Authored by the expert who managed and guided the team behind the South Africa Property Pack

Everything you need to know before buying real estate is included in our South Africa Property Pack

Thinking about buying property in Durban in 2026 but wondering if the timing is right?

In this article, we look at current housing prices in Durban, rental demand, inventory trends, and local factors that could push prices up or down in the months ahead.

We constantly update this blog post with the freshest data we can find, so you always get the latest picture of the Durban property market.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Durban.

So, is now a good time?

As of early 2026, we would say it's rather a good time to buy property in Durban, though it's not a perfect "go ahead" for everyone.

The strongest signal is that interest rates have come down, with the repo rate at 6.75% after the November 2025 cut, making monthly bond payments more affordable than they were a year ago.

Another strong signal is that Durban's for-sale inventory dropped from about 11,600 listings in July 2025 to around 10,600 by December 2025, which tells us demand is absorbing stock.

Rent growth is running above inflation at roughly 5% per year, time-on-market is stable around 12 weeks, and the N2/N3 highway upgrades are bringing long-term value to suburbs along that corridor.

If you're buying to live in, focus on established suburbs like Umhlanga, Durban North, or Westville; if you're buying to rent out, sectional-title apartments in well-located nodes tend to offer gross yields in the 7% to 10% range.

This is not financial or investment advice, we don't know your personal situation, and you should always do your own research before making any property decision.

Is it smart to buy now in Durban, or should I wait as of 2026?

Do real estate prices look too high in Durban as of 2026?

As of early 2026, Durban property prices do not look obviously overheated, and most signals suggest the market is in a recovery phase rather than sitting at a dangerous peak.

One clear on-the-ground signal is that Durban listings dropped by about 1,000 units between July and December 2025, which typically happens when buyer demand is healthy enough to absorb available stock.

Another useful indicator is that the national time-on-market sits around 12 weeks, meaning homes are selling at a steady pace rather than sitting unsold for months, which is what you would expect in a truly overpriced market.

You can also read our latest update regarding the housing prices in Durban.

Does a property price drop look likely in Durban as of 2026?

As of early 2026, the likelihood of a meaningful property price drop in Durban over the next 12 months is low, unless something unexpected breaks like a spike in interest rates or a severe municipal services crisis.

A plausible range for Durban property prices over the coming year would be somewhere between flat growth and roughly 6% appreciation, with a sharp decline looking unlikely given the current rate environment.

The single most important macro factor that could trigger a price drop in Durban would be a sudden reversal in interest rates, pushing monthly bond payments back up and choking off buyer demand.

However, with inflation sitting in the mid-3% range in late 2025 and the Reserve Bank signaling a supportive stance, the odds of aggressive rate hikes in the near term look quite low.

Finally, please note that we cover the price trends for next year in our pack about the property market in Durban.

Could property prices jump again in Durban as of 2026?

As of early 2026, the likelihood of a renewed double-digit price surge in Durban is medium, meaning it's possible but not the base case most buyers should plan around.

If conditions align well, Durban property prices could rise by 7% to 10% over the next 12 months, though mid-single-digit growth remains the more conservative and likely expectation.

The single biggest demand-side trigger that could push Durban prices higher would be further rate cuts from the Reserve Bank, which would unlock more buyer demand by lowering monthly bond payments.

Please also note that we regularly publish and update real estate price forecasts for Durban here.

Are we in a buyer or a seller market in Durban as of 2026?

As of early 2026, Durban is a slight buyer's market overall, though some high-demand neighborhoods like Umhlanga Ridge and Durban North are tilting toward sellers.

With time-on-market sitting around 12 weeks nationally and Durban inventory shrinking, the market is roughly balanced, which means buyers have some room to negotiate but should not expect desperate sellers everywhere.

Looking at price reductions, there is no widespread discounting happening in the most desirable Durban suburbs, though you will find more flexibility in less liquid pockets like some CBD-fringe apartment blocks or areas with service delivery concerns.

