Authored by the expert who managed and guided the team behind the South Africa Property Pack

Everything you need to know before buying real estate is included in our South Africa Property Pack

Wondering if January 2026 is a good time to buy property in South Africa? You're not alone, and we've gathered the latest data and signals to help you decide.

In this article, we break down current housing prices in South Africa, market trends, and what the numbers actually tell us about buying now versus waiting.

We constantly update this blog post to reflect the freshest data available, so you're always getting the most relevant insights.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in South Africa.

So, is now a good time?

As of early 2026, we would say it's a "rather yes" to buy property in South Africa, especially if you're buying for fundamentals like a home to live in or a rental in a proven area.

The strongest signal is that national house price growth is moderate (around 4% to 6% nominal), while inflation sits at roughly 3.5%, meaning real prices are not running away from buyers.

Another strong signal is that interest rates have stabilized, with the repo rate at 6.75% and possible further cuts expected, which is improving affordability compared to recent years.

Other supporting signals include resilient rental demand, soft new construction supply, and South Africa's recent removal from the FATF grey list, which has boosted investor confidence by 30% to 35% according to industry reports.

The best strategies right now include targeting well-located apartments or townhouses in Cape Town, Johannesburg's secure estates, or coastal lifestyle nodes where rental yields of 7% to 10% gross are achievable, whether for long-term rentals or personal use.

Please note this is not financial or investment advice, we don't know your personal situation, and you should always do your own research before making any property decision.

Is it smart to buy now in South Africa, or should I wait as of 2026?

Do real estate prices look too high in South Africa as of 2026?

As of early 2026, South Africa's property prices do not look bubble-high, with national nominal house price growth running at roughly 4% to 6% year-on-year, while inflation hovers around 3.5%, which means real (after-inflation) price gains are modest at best.

One clear on-the-ground signal that prices are not overstretched is the average time-on-market, which FNB's estate agent survey put at around 12 weeks nationally in 2025, suggesting homes are moving but not flying off the shelves in a frenzy.

Another telling sign is that rental yields for apartments and townhouses in South Africa remain healthy at 7% to 10% gross, which indicates purchase prices have not disconnected wildly from what properties can actually earn.

You can also read our latest update regarding the housing prices in South Africa.

Does a property price drop look likely in South Africa as of 2026?

As of early 2026, the likelihood of a meaningful property price decline in South Africa over the next 12 months appears low, mainly because interest rates have stabilized and inflation is contained.

A plausible downside-to-upside range for South Africa property prices over the next year is roughly minus 5% nominal (around minus 8% real) to plus 9% nominal, with the base case leaning toward modest gains rather than losses.

The single most important macro factor that could increase the odds of a price drop in South Africa is a sharp spike in interest rates, which would squeeze affordability and force sellers to cut prices.

However, with inflation tracking around 3.5% and the South African Reserve Bank signaling possible further rate cuts in 2026, a sudden rate spike looks unlikely in the coming months.

Finally, please note that we cover the price trends for next year in our pack about the property market in South Africa.

Could property prices jump again in South Africa as of 2026?

As of early 2026, the likelihood of a renewed price surge in South Africa is medium nationally, but higher in hot pockets like the Western Cape where demand continues to outstrip supply.

A plausible upside price change range for South Africa over the next 12 months is 6% to 9% nominal nationally, with select suburbs in Cape Town and coastal lifestyle nodes potentially seeing 10% to 15% gains if supply stays tight.

The single biggest demand-side trigger that could drive prices to jump in South Africa is further interest rate cuts combined with continued semigration to the Western Cape and coastal regions, which would unlock more buyers while supply remains constrained.

Please also note that we regularly publish and update real estate price forecasts for South Africa here.

Are we in a buyer or a seller market in South Africa as of 2026?

As of early 2026, South Africa's property market looks balanced to slightly buyer-leaning nationally, though the Western Cape remains tilted in favor of sellers due to persistent stock shortages.

The estimated months-of-inventory in South Africa translates to roughly 12 weeks average time-on-market, which typically means buyers have some room to negotiate on price and terms rather than facing bidding wars.

