Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Cape Town's property market is included in our pack

Cape Town remains one of Africa's most accessible property markets for foreign buyers, with no nationality-based restrictions and full freehold ownership rights in January 2026.

This guide covers what you can legally buy, visa requirements, the buying process, financing options, and the real costs you should expect as a foreigner purchasing residential property in Cape Town.

We constantly update this blog post with fresh data on Cape Town housing prices, regulations, and market conditions to help you make informed decisions.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Cape Town.

Insights

- Foreign buyers account for 40% of Cape Town luxury property sales above R10 million, making international investment a major market driver in the Atlantic Seaboard and City Bowl areas.

- Non-resident foreigners can typically borrow only up to 50% of the property value from South African banks, meaning you need at least half the purchase price in cash from abroad.

- Cape Town property prices have risen 141% since 2010, with the average sale price now around R2.1 million and prime areas commanding R30,000 to R60,000 per square meter.

- Transfer duty in Cape Town is progressive and can add 3.5% to 9% to your purchase price depending on the property value, with properties under R1.1 million exempt from this tax.

- The biggest mistake foreigners make in Cape Town is not properly documenting money flows through authorized bank channels, which creates serious problems when trying to repatriate sale proceeds years later.

- Cape Town's prime lending rate sits at 10.25% as of late 2025, but foreign buyers typically pay 0.5% to 2% above prime due to higher risk profiles.

- Property ownership in Cape Town does not grant residency or citizenship, so treat any purchase as a lifestyle or investment decision rather than an immigration strategy.

- Annual municipal property rates in Cape Town run about 0.7% of your property's value, with a R5 million home costing roughly R36,000 per year in rates alone.

- The property transfer process in Cape Town typically takes 8 to 12 weeks from accepted offer to deed registration, with a conveyancing attorney handling all legal requirements.

- Rental yields in Cape Town average 9.4% citywide for apartments, with emerging neighborhoods like Woodstock and Observatory delivering 8% to 11% returns.

What can I legally buy and truly own as a foreigner in Cape Town?

What property types can foreigners legally buy in Cape Town right now?

In January 2026, foreigners can legally buy virtually any type of residential property in Cape Town, including apartments, townhouses, freestanding houses, villas, penthouses, and homes in security estates.

The most important legal requirement is that you must comply with South African exchange control regulations when bringing funds into the country, which means using authorized bank channels and keeping proper documentation of your money flows.

Your ownership is secured through registration in the Deeds Registry, which gives you the same title deed protection as South African citizens, and this registration is what proves you truly own the property rather than any contract or agent's assurance.

Unlike many countries that impose foreign buyer quotas or nationality restrictions, South Africa treats all international buyers equally whether you come from Europe, North America, Asia, or anywhere else in the world.

Finally, please note that our pack about the property market in Cape Town is specifically tailored to foreigners.

Can I own land in my own name in Cape Town right now?

Yes, if you buy a full-title property in Cape Town, you can own both the land and the buildings in your personal name, with your ownership recorded in the Deeds Registry just like any South African citizen.

This applies to freestanding houses, villas, and most residential plots, though sectional title properties like apartments give you ownership of your unit plus a share of common property rather than direct land ownership.

The critical practical point is ensuring your purchase funds are properly channeled through an authorized South African bank so you can prove the foreign source of your investment when you eventually want to repatriate your money after selling.

As of 2026, what other key foreign-ownership rules or limits should I know in Cape Town?

As of January 2026, the rules that most often affect foreign buyers in Cape Town are not formal ownership restrictions but practical constraints like sectional title body corporate rules, estate HOA regulations, and City of Cape Town zoning requirements that determine what you can actually do with your property.

There is no foreign-ownership quota for apartments or condos in Cape Town, so you will not face percentage limits on how many units in a building can be owned by foreigners.

However, you should know that SARS (the South African Revenue Service) increasingly requires tax reference numbers for both buyers and sellers as part of transfer duty compliance, so plan to obtain your South African tax number early in the process to avoid delays.

There are no major regulatory changes specifically targeting foreign ownership expected in 2026, though ongoing political discussions about agricultural land restrictions could eventually affect rural properties outside Cape Town's urban areas.

What's the biggest ownership mistake foreigners make in Cape Town right now?

The single biggest mistake foreigners make in Cape Town is not properly documenting their money flow through authorized bank channels, which creates serious problems years later when they try to repatriate their sale proceeds back to their home country.