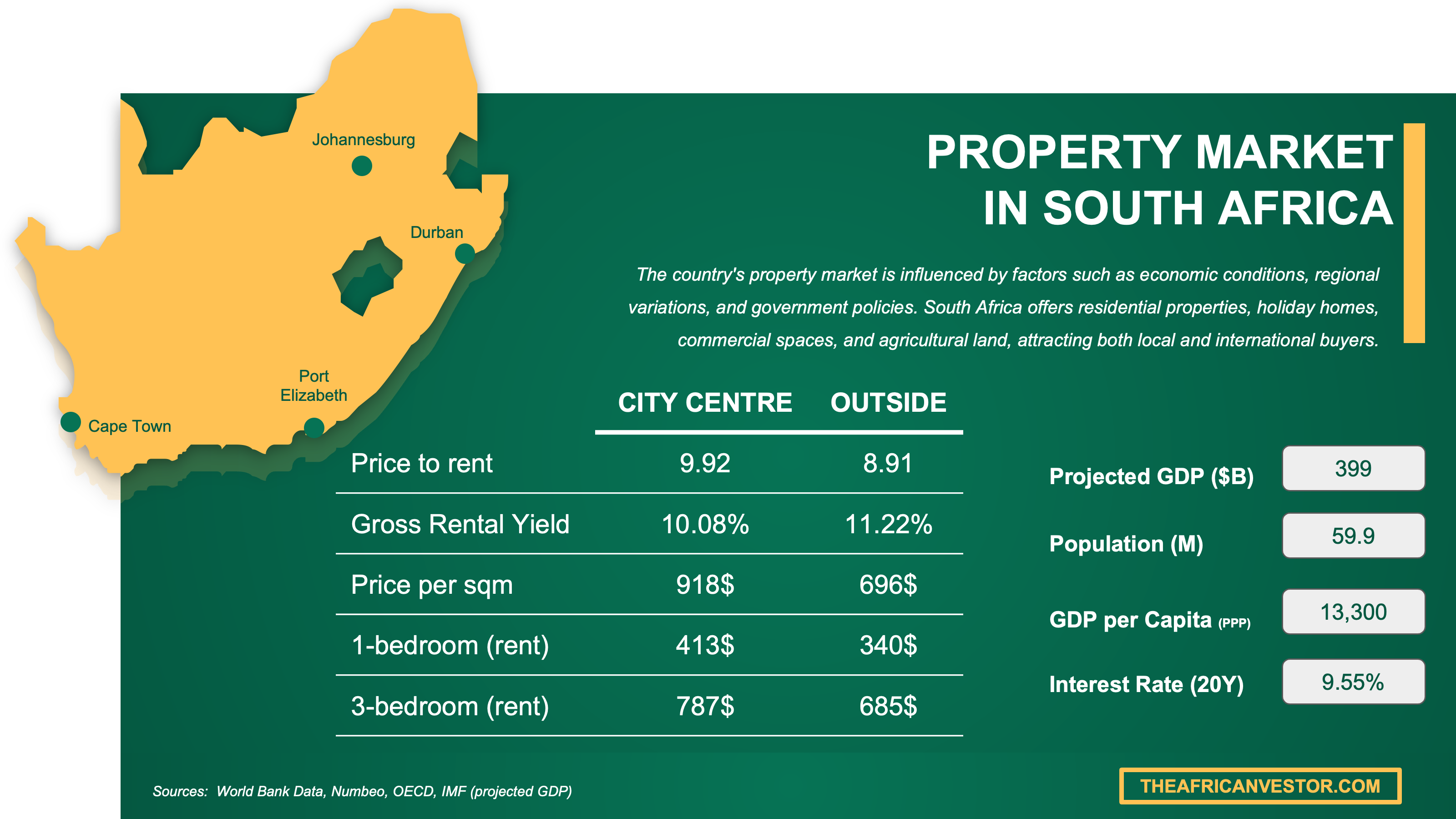

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Are homes overpriced, or fairly priced in Durban as of 2026?

