Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Cape Town's property market is included in our pack

Buying property in Cape Town as a foreigner comes with extra costs that can catch you off guard if you don't plan ahead.

We constantly update this blog post to make sure you have the most current information on taxes, fees, and closing costs in Cape Town in 2026.

Below, you'll find everything you need to know about the real costs of buying residential property in Cape Town, from transfer duty to conveyancing fees to ongoing ownership expenses.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Cape Town.

Overall, how much extra should I budget on top of the purchase price in Cape Town in 2026?

How much are total buyer closing costs in Cape Town in 2026?

As of early 2026, total buyer closing costs in Cape Town typically range from about 2% to 15% of the purchase price, which means on a R3,000,000 property (around $162,000 or €150,000), you could pay anywhere from R60,000 to R450,000 (roughly $3,200 to $24,300, or €3,000 to €22,500) in additional costs.

The minimum extra budget possible when keeping expenses to the bare legal minimum is around R30,000 to R60,000 (approximately $1,600 to $3,200, or €1,500 to €3,000), which covers just the conveyancer fee, deeds office registration, and basic administrative costs on a cash purchase where no transfer duty applies.

The maximum extra budget buyers should realistically plan for in Cape Town is around 15% to 16% of the purchase price, which on a R10,000,000 property (about $540,000 or €500,000) could mean R1,500,000 to R1,600,000 (roughly $81,000 to $86,500, or €75,000 to €80,000) when transfer duty, bond registration, and all professional fees are included.

Whether your closing costs fall at the low end or high end depends mainly on whether transfer duty applies (it's progressive and becomes substantial above certain thresholds), whether you're buying with cash or a mortgage (bonds add attorney and bank fees), and whether you're buying from a VAT-registered developer (VAT replaces transfer duty on new builds).

What's the usual total % of fees and taxes over the purchase price in Cape Town?

The usual total percentage of fees and taxes over the purchase price in Cape Town falls between 3% and 8% for most mid-market residential transactions, though this can climb significantly higher for more expensive properties.

A realistic low-to-high percentage range that covers most standard property transactions in Cape Town is 2% to 4% when transfer duty doesn't apply (common for lower-value properties or VAT-inclusive new builds) and 6% to 15% or more when transfer duty kicks in on higher-value resales.

Of that total percentage, government taxes (mainly transfer duty) typically make up the largest portion, often 60% to 80% of total closing costs on mid-to-high value properties, while professional service fees like conveyancing, deeds registration, and bond costs account for the remainder.

By the way, you will find much more detailed data in our property pack covering the real estate market in Cape Town.

What costs are always mandatory when buying in Cape Town in 2026?

As of early 2026, the mandatory costs when buying property in Cape Town include either transfer duty or VAT (you pay one or the other, not both), conveyancer fees for the transfer attorney, Deeds Office registration fees, municipal rates clearance, and if you're using a mortgage, bond registration attorney fees plus bank initiation and service fees.

Costs that are optional but highly recommended for buyers in Cape Town include an independent building inspection (especially important for older homes exposed to Cape Town's coastal climate), an independent property valuation, a tax advisor consultation if you plan to rent the property or have multi-country tax obligations, and sworn translations or apostilles if your documents aren't in English.

Don't lose money on your property in Cape Town

100% of people who have lost money there have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What taxes do I pay when buying a property in Cape Town in 2026?

What is the property transfer tax rate in Cape Town in 2026?

As of early 2026, the property transfer tax (called transfer duty in South Africa) is a progressive national tax that starts at 0% for lower-value properties and increases through multiple brackets, with the top marginal rate applying to high-value purchases.

There are no extra transfer taxes for foreigners buying property in Cape Town, meaning non-residents pay the same transfer duty rates as South African citizens, though foreigners often face additional administrative costs for FICA compliance documentation.

Buyers pay VAT (currently 15%) on residential property purchases in Cape Town only when buying a new-build from a VAT-registered developer, in which case the price is typically VAT-inclusive and transfer duty does not apply.

Buyers do not pay stamp duty in Cape Town because South Africa abolished stamp duty on property transactions back in 2009, so this is one cost you can cross off your list entirely.

Are there tax exemptions or reduced rates for first-time buyers in Cape Town?