While exact price-reduction data is not centrally published in South Africa, the combination of steady (not frenzied) selling times and moderate price growth suggests many sellers are open to negotiation, especially outside of Cape Town's hottest suburbs.

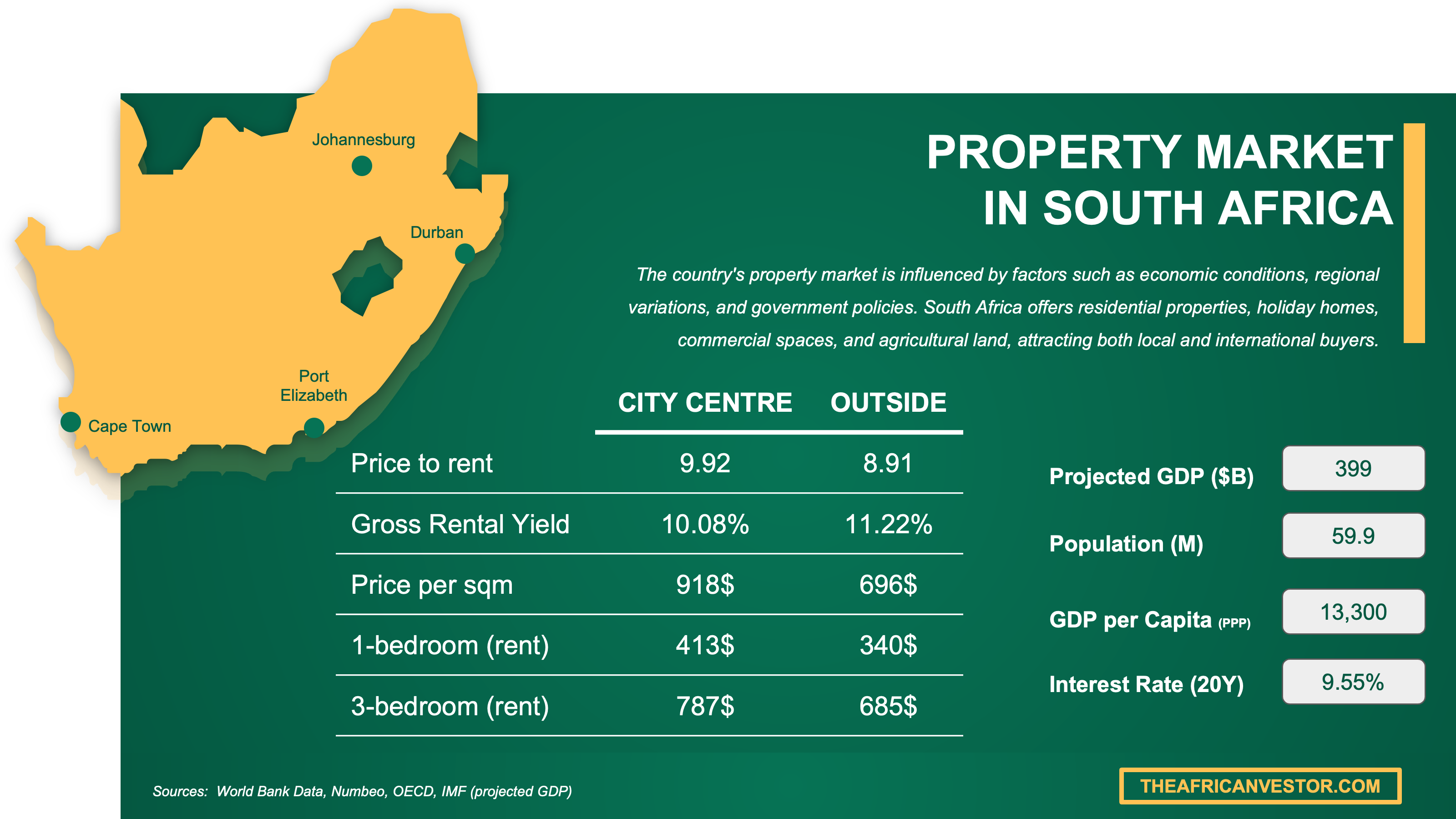

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Are homes overpriced, or fairly priced in South Africa as of 2026?

Are homes overpriced versus rents or versus incomes in South Africa as of 2026?