Are homes overpriced versus rents or versus incomes in Durban as of 2026?

As of early 2026, Durban homes appear roughly fairly priced when compared to rents, with gross yields typically ranging from 7% to 10% depending on the property type and location.

The price-to-rent ratio in Durban suggests that buying is competitive with renting in many suburbs, especially compared to markets where yields compress below 5% and buying becomes much harder to justify financially.

When it comes to price-to-income, Durban looks expensive if you compare against South Africa's national median household income of around R96,000 per year, but most Durban purchases are made by above-median earners or multi-income families, which makes affordability more realistic for typical buyers in this market.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in Durban.

Are home prices above the long-term average in Durban as of 2026?

As of early 2026, Durban home prices are likely modestly above their long-term nominal average, but in real (inflation-adjusted) terms, the market does not look extreme or bubble-like.

Over the past 12 months, Durban property prices have grown in the 3% to 5% range according to most indexes, which is only slightly above the pre-pandemic pace and not the kind of runaway growth that signals trouble ahead.

When you adjust for inflation running around 3% to 4%, real price growth in Durban is small, which means buying power has not been wildly outpaced and the market is not sitting at a dangerous peak.

Get fresh and reliable information about the market in Durban

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What local changes could move prices in Durban as of 2026?

Are big infrastructure projects coming to Durban as of 2026?

As of early 2026, the biggest infrastructure project likely to affect Durban property prices is the N2/N3 corridor upgrade, which is part of a strategic logistics spine linking the port to inland economic hubs.

This project is already underway with phased construction, and it should improve commute times and reliability for suburbs along the Outer West corridor, including areas like Westville, Pinetown, Kloof, and Hillcrest.

For the latest updates on the local projects, you can read our property market analysis about Durban here.

Are zoning or building rules changing in Durban as of 2026?

The most important zoning direction in Durban right now is the push toward nodal development and corridor densification, as outlined in eThekwini's Spatial Development Framework for 2025-2026.

As of early 2026, this means buyers should expect more apartment and mixed-use development near designated investment nodes, which could change neighborhood character over time but is not a sudden blanket upzoning across the whole city.

The areas most affected by these planning directions include densification corridors like the beachfront, Umhlanga, and parts of the Outer West, where future redevelopment pressure is most likely to show up.

Are foreign-buyer or mortgage rules changing in Durban as of 2026?

As of early 2026, there are no major new restrictions on foreign buyers in Durban, and the bigger factor affecting affordability remains the repo rate path rather than any sweeping mortgage rule changes.

A draft amendment to National Credit Act regulations was floated in 2025 but has since been referenced as withdrawn, so there is no confirmed new affordability rule in force that would tighten mortgage access for buyers.

For foreign buyers, the main hurdles remain exchange control compliance and banking processes rather than outright bans, meaning the practical landscape has not shifted dramatically.

You can also read our latest update about mortgage and interest rates in South Africa.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Will it be easy to find tenants in Durban as of 2026?

Is the renter pool growing faster than new supply in Durban as of 2026?

As of early 2026, renter demand in Durban appears to be holding up well against new supply, with rent growth running above inflation at around 5% year-on-year.

The clearest demand signal is that average national rent reached about R9,300 per month by late 2025, suggesting tenants are still competing for quality units even as household budgets tighten.

On the supply side, Stats SA's building plan data shows residential approvals were down in early 2025, which means new rental stock is not flooding the Durban market and existing landlords face less competition from brand-new units.

Are days-on-market for rentals falling in Durban as of 2026?

As of early 2026, well-priced rentals in Durban's best areas are letting within 2 to 4 weeks, while weaker locations or overpriced units can sit for 6 to 10 weeks or longer.

The gap in letting speed is significant: a modern apartment in Umhlanga Ridge or a family home in Durban North will find a tenant much faster than an older flat in a CBD-fringe block with high levies.