South Africa does not offer a universal first-time buyer discount on transfer duty, but the progressive bracket system means properties below a certain value threshold attract 0% transfer duty, which effectively benefits first-time buyers purchasing more affordable homes.

If you buy property through a company instead of as an individual in Cape Town, transfer duty still applies (with slightly different rules for companies and trusts), and you'll face more complex ongoing tax treatment including corporate income tax, capital gains rules, and potential dividend withholding taxes.

There is a significant tax difference between buying a new-build versus a resale property in Cape Town: new-builds from VAT-registered developers include 15% VAT in the price (no transfer duty), while resale properties from private sellers attract transfer duty (no VAT).

Since there's no formal first-time buyer exemption scheme, there are no specific documentation requirements to meet, but you should keep records of your purchase for future capital gains tax calculations when you eventually sell.

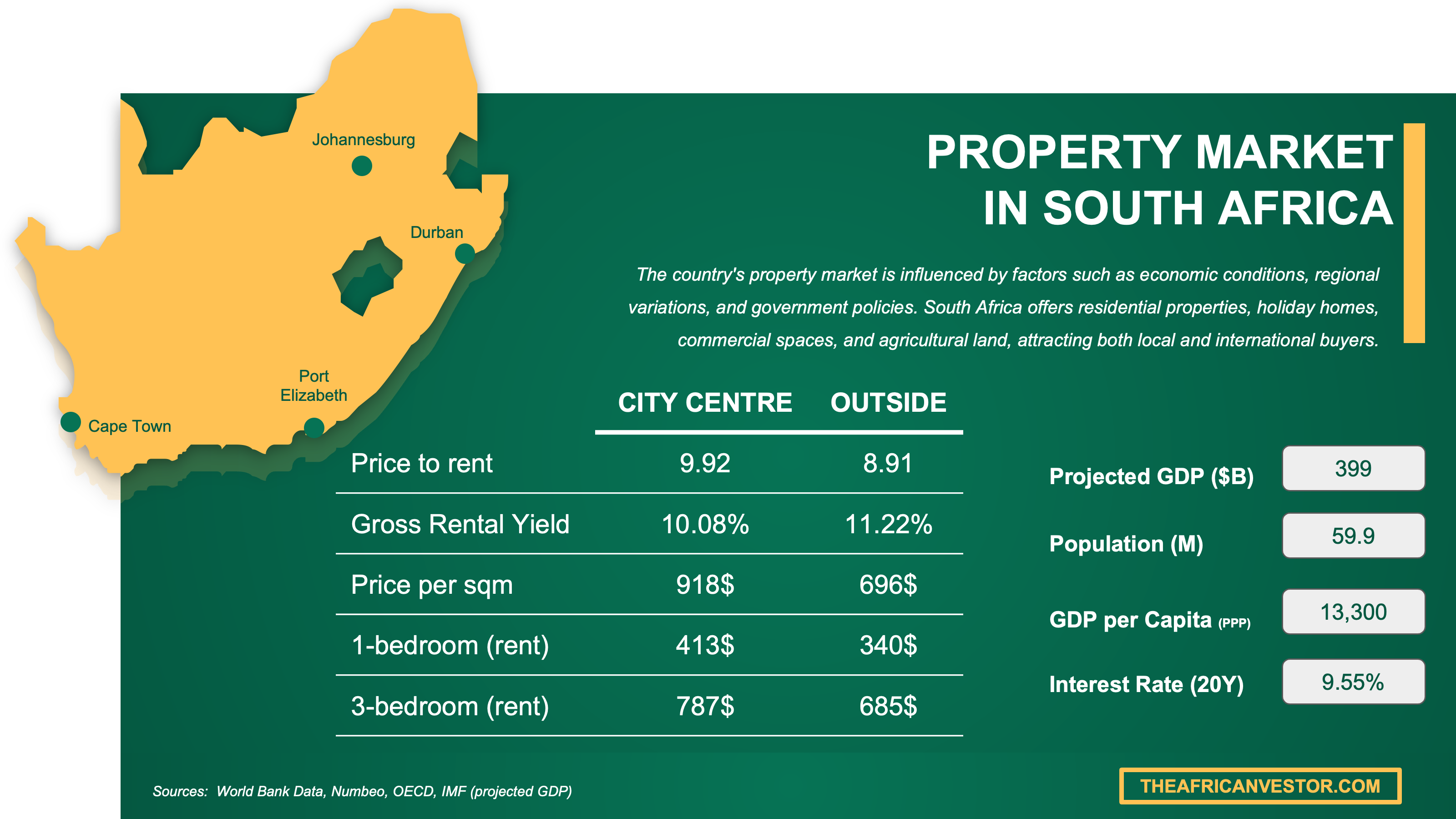

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Which professional fees will I pay as a buyer in Cape Town in 2026?

