 for a one-bedroom, R16,000 to R28,000 for a two-bedroom, and townhouses or cluster homes range from R25,000 to R48,000 monthly.

You may want to check our latest analysis about the rents in Johannesburg here.

Get fresh and reliable information about the market in Johannesburg

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Which Are the Up-and-Coming Areas to Invest in Johannesburg?

Which neighborhoods in Johannesburg are gentrifying and attracting new investors in 2026?

As of early 2026, the Johannesburg neighborhoods showing gentrification and attracting new investors include Maboneng and adjacent City and Suburban pockets (creative economy revival), Braamfontein (student and young professional regeneration), Newtown (cultural precinct improvement), and parts of Orange Grove/Norwood along the urban corridor framework.

These gentrifying Johannesburg neighborhoods have experienced annual price appreciation of 5% to 10% in select micro-pockets, though it's important to note that gentrification in Johannesburg tends to be node-based (specific streets or building clusters) rather than suburb-wide, meaning performance varies dramatically building by building.

Which areas in Johannesburg have major infrastructure projects planned that will boost prices?

The Johannesburg areas with major infrastructure projects expected to boost property prices are neighborhoods along the Rea Vaya Phase 1C BRT corridor (connecting CBD to Alexandra and Sandton), areas benefiting from the Corridors of Freedom densification framework, and station-adjacent pockets near Gautrain stops.

The specific infrastructure projects underway include the Rea Vaya Phase 1C trunk route with 13 new stations connecting Johannesburg CBD through Hillbrow, Yeoville, Orange Grove, Highlands North, Alexandra, Marlboro, and into Sandton, plus the Rivonia-Katherine Corridor road strengthening project in Sandton that will accommodate dedicated BRT lanes.

Historically in Johannesburg, areas near completed major transit infrastructure have seen price increases of 10% to 20% above market averages within 3 to 5 years of project completion, as improved connectivity increases rental demand and reduces the "location discount" that previously affected commute-heavy areas.

You'll find our latest property market analysis about Johannesburg here.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Which Areas in Johannesburg Should I Avoid as a Property Investor?

Which neighborhoods in Johannesburg with lots of problems I should avoid and why?

The Johannesburg neighborhoods with significant problems that property investors should generally avoid are the distressed inner-city areas of Hillbrow, Berea, Yeoville, and Joubert Park, where building governance issues, high crime rates, and resale illiquidity create substantial investment risks.

Each of these problematic Johannesburg areas has specific issues that destroy returns:

- Hillbrow: Hijacked buildings, severe levy arrears, gang activity, and virtually no resale market for individual units

- Berea: Overcrowding, building maintenance backlogs, and insurance difficulties that increase holding costs

- Yeoville: High vacancy rates, security costs that erase rental income, and weak tenant quality

- Joubert Park: Building governance collapse in many complexes, leading to unpredictable special levies

- Distressed CBD fringe blocks: Low headline prices mask hidden costs from arrears, repairs, and vacancy

For any of these Johannesburg neighborhoods to become viable investment options, they would need sustained municipal intervention to address building hijacking, significant private security investment, and most importantly, professional body corporate management restoration that many buildings currently lack.

Buying a property in the wrong neighborhood is one of the mistakes we cover in our list of risks and pitfalls people face when buying property in Johannesburg.

Which areas in Johannesburg have stagnant or declining property prices as of 2026?

As of early 2026, the Johannesburg areas with stagnant or declining property prices include inner-city CBD residential stock (down 15% to 20% since 2020), oversupplied high-rise apartment clusters in parts of Sandton CBD, and poorly managed sectional title developments in southern suburbs where security and service delivery have deteriorated.

These stagnating Johannesburg areas have experienced flat to negative growth of 0% to minus 3% annually over the past three to five years, while the broader Johannesburg market has seen modest nominal appreciation of 2% to 4%, meaning these areas have significantly underperformed in real terms.

The underlying causes of price stagnation or decline in these Johannesburg areas are distinct:

- Johannesburg CBD residential: Urban decay, crime perception, and flight of professional tenants to northern suburbs

- Oversupplied Sandton high-rises: Investor-heavy ownership with identical competing units crushing rental rates

- Poorly managed southern suburbs: Body corporate failures leading to maintenance backlogs and service cuts

- Far-flung developments: Distance from job nodes without compensating lifestyle benefits reduces buyer depth

Buying real estate in Johannesburg can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Which Areas in Johannesburg Have the Best Long-Term Appreciation Potential?

Which areas in Johannesburg have historically appreciated the most recently?