If you make this mistake, you could find yourself stuck with Rand proceeds you cannot easily convert and transfer abroad, or facing lengthy delays and additional compliance requirements with the South African Reserve Bank that eat into your returns.

Other classic pitfalls include underestimating monthly running costs in sectional title schemes (levies can be substantial and special levies can appear unexpectedly), assuming property ownership provides immigration benefits (it does not), and failing to verify that your intended use of the property aligns with zoning regulations before you buy.

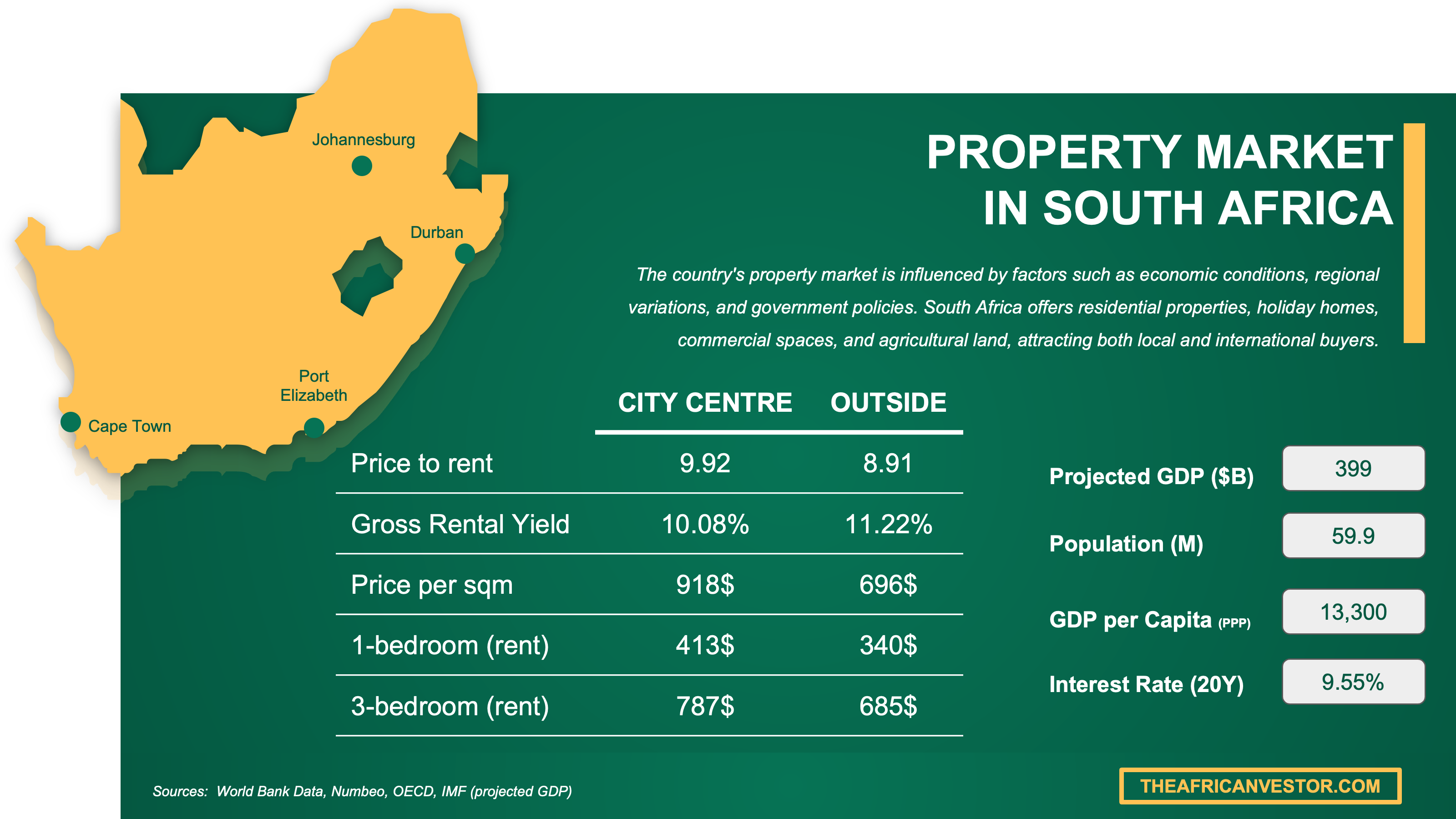

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which visa or residency status changes what I can do in Cape Town?