How much does a notary or conveyancing lawyer cost in Cape Town in 2026?

As of early 2026, conveyancing attorney fees in Cape Town follow guideline tariffs starting around R6,435 (about $350 or €320) for properties up to R100,000 and scaling up to approximately R64,260 (around $3,470 or €3,210) for the first R5,000,000, plus about R5,000 (roughly $270 or €250) for each additional R1,000,000 in value.

Conveyancing fees in Cape Town are typically charged on a sliding scale based on the property price rather than a flat rate, though the fees are negotiable and your final invoice will include sundries like postage, deeds searches, and FICA administration on top of the guideline tariff.

Translation or interpreter services for foreign buyers in Cape Town cost approximately R1,000 to R3,000 (around $55 to $160, or €50 to €150) for a document translation bundle, and about R600 to R1,200 per hour ($32 to $65, or €30 to €60) for an in-person interpreter if needed.

A tax advisor is not mandatory but highly recommended if you plan to rent out your Cape Town property or have income in multiple countries, with a focused consultation and written summary typically costing R2,000 to R6,000 (approximately $108 to $325, or €100 to €300).

We have a whole part dedicated to these topics in our our real estate pack about Cape Town.

What's the typical real estate agent fee in Cape Town in 2026?

As of early 2026, the typical real estate agent fee in Cape Town ranges from about 5% to 7.5% of the sale price plus 15% VAT, which on a R3,000,000 property (roughly $162,000 or €150,000) works out to approximately R172,500 to R258,750 (around $9,300 to $14,000, or €8,600 to €12,900) including VAT.

In Cape Town, the seller typically pays the real estate agent's commission out of the sale proceeds, so this cost usually doesn't appear in your buyer closing budget, though the commission is negotiable and can occasionally be structured differently.

The realistic low-to-high range for agent fees in Cape Town is about 4% on the low end (for high-value properties where agents compete for listings) to 8% or more on the high end, with most transactions falling in the 5% to 7% range before VAT.

How much do legal checks cost (title, liens, permits) in Cape Town?

Legal checks including title search, liens verification, and permits review in Cape Town are typically bundled into your conveyancer's work and sundries, with individual Deeds Office search fees being modest but accumulating through attorney administration to add roughly R1,000 to R3,000 (about $55 to $160, or €50 to €150) to your overall costs.

A property valuation fee in Cape Town typically costs R3,500 to R7,000 (approximately $190 to $380, or €175 to €350) for a standard residential valuation, though if you're getting a mortgage, the bank may include the valuation in their process.

The most critical legal check you should never skip in Cape Town is the title deed verification through the Deeds Office, as this confirms the seller has clear ownership and reveals any bonds, servitudes, or restrictions registered against the property.

Buying a property with hidden issues is something we mention in our list of risks and pitfalls people face when buying real estate in Cape Town.

Get the full checklist for your due diligence in Cape Town

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What hidden or surprise costs should I watch for in Cape Town right now?

What are the most common unexpected fees buyers discover in Cape Town?

The most common unexpected fees buyers discover in Cape Town include sectional title levies and special levies (very common in apartments and townhouses across areas like the City Bowl and Atlantic Seaboard), municipal rates that are higher than expected based on the City's valuation, compliance certificate remediation costs, and extra FICA documentation expenses for foreign buyers.

You typically won't inherit the seller's unpaid municipal property taxes because conveyancers require municipal clearance before registration, but you can inherit body corporate issues like underfunded reserves or pending special levies, which is why reviewing levy statements, budgets, and AGM minutes is essential.

Buyers do occasionally get targeted by scams with fake listings or fake fees in Cape Town's competitive market, but you can protect yourself by only paying deposits into your conveyancer's trust account linked to a signed offer to purchase and by verifying the agent's registration.