The Johannesburg areas that have historically appreciated the most over the past five to ten years are Parkhurst/Parktown North (lifestyle suburb renovation wave), Rosebank/Illovo (node strengthening and densification), Bryanston/Rivonia (school catchment and corporate proximity), and Melrose/Melrose Arch adjacent areas (premium security demand).

Each of these top-performing Johannesburg areas has achieved distinct appreciation results:

- Parkhurst/Parktown North: Approximately 25% to 35% cumulative growth over five years, driven by lifestyle retail and renovation culture

- Rosebank/Illovo: Around 20% to 30% cumulative appreciation, supported by Gautrain access and mixed-use development

- Bryanston/Rivonia: Steady 15% to 25% growth over five years from consistent family demand and corporate tenant base

- Greenside/Parkview: Approximately 20% to 28% appreciation, benefiting from lifestyle precinct spillover

The main driver of above-average appreciation in these Johannesburg areas has been the combination of security infrastructure investment, walkable or semi-walkable neighborhood character (rare in Johannesburg), and consistent buyer depth from both owner-occupiers and investors seeking defensive assets.

By the way, you will find much more detailed trends and forecasts in our pack covering there is to know about buying a property in Johannesburg.

Which neighborhoods in Johannesburg are expected to see price growth in coming years?

The Johannesburg neighborhoods expected to see the strongest price growth in coming years are station-adjacent areas along the Rea Vaya Phase 1C corridor (connectivity premium), Rosebank node (continued corporate and lifestyle gravity), mid-market family clusters in Fourways/Douglasdale and Bryanston/Rivonia, and select Randburg pockets like Linden and Northcliff edge.

Each of these high-potential Johannesburg neighborhoods has distinct projected growth drivers:

- Rea Vaya Phase 1C corridor areas: Expected 5% to 8% annual growth as connectivity improves rental demand

- Rosebank node: Projected 4% to 6% annual appreciation from continued mixed-use densification

- Fourways (Douglasdale/Lonehill): Anticipated 3% to 5% growth from young family absorption and lifestyle retail

- Bryanston/Rivonia: Steady 3% to 5% annual growth supported by school catchment and corporate base

The single most important catalyst expected to drive future price growth in these Johannesburg neighborhoods is improved public transport connectivity, particularly the completion of Rea Vaya Phase 1C linking Alexandra, Sandton, and the CBD, which will increase rental demand and reduce the location discount currently affecting some areas.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What Do Locals and Expats Really Think About Different Areas in Johannesburg?

Which areas in Johannesburg do local residents consider the most desirable to live?

The Johannesburg areas that local residents consider most desirable to live are Parkview, Greenside, and Parkhurst (lifestyle and community feel), Houghton and Saxonwold (prestige and leafy character), and Bryanston (family-friendly with school access and corporate proximity).

Each of these locally-preferred Johannesburg areas offers distinct qualities:

- Parkview/Greenside/Parkhurst: Walkable streets, independent restaurants, active community associations, and renovation culture

- Houghton/Saxonwold/Forest Town: Large stands, heritage architecture, proximity to Johannesburg Zoo, and prestige address

- Bryanston: Top school catchments, secure estates, family-oriented shopping, and easy corporate commute

- Linden/Northcliff: More affordable lifestyle alternative with similar community feel to Parkhurst

The typical resident demographic in these locally-preferred Johannesburg areas includes established families with school-age children, professionals in their 30s to 50s who value lifestyle over pure investment returns, and long-term Johannesburg residents who prioritize community character.

Local preferences in Johannesburg generally align with foreign investor targets in areas like Sandton and Rosebank, but locals often place higher value on lifestyle suburbs like Parkhurst and Greenside that may offer lower rental yields but better quality of life.

Which neighborhoods in Johannesburg have the best reputation among expat communities?

The Johannesburg neighborhoods with the best reputation among expat communities are Morningside in Sandton, Bryanston, Rivonia, Illovo, Rosebank, and the Melrose Arch precinct, where security infrastructure, international school access, and easy Gautrain connections meet expat needs.

Each of these expat-favored Johannesburg neighborhoods appeals for specific reasons:

- Morningside (Sandton): Gated complexes, walkable pockets, proximity to corporate headquarters, and family-friendly

- Bryanston/Rivonia: Secure estates, top international schools nearby, and familiar suburban feel

- Rosebank/Illovo: Gautrain access, lifestyle amenities, and professional tenant ecosystem

- Melrose Arch: Precinct-style security that eliminates car dependence anxiety for newcomers

The typical expat profile in these popular Johannesburg neighborhoods includes corporate transferees on 2 to 4 year assignments, diplomatic and NGO staff, mining and finance executives, and increasingly, remote workers from Europe and North America seeking cost-of-living arbitrage.