Do I need a specific visa to buy property in Cape Town right now?

You do not need any specific visa to buy property in Cape Town, and many foreigners successfully purchase while visiting on a standard tourist visa or even without being physically present in South Africa at all.

The most common administrative hurdle for non-residents is satisfying FICA (Financial Intelligence Centre Act) compliance requirements, which means providing proper identity documents, proof of address from your home country, and evidence of your source of funds.

In practice for 2026, you should plan as if you need a South African tax reference number before completing a purchase, because SARS increasingly requires this for transfer duty processes and getting one early prevents delays.

A typical document set for foreign buyers includes your passport, proof of residential address in your home country, bank statements showing source of funds, and potentially a letter from your bank confirming the origin of your purchase money.

Does buying property help me get residency and citizenship in Cape Town in 2026?

As of January 2026, buying property in Cape Town does not grant you residency or citizenship, so you should treat any purchase purely as a lifestyle or investment decision rather than an immigration pathway.

South Africa does not have a "golden visa" program that automatically converts property investment into residency rights, unlike some other countries where real estate purchases unlock immigration benefits.

If you want to live in South Africa long-term, you would need to qualify through other pathways such as a work visa, business visa, retired persons visa (requiring proof of R37,000 monthly passive income), or financially independent visa (requiring proof of R120,000 monthly income), though owning property can support these applications by demonstrating financial stability.

We give you all the details you need about the different pathways to get residency and citizenship in Cape Town here.

Can I legally rent out property on my visa in Cape Town right now?

Your visa status does not prevent you from renting out property you own in Cape Town, because rental income is tied to property ownership rather than immigration status, and foreign owners routinely earn rental income while living abroad.

You do not need to live in South Africa to rent out your Cape Town property, and most foreign owners manage their rentals through local letting agents who handle tenant relationships, maintenance, and rent collection on their behalf.

The important detail for foreigners is that you will be taxed in South Africa on your rental income because it is "South African source income," which means you need to file with SARS, though double-tax agreements with your home country may reduce the overall tax burden.

We cover everything there is to know about buying and renting out in Cape Town here.

Get fresh and reliable information about the market in Cape Town

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

How does the buying process actually work step-by-step in Cape Town?

What are the exact steps to buy property in Cape Town right now?

The standard sequence in Cape Town is: find a property and check monthly costs, make an Offer to Purchase with any conditions, have the seller appoint a conveyancing attorney, complete FICA compliance and provide source-of-funds documentation, pay transfer duty, arrange financing if needed, and finally have your deed registered at the Deeds Office.

You do not need to be physically present for most steps because conveyancers can handle document execution arrangements, though some buyers prefer to visit for viewings and to sign certain documents in person.

The deal typically becomes legally binding when both parties sign the Offer to Purchase and any suspensive conditions (like financing approval) are fulfilled, at which point neither buyer nor seller can easily withdraw without consequences.

From accepted offer to final registration, expect the process to take 8 to 12 weeks in Cape Town, though delays can occur if there are title deed issues, bond cancellations on the seller's side, or complications with your mortgage application.

We have a document entirely dedicated to the whole buying process our pack about properties in Cape Town.

Is it mandatory to get a lawyer or a notary to buy a property in Cape Town right now?

A conveyancing attorney is effectively mandatory in Cape Town because all property transfers must be prepared and lodged through conveyancing processes for registration at the Deeds Office, though you do not typically hire a separate "lawyer" for routine residential purchases.

The key difference is that in South Africa, conveyancers handle the technical transfer and deeds registration work (and are usually appointed by the seller), while a notary is only needed for specific notarial acts that rarely apply to standard home purchases.

One key item to confirm is that your conveyancer's scope includes verifying title, obtaining necessary clearances (municipal, body corporate if applicable), and ensuring your foreign funds are properly documented so you can repatriate sale proceeds in the future.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What checks should I run so I don't buy a problem property in Cape Town?

How do I verify title and ownership history in Cape Town right now?

The official registry for verifying title and ownership in Cape Town is the Deeds Registry, which maintains records of all registered property transactions, and your conveyancer will run a deeds search as a standard part of the transfer process.

The key document you need is the title deed itself, which shows the registered owner, property description, and any registered bonds or servitudes affecting the property.