As of early 2026, South Africa homes appear fairly priced to slightly expensive when comparing purchase costs to rents, though affordability versus incomes remains stretched due to elevated mortgage rates.

The estimated price-to-rent ratio in South Africa varies by property type, but gross rental yields of 7% to 10% for apartments and 5% to 7% for freestanding houses suggest prices have not disconnected dramatically from rental income potential.

The estimated price-to-income multiple in South Africa remains challenging, with formal-sector average earnings around R29,500 per month and prime mortgage rates at 10.25%, meaning many households struggle to qualify for larger bonds even as inflation eases.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in South Africa.

Are home prices above the long-term average in South Africa as of 2026?

As of early 2026, South Africa property prices do not appear to be in a long-run blow-off top, with the market looking more like a grind or plateau than a boom when viewed against historical cycles.

The estimated recent 12-month price change in South Africa of roughly 4% to 6% nominal is broadly in line with, or slightly above, the pre-pandemic pace, suggesting the market is recovering but not overheating.

When adjusted for inflation, South Africa real home prices remain below their prior cycle peak from the mid-2000s boom, which means there is still some room for catch-up growth rather than a bubble-like overshoot.

Get fresh and reliable information about the market in South Africa

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What local changes could move prices in South Africa as of 2026?

Are big infrastructure projects coming to South Africa as of 2026?

As of early 2026, the biggest infrastructure project likely to affect property prices in South Africa is the government's R1 trillion infrastructure program, with specific local impact coming from projects like Cape Town's MyCiTi bus rapid transit expansion.

The MyCiTi expansion is actively underway, with routes extending into areas like Mitchells Plain, Khayelitsha, and the Wynberg corridor, and completion of various phases expected to roll out through 2026 and beyond.

For the latest updates on the local projects, you can read our property market analysis about South Africa here.

Are zoning or building rules changing in South Africa as of 2026?

The single most important zoning change being discussed in South Africa involves densification rules at municipal level, with Cape Town's Municipal Planning Amendment By-law 2025 being a concrete example of how cities are adjusting where and how densely developers can build.

As of early 2026, these zoning changes could put moderate upward pressure on prices in areas where densification is now allowed, as more rental stock becomes viable, while also potentially increasing supply over time which could moderate growth in specific nodes.

The areas most affected by these rule changes in South Africa are typically inner-city and transit-adjacent neighborhoods like Woodstock, Salt River, and Observatory in Cape Town, or Rosebank and Sandton edges in Johannesburg, where mixed-use densification is being actively debated.

Are foreign-buyer or mortgage rules changing in South Africa as of 2026?

As of early 2026, foreign-buyer and mortgage rule changes in South Africa are modest, with the main impact on prices coming from interest rate movements rather than major regulatory shifts.

The most notable foreign-buyer rule changes involve tightened tax compliance and documentation requirements under SARB's Exchange Control Circular 15/2025, which adds administrative friction for non-residents but does not ban or heavily restrict foreign purchases.

On the mortgage side, there are no major new LTV limits or stress tests being introduced, though banks continue to require rigorous affordability checks given the elevated prime rate of 10.25%, which effectively limits how much buyers can borrow.

You can also read our latest update about mortgage and interest rates in South Africa.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Will it be easy to find tenants in South Africa as of 2026?

Is the renter pool growing faster than new supply in South Africa as of 2026?

As of early 2026, the balance between renter-demand growth and new rental supply in South Africa appears to favor landlords, with demand staying resilient while new construction has been soft.

The clearest signal of renter demand in South Africa is the combination of semigration (people moving from Gauteng to the Western Cape and coastal areas) and urbanization, which continues to drive household formation in major metros.

On the supply side, official building statistics show that residential building plans have been weak in recent periods, which typically means fewer new rental units coming to market and tighter conditions for landlords.

Are days-on-market for rentals falling in South Africa as of 2026?

As of early 2026, precise days-on-market data for rentals in South Africa is not centrally published, but directional signals suggest letting times remain healthy in well-located stock, with rent escalations running above CPI.

The estimated difference in days-on-market between best areas like Cape Town's City Bowl or Johannesburg's Sandton versus weaker nodes can be significant, with prime rentals often letting within 2 to 4 weeks while less desirable properties may sit for 8 to 12 weeks or longer.