Which areas in Johannesburg do locals say are overhyped by foreign buyers?

The Johannesburg areas that locals commonly say are overhyped by foreign buyers are "any Sandton address" (when in reality some high-rise clusters underperform), CBD revival pockets (where building governance risk can erase returns), and luxury precinct developments marketed heavily to offshore investors.

Locals believe these Johannesburg areas are overvalued for specific reasons:

- Generic "Sandton" investments: Oversupplied high-rise clusters compete brutally on rent, compressing actual yields despite prestige address

- CBD "revival" buildings: Governance risk is building-specific, and foreign buyers often lack local knowledge to distinguish good from bad

- Heavily-marketed new developments: Developer pricing often exceeds resale reality, and promised rental guarantees may not materialize

Foreign buyers typically value the Sandton brand recognition and perceived safety of new developments, while locals understand that micro-location, building management quality, and body corporate health matter far more than suburb name or marketing materials.

By the way, we've written a blog article detailing the experience of buying a property as a foreigner in Johannesburg.

Which areas in Johannesburg are considered boring or undesirable by residents?

The Johannesburg areas that residents commonly consider boring or undesirable include far-flung developments without lifestyle amenities or job node access, older suburban areas with limited retail or restaurant culture, and commuter-heavy zones where residents spend more time in traffic than enjoying their neighborhood.

Residents find these Johannesburg areas boring or undesirable for specific reasons:

- Distant southern developments: Long commutes to Sandton/Rosebank without compensating lifestyle or affordability benefits

- Older Roodepoort pockets: Limited walkability, aging infrastructure, and lack of trendy retail or dining

- Pure commuter suburbs: Bedroom communities with no distinct character where residents leave for everything

- Oversupplied apartment clusters: Identical buildings without community feel or neighborhood identity

Don't lose money on your property in Johannesburg

100% of people who have lost money there have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Johannesburg, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why It's Authoritative | How We Used It |

|---|---|---|

| Stats SA Residential Property Price Index | Official national statistics agency tracking residential property prices | We anchored citywide price trend analysis against this official baseline. We used it to validate whether suburb-level claims aligned with measured market reality. |

| Lightstone Property Data | Major property data provider used by banks and large firms | We used transaction volumes and sold price trends to assess liquidity by neighborhood. We identified where buyer depth is improving versus thinning out. |

| PayProp Rental Index | Processes large volumes of rental payments with long-running index | We used rent growth data and tenant affordability constraints to set realistic yield expectations. We anchored neighborhood rent ranges against this national baseline. |

| TPN Residential Rental Monitor | Specialized rental credit bureau with large tenant payment database | We cross-referenced tenant arrears and payment health to identify lower-risk neighborhoods. We used vacancy rate data to assess demand strength by area. |

| AirDNA Johannesburg | Most widely cited independent short-term rental data provider globally | We anchored Airbnb occupancy, ADR, and revenue estimates against their market snapshot. We identified oversaturation signals using supply and performance trends. |

| City of Johannesburg IDP 2025/26 | Official city government plan outlining priorities and projects | We tied "up-and-coming" claims to actual municipal investment priorities. We validated infrastructure-based neighborhood recommendations against official plans. |

| Johannesburg Development Agency | Municipal entity responsible for infrastructure projects | We sourced Rea Vaya Phase 1C progress updates and corridor details. We used project timelines to assess which areas will benefit from improved connectivity. |

| SAPS Crime Statistics | Official government publication of police-recorded crime data | We used quarterly crime releases to ground safety assessments in official data. We avoided making safety claims based on hearsay or anecdote. |

| Crimehub Crime Wizard | Structured interface built on SAPS-released station-level data | We used station comparisons to translate crime risk into actionable location guidance. We validated "avoid" recommendations against persistent station-level patterns. |

| SARS Transfer Duty Rates | Official source for property transfer duty brackets | We used current duty tables to help foreign buyers estimate acquisition costs accurately. We ensured budget guidance reflected actual early 2026 rates. |

| SARB Financial Surveillance | Reserve Bank department responsible for exchange control | We referenced FinSurv guidance for foreign buyer money movement processes. We ensured our foreigner checklist aligned with official exchange control administration. |

Get the full checklist for your due diligence in Johannesburg

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

Related blog posts