Most buyers and their conveyancers check ownership history going back at least 10 years in Cape Town to identify any patterns of frequent transfers, disputes, or irregularities that might signal problems.

A clear red flag that should stop or pause your purchase is any discrepancy between who claims to be selling and who is actually registered as the owner, or any registered bonds that the seller has not disclosed or arranged to cancel on transfer.

You will find here the list of classic mistakes people make when buying a property in Cape Town.

How do I confirm there are no liens in Cape Town right now?

The standard way to confirm there are no liens or encumbrances in Cape Town is through a deeds search conducted by your conveyancer, which reveals any registered bonds (mortgages) over the property.

Beyond registered bonds, buyers should specifically ask about municipal debt (rates and utilities arrears) and, for sectional title properties, levy arrears owed to the body corporate, as these must be cleared before transfer can proceed.

The best written proof is the municipal rates clearance certificate and, for sectional title units, a levy clearance certificate from the body corporate, both of which your conveyancer will obtain as part of the transfer process.

How do I check zoning and permitted use in Cape Town right now?

The authority for checking zoning in Cape Town is the City of Cape Town's Development Management department, and you can verify permitted uses by checking the property's zoning classification against the City's Zoning Scheme Regulations.

The document that confirms zoning is the City's zoning records or a zoning certificate, which specifies whether your property is zoned for single residential, general residential, or mixed use, and what activities are permitted.

A common pitfall foreigners miss in Cape Town is assuming they can add a second dwelling, run a home business, or operate short-term rentals without checking whether the zoning actually permits these uses, which can require formal departures or consent applications.

Buying real estate in Cape Town can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Can I get a mortgage as a foreigner in Cape Town, and on what terms?

Do banks lend to foreigners for homes in Cape Town in 2026?

As of January 2026, major South African banks do lend to foreigners for home purchases in Cape Town, though the terms are stricter than for local residents and you should not assume you will get the same deal as a South African buyer.

The realistic loan-to-value range for non-resident foreign buyers in Cape Town is typically capped at 50%, meaning you need to fund at least half the purchase price from your own foreign-sourced funds.

The most common eligibility requirement that determines whether you qualify is your ability to prove income and creditworthiness to the South African bank, with foreign income documentation and sometimes a larger deposit improving your chances of approval.

You can also read our latest update about mortgage and interest rates in South Africa.

Which banks are most foreigner-friendly in Cape Town in 2026?

As of January 2026, the three most foreigner-friendly banks for mortgages in Cape Town are FNB (through their Foreign Choice product), Absa (through their International Mortgages unit), and Standard Bank (through their non-resident banking channel).

What makes these banks more foreigner-friendly is that they have dedicated products or teams specifically designed to handle non-resident applications, which means staff understand the documentation requirements and process for foreign buyers.

All three banks will lend to non-residents who do not have South African residency, though you will typically face stricter requirements including larger deposits, more documentation of income and source of funds, and potentially higher interest rates.

We actually have a specific document about how to get a mortgage as a foreigner in our pack covering real estate in Cape Town.

What mortgage rates are foreigners offered in Cape Town in 2026?

As of January 2026, foreign buyers in Cape Town typically see mortgage rates ranging from prime (10.25%) to prime plus 2% (12.25%), with your specific rate depending on your deposit size, income documentation, and overall risk profile.

Most mortgages in South Africa are variable rate loans linked to prime, meaning your rate moves when the Reserve Bank changes the repo rate, though some banks offer fixed-rate options that are typically 0.5% to 1% higher than variable rates at inception.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What will taxes, fees, and ongoing costs look like in Cape Town?

What are the total closing costs as a percent in Cape Town in 2026?

Total closing costs in Cape Town in 2026 typically run from about 3.5% of the purchase price for lower-value properties to around 9% or more for higher-value properties, with the exact percentage depending heavily on the price bracket.

The realistic range covering most standard transactions is 3% to 10%, with the variance explained by South Africa's progressive transfer duty structure that charges higher percentages on more expensive properties.

The specific fee categories making up closing costs include transfer duty (the biggest component for properties above R1.1 million), conveyancing fees, deeds office fees, and if you take a mortgage, bond registration costs and bank-related legal fees.

Transfer duty is usually the single biggest contributor to closing costs in Cape Town, and it scales from 0% on properties up to R1.1 million to 13% on the portion above R11 million.