One common reason days-on-market falls in South Africa is tight supply in high-demand suburbs, especially in the Western Cape where semigration continues to outpace new rental stock coming to market.

Are vacancies dropping in the best areas of South Africa as of 2026?

As of early 2026, vacancy rates in the best-performing rental areas of South Africa like Cape Town's City Bowl (Gardens, Oranjezicht, Tamboerskloof), Sea Point, Sandton in Johannesburg, and Umhlanga in Durban appear to be stable to tightening due to persistent demand and limited new supply.

The estimated vacancy rate in these best areas is generally lower than the overall market average, with premium suburbs benefiting from their combination of jobs, amenities, perceived safety, and good transport links.

One practical sign for landlords that the best areas in South Africa are tightening is when rent escalations consistently exceed CPI by 1 to 2 percentage points, which indicates landlords have pricing power and are not struggling to fill units.

By the way, we've written a blog article detailing what are the current rent levels in South Africa.

Buying real estate in South Africa can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Am I buying into a tightening market in South Africa as of 2026?

Is for-sale inventory shrinking in South Africa as of 2026?

As of early 2026, it is difficult to estimate precise year-on-year changes in for-sale inventory across South Africa because centralized listing data is not consistently published, but leading indicators suggest supply is not expanding rapidly.

The estimated months-of-supply in South Africa, using time-on-market as a proxy, suggests a roughly balanced market at around 3 months (12 weeks) nationally, though the Western Cape is tighter and Gauteng is softer.

The single most likely reason inventory is not growing much in South Africa is that homeowners locked into older, cheaper mortgages are reluctant to sell and take on new debt at higher rates, a pattern common in rate-sensitive markets.

Are homes selling faster in South Africa as of 2026?

As of early 2026, the estimated median time-to-sell for homes in South Africa is around 12 weeks (roughly 3 months), which is steady rather than rapidly speeding up, suggesting the market is functioning but not in a frenzy.

The estimated year-over-year change in median days-on-market for South Africa appears roughly flat to slightly improving, meaning homes are not sitting dramatically longer but also not flying off the market within days.

Are new listings slowing down in South Africa as of 2026?

As of early 2026, we are not confident in precise year-on-year new listing numbers for South Africa because centralized data is limited, but anecdotal signals suggest listings are not surging and may be modestly slower than pre-pandemic norms.

The typical seasonal pattern for new listings in South Africa sees activity pick up after the December holiday slowdown and peak in autumn (March to May), and current levels do not appear unusually low compared to this pattern.

The single most plausible reason new listings might be slow in South Africa is seller caution, as homeowners wait for rates to fall further before testing the market, hoping for better conditions later in 2026.

Is new construction failing to keep up in South Africa as of 2026?

As of early 2026, official building statistics show that new residential construction in South Africa has been soft, with building plans passed running below levels that would suggest a coming supply glut.

The estimated recent trend in permits and completions in South Africa shows a period of weaker residential plans, which typically translates to fewer new units delivered 12 to 24 months later.

The single biggest bottleneck limiting new construction in South Africa is a combination of financing challenges for developers (given high interest rates) and municipal service delivery concerns that make some areas less attractive for new projects.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

Will it be easy to sell later in South Africa as of 2026?

Is resale liquidity strong enough in South Africa as of 2026?

As of early 2026, resale liquidity in South Africa is adequate for correctly priced homes in mainstream suburbs and excellent in high-demand nodes, but can be thin in areas with weak municipal services or high crime.

The estimated median days-on-market for resale homes in South Africa is around 12 weeks (84 days), which compares reasonably to a healthy liquidity benchmark of 8 to 12 weeks for functioning markets.

One property characteristic that most improves resale liquidity in South Africa is location within a secure estate or suburb with reliable municipal services, as buyers increasingly prioritize safety and functioning infrastructure over other features.

Is selling time getting longer in South Africa as of 2026?

As of early 2026, selling time in South Africa appears steady compared to last year, with no clear evidence of a significant lengthening in how long homes take to sell.

The estimated current median days-on-market in South Africa is around 12 weeks, with a realistic range of 8 weeks for well-priced homes in strong areas to 16 weeks or more for overpriced or poorly located properties.