One common reason days-on-market falls in Durban is genuine undersupply in popular nodes combined with seasonal demand peaks around year-end when people relocate for new jobs or the school year.

Are vacancies dropping in the best areas of Durban as of 2026?

As of early 2026, vacancies in Durban's top rental areas like Umhlanga Ridge, La Lucia, Durban North, Morningside, and Westville are estimated at around 4% to 6%, which is tighter than the broader metro average of roughly 6% to 9%.

This means landlords in prime Durban suburbs are seeing less downtime between tenants compared to those in less desirable locations, where vacancies can stretch longer and eat into returns.

One practical sign that the best areas are tightening first is when agents report multiple applications for the same unit within days of listing, something that is happening more often in Durban North and Umhlanga than in oversupplied pockets.

By the way, we've written a blog article detailing what are the current rent levels in Durban.

Buying real estate in Durban can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Am I buying into a tightening market in Durban as of 2026?

Is for-sale inventory shrinking in Durban as of 2026?

As of early 2026, for-sale inventory in Durban has shrunk noticeably, with total listings dropping from around 11,600 in July 2025 to about 10,600 by December 2025.

This decline of roughly 1,000 listings over six months suggests the market is tightening, though we do not have a precise months-of-supply figure for Durban alone since that data is not published at the metro level.

The most likely reason inventory is shrinking is that buyer demand picked up as rates eased, while new listings have not kept pace, which is a classic recipe for a tightening resale market.

Are homes selling faster in Durban as of 2026?

As of early 2026, homes in Durban are selling at a steady pace, with national benchmarks showing time-on-market around 12 weeks, which is neither sluggish nor frantic.

There is no strong public evidence of a dramatic year-on-year speedup in Durban specifically, but the combination of falling inventory and stable selling times suggests the market is absorbing stock rather than slowing down.

Are new listings slowing down in Durban as of 2026?

As of early 2026, new listings in Durban appear to be slowing, which is consistent with the overall inventory decline we have seen since mid-2025.

The seasonal pattern in Durban typically sees a dip in new listings around the December-January holiday period, but the current level looks low even accounting for seasonality.

The most plausible reason new listings are slowing is that many homeowners who locked in lower rates in earlier years are hesitant to sell and take on a new bond at today's rates, a dynamic often called "rate lock-in."

Is new construction failing to keep up in Durban as of 2026?

As of early 2026, new construction in Durban is not keeping pace with demand, as Stats SA data shows residential building plans were down nationally in early 2025.

The recent trend in permits and completions suggests that the pipeline is constrained rather than flooding the market, which supports prices in the medium term but limits choice for buyers.

The single biggest bottleneck limiting new construction in Durban is likely a combination of municipal approval delays and cautious developer financing after the high-rate period, rather than a shortage of land or labor.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

Will it be easy to sell later in Durban as of 2026?

Is resale liquidity strong enough in Durban as of 2026?

As of early 2026, resale liquidity in Durban is strong enough in the right neighborhoods, though the city is very much a micro-market where some areas sell quickly and others drag.

The median time-on-market for resale homes in Durban's best suburbs sits around 10 to 14 weeks, which is within the healthy liquidity range where sellers can expect a reasonable sale timeline if priced correctly.

The property characteristic that most improves resale liquidity in Durban is location in a high-demand suburb like Umhlanga Ridge, Durban North, Morningside, Westville, or Hillcrest, where schools, safety, and municipal reliability are strongest.

Is selling time getting longer in Durban as of 2026?

As of early 2026, there is no strong evidence that selling time in Durban is getting materially longer, with FNB's surveys showing time-on-market relatively stable around 12 weeks.

The realistic range across most Durban listings runs from about 8 weeks for well-priced homes in liquid suburbs to 16 weeks or more for overpriced or less desirable properties.

One clear reason selling time can lengthen in Durban is affordability pressure, where buyers who qualify for smaller bonds take longer to match with suitable stock, especially in price bands above R2 million.