If you want to go into more details, we also have a blog article detailing all the property taxes and fees in Cape Town.

What annual property tax should I budget in Cape Town in 2026?

As of January 2026, annual property rates (municipal taxes) in Cape Town typically run about 0.7% of your property's municipal valuation, which for a R5 million home means roughly R36,000 per year (about $2,000 USD or EUR 1,850), though properties qualifying for the primary residence reduction pay less.

Property tax in Cape Town is assessed using a rate-in-the-rand (0.007159 for residential in 2025/26) applied to your municipal valuation, with a R435,000 reduction available for qualifying owner-occupied primary residences valued under R7 million.

How is rental income taxed for foreigners in Cape Town in 2026?

As of January 2026, foreign owners earning rental income from Cape Town property pay South African income tax on their net rental profit (rent minus allowable expenses) at progressive rates that can range from 18% to 45% depending on total taxable income, though many smaller landlords fall into the 18% to 26% brackets.

The basic requirement for foreign owners is to register with SARS, file annual tax returns declaring your rental income, and pay any tax due, with double-tax agreements potentially providing relief if your home country also taxes this income.

What insurance is common and how much in Cape Town in 2026?

As of January 2026, annual buildings insurance premiums for a standard Cape Town home typically range from R4,000 to R15,000 (about $220 to $830 USD or EUR 200 to EUR 770) depending on rebuild value, with contents insurance adding another R3,000 to R10,000 annually depending on coverage level.

The most common coverage that Cape Town homeowners carry is buildings insurance for freestanding homes (covering the structure against fire, storm, and other damage) or contents insurance for sectional title apartments where the body corporate insures the building itself.

The biggest factor affecting insurance premiums in Cape Town is location and security features, with homes in high-risk areas or without security measures like electric fencing, alarm systems, or being within a security estate paying significantly higher premiums than well-secured properties.

Get the full checklist for your due diligence in Cape Town

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Cape Town, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| South African Revenue Service (SARS) - Transfer Duty Rates | Official tax authority that sets and publishes transfer duty brackets. | We used it to calculate closing costs by price band. We also anchored our total transaction cost estimates on these official rates. |

| SARS - Tax and Non-Residents | Official SARS explanation of how non-residents are taxed in South Africa. | We used it to explain rental income taxation for foreigners. We also used it to clarify the source-based taxation principle. |

| South African Reserve Bank - MPC Statement | Central bank's official monetary policy communication setting the repo rate. | We used it to establish the interest rate environment for January 2026. We calculated realistic mortgage rate ranges based on this official data. |

| South African Government - Deeds Registries Act | Official publication of the law governing property title registration. | We used it to explain what true ownership means in South Africa. We also used it to support how title can be verified and inspected. |

| City of Cape Town - Property Rates 2025/26 | City's official published rates schedule for municipal property taxes. | We used it to calculate realistic annual property rate costs. We also explained the primary residence reduction mechanism. |

| City of Cape Town - Zoning Scheme Regulations | City's controlling rulebook for land use rights and zoning classifications. | We used it to explain how to verify permitted property uses. We also structured our zoning due diligence guidance around it. |

| Standard Bank - Non-Resident Banking | Major South African bank stating its non-resident product terms publicly. | We used it to confirm the 50% LTV cap commonly applied to non-residents. We also used it to explain practical banking steps foreigners need. |

| FNB - Foreign Choice Home Loans | Major bank's official product page for foreign buyer mortgages. | We used it to confirm that mainstream banks actively lend to foreigners. We identified FNB as one of the foreigner-friendly lenders. |

| Absa - International Mortgages | Major bank's official channel dedicated to foreign borrowers. | We used it to show foreign buyer lending is a supported offering. We also shaped documentation expectations based on their guidance. |

| STBB Attorneys - Non-Resident Buying Guide | Well-known South African conveyancing firm publishing practical legal guidance. | We used it to explain the conveyancing workflow and typical process. We also used it to support non-resident compliance steps. |

| Department of Home Affairs - Remote Work Visa Requirements | Issuing authority's published requirements for the remote work visa. | We used it to explain visa options for long-term stays. We clarified when tax registration might be triggered by time in-country. |

| South African Government - Visa Application Info | Official government service portal summarizing visa basics. | We used it to ground our visa discussion in official terminology. We confirmed you do not need a special visa just to buy property. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Related blog posts