One clear reason selling time can lengthen in South Africa is affordability pressure, as high mortgage rates at 10.25% prime limit how many buyers can qualify, which reduces the pool of potential purchasers for any given listing.

Is it realistic to exit with profit in South Africa as of 2026?

As of early 2026, the likelihood of selling with a profit in South Africa is medium to high if you hold for a typical period of 5 or more years, buy at a fair price, and choose the right micro-location.

The estimated minimum holding period in South Africa that most often makes exiting with profit realistic is around 5 to 7 years, which allows time for price appreciation to outpace transaction costs and inflation.

The estimated total round-trip cost drag in South Africa (buying plus selling costs including transfer duty, agent commissions, and legal fees) is roughly 10% to 13% of the property value, which translates to approximately R120,000 to R195,000 on a R1.5 million home, or around USD 6,500 to USD 10,500 (EUR 6,000 to EUR 9,700) at current exchange rates.

One clear factor that most increases profit odds in South Africa is buying in a suburb with strong demand fundamentals (jobs, schools, security, and services) where scarcity supports prices, rather than speculating on weaker areas hoping for a turnaround.

Get the full checklist for your due diligence in South Africa

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about South Africa, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Stats SA Residential Property Price Index | South Africa's official national statistics agency publishing the primary home price inflation index. | We used it as the official baseline for national house-price inflation. We compared it to inflation and private-sector indices to check price direction. |

| Stats SA Consumer Price Index | The official inflation measure used across government and financial markets in South Africa. | We used it to convert nominal house-price growth into real (after-inflation) growth. We also used it to gauge affordability and interest-rate pressure. |

| South African Reserve Bank | South Africa's central bank and the primary source for repo and prime lending rates. | We used it to anchor mortgage-rate assumptions as of the first half of 2026. We linked rates to affordability and buyer demand. |

| BIS Residential Property Prices via FRED | The Bank for International Settlements is a top-tier international data provider for long-run price series. | We used it to validate longer-run price trends and check whether South Africa is in a boom, slump, or flat cycle. |

| Stats SA Building Statistics | Official recurring release tracking housing supply signals including building plans and completions. | We used it to assess whether construction is accelerating or cooling. We treated slowing plans as a future supply tightness signal. |

| FNB Estate Agents Survey | FNB is a major South African bank with a long-standing, data-driven market survey from estate agents. | We used it for time-on-market as a buyer-versus-seller leverage signal. We used it to infer liquidity and whether stock is moving. |

| PayProp Rental Index | PayProp is a large rental-payment platform with widely cited methodology for tracking rents. | We used it for national rent growth and rent levels. We translated rents into gross yield ranges to compare buy versus rent economics. |

| TPN Residential Rental Monitor | TPN is a major tenant-analytics and credit bureau player in South African rentals. | We used it to gauge tenant health and rent escalation momentum. We used it as a proxy for renter demand resilience. |

| Absa Homeowner Sentiment Index | Absa is a major bank and the HSI is a long-running, widely cited property sentiment survey. | We used it to measure buyer and seller confidence and intentions. We treated it as demand temperature rather than a price index. |

| Lightstone Property Newsletter | Lightstone is a leading South African property-data firm using deeds and valuation datasets. | We used it to identify where foreign demand is concentrated and how it behaves. We used those insights to flag hot pockets versus national average. |

| National Treasury Budget Review | The government's core macro and fiscal plan document for South Africa. | We used it to anchor the macro backdrop including growth assumptions and public spending direction. |

| City of Cape Town MyCiTi Expansion | Official municipal transport page describing planned routes and build stages. | We used it to explain how transit upgrades can shift micro-markets. We linked planned connectivity to rental depth in affected corridors. |

| Cape Town Municipal Planning Amendment By-law 2025 | The actual gazetted by-law text showing real zoning and planning rule changes. | We used it as an example of how rules can move prices locally even if national prices are flat. |

| Stats SA Quarterly Employment Statistics | Official dataset behind formal-sector earnings trends in South Africa. | We used it to ground household income momentum as a key driver of price ceilings. We combined it with home prices to estimate affordability pressure. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.