Is it realistic to exit with profit in Durban as of 2026?

As of early 2026, the likelihood of selling with a profit in Durban is medium to high if you hold for at least 5 to 7 years, but quick flips are risky given transaction costs and modest annual growth.

Most buyers need a holding period of at least 5 years to realistically cover transaction costs and see enough appreciation to exit profitably, especially if they are financing with a bond.

The total round-trip cost drag in Durban, including transfer duty, agent commission, bond costs, and legal fees, runs roughly 10% to 13% of the property value, which is around R200,000 to R260,000 on a R2 million home (approximately $11,000 to $14,500 USD or 10,000 to 13,500 EUR).

The factor that most increases profit odds in Durban is buying below market value from a motivated seller in a resilient suburb, then holding through a stable-rate or improving-growth window.

Get the full checklist for your due diligence in Durban

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Durban, we always rely on the strongest methodology we can, and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's trustworthy | How we used it |

|---|---|---|

| Statistics South Africa (RPPI) | South Africa's official statistics agency publishing formal house-price data. | We used it to anchor what is normal for national house-price inflation. We treat it as a baseline to sanity-check private indexes. |

| Stats SA (CPI) | The official inflation release hub with downloadable CPI publications. | We used it to anchor inflation so we can discuss real versus nominal property growth. We also interpret affordability pressure on households through this data. |

| South African Reserve Bank (MPC) | The central bank's primary record for the repo rate and policy stance. | We used it to set the interest-rate backdrop buyers finance against. We also reference it for the "rates may move next" discussion. |

| Reuters | A globally recognized wire service citing official data and market consensus. | We used it to cross-check the near-term rate narrative and rate-cut expectations. We only rely on it where it clearly refers back to official facts. |

| FNB Property Barometer | A major bank with a long-running property research program. | We used it to understand cycle momentum and regional rotation. We also use it as a triangulation point against Stats SA and other private indexes. |

| FNB Estate Agents Survey | A structured survey by a major bank focused on market tightness. | We used it for buyer-versus-seller signals like time on market and agent sentiment. We treat it as ground-level pulse rather than a price index. |

| PayProp Rental Index | A large rental payments platform publishing a consistent rental index. | We used it to anchor rent growth, rent levels, and tenant stress indicators. We assess whether rents keep pace with prices for investors. |

| MRI TPN Vacancy Survey | A recognized credit bureau and data provider with formal vacancy reporting. | We used it to triangulate vacancy direction and provincial differences. We treat it as the best publicly available rental tightness proxy. |

| BetterBond Property Brief | A major mortgage originator whose application trends are meaningful. | We used it to cross-check whether buyer activity and lending appetite are rising. We treat it as demand-side evidence rather than a price measure. |

| Stats SA Building Statistics | Official supply-side construction approval and completion data. | We used it to judge whether new supply is accelerating or constrained. We ground "construction failing to keep up" claims with this data. |

| eThekwini IDP | The city's official planning and budgeting framework repository. | We used it to identify the city's stated priorities that can influence neighborhoods. We treat it as what government is planning rather than what is guaranteed. |

| eThekwini Draft SDF 2025-2026 | An official municipal spatial planning document source. | We used it to understand densification corridors and land-use direction. We focus on implications for where supply could expand. |

| SANRAL N2/N3 Upgrades | A formal project brochure describing a nationally significant corridor upgrade. | We used it to ground the infrastructure tailwind conversation around Durban's logistics spine. We focus on how travel-time changes affect suburb demand. |

| Property24 Durban Trends | The country's largest portal referencing Deeds Office data and listings volumes. | We used it for near-real-time supply signals like listings counts. We treat it as directional rather than perfect truth. |

| Government of South Africa (NCA Notice) | The official government notice record for credit regulation changes. | We used it to check whether mortgage affordability rules were changing around 2026. We rely on it over commentary pieces because it is the primary source. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Related blog posts