Fees that are usually not disclosed upfront by sellers or agents in Cape Town include bond-related extras like initiation fees and monthly service fees, sundries on attorney invoices for couriers and FICA administration, and body corporate special levies that may have been approved but not yet billed.

In our property pack covering the property buying process in Cape Town, we go into details so you can avoid these pitfalls.

Are there extra fees if the property has a tenant in Cape Town?

Extra fees when buying a tenanted property in Cape Town typically include lease handover administration through the agent or attorney and deposit transfer accounting, which together might add R2,000 to R5,000 (approximately $108 to $270, or €100 to €250) to your transaction, plus potential negotiation costs if you want vacant occupation.

When purchasing a tenanted property in Cape Town, you inherit the existing lease as the new landlord, meaning you must honor all terms of the tenant's lease agreement including the rental amount, notice periods, and any other conditions until the lease naturally expires.

It is generally not possible to terminate an existing lease immediately after purchase in Cape Town unless the lease contains an early termination clause or you negotiate a mutual agreement (often involving compensation) with the sitting tenant.

A sitting tenant in Cape Town typically has a mixed effect on market value: it can be attractive to investors seeking immediate rental income, but it often reduces the pool of interested buyers and may give you negotiating leverage if you want vacant possession.

If you want to optimize your rental strategy, you can read our complete guide on how to buy and rent out in Cape Town.

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which fees are negotiable, and who really pays what in Cape Town?

Which closing costs are negotiable in Cape Town right now?

Closing costs that are negotiable in Cape Town include conveyancer fees (the LSSA guidelines are recommendations, not fixed prices), bond attorney fees if you're financing (you may have some choice through your bank's panel), and professional services like building inspections and valuations where you can shop around for quotes.

Closing costs that are fixed by law or regulation and cannot be negotiated in Cape Town include transfer duty or VAT (set by SARS), Deeds Office registration fees (set by the Chief Registrar of Deeds), and the basic municipal rates clearance process.

Buyers in Cape Town can typically achieve a 5% to 15% reduction on negotiable fees like conveyancing by getting multiple quotes, especially on larger transactions where attorneys compete for the business, though the savings on individual fees are often modest compared to the overall purchase price.

Can I ask the seller to cover some closing costs in Cape Town?

In Cape Town, sellers will occasionally agree to cover some closing costs, but this is more commonly structured as a price reduction or credit rather than the seller directly paying your transfer fees, and success depends heavily on market conditions and your negotiating position.

The specific closing costs sellers are most commonly willing to cover in Cape Town include repairs needed to obtain compliance certificates (electrical, plumbing, beetle, gas, electric fence), credits for pending special levies, and sometimes prorated rates and levies adjustments.

Sellers are more likely to accept covering closing costs in Cape Town during slower market periods, when properties have been listed for extended periods, or when there are known defects or compliance issues that give buyers negotiating leverage.

Is price bargaining common in Cape Town in 2026?

As of early 2026, price bargaining is common and expected in Cape Town's residential property market, though how much room you have to negotiate varies significantly by neighborhood, property type, and how long the property has been on the market.

Buyers in Cape Town typically negotiate about 3% to 8% below the asking price as a starting point, which on a R5,000,000 property (roughly $270,000 or €250,000) could mean R150,000 to R400,000 (approximately $8,100 to $21,600, or €7,500 to €20,000) in savings, though hot areas like the Atlantic Seaboard and City Bowl often see tighter discounting.

Don't sign a document you don't understand in Cape Town

Buying a property over there? We have reviewed all the documents you need to know. Stay out of trouble - grab our comprehensive guide.

What monthly, quarterly or annual costs will I pay as an owner in Cape Town?

What's the realistic monthly owner budget in Cape Town right now?

A realistic monthly owner budget in Cape Town (excluding any mortgage payment) typically ranges from R3,000 to R12,000 or more (approximately $160 to $650, or €150 to €600), depending mainly on whether you own in a sectional title scheme and the municipal value of your property.

The main recurring expense categories that make up this monthly budget in Cape Town include municipal property rates, body corporate or homeowners association levies (if applicable), water and electricity, building insurance, security services, and a maintenance reserve.

The realistic low-to-high range for monthly owner costs in Cape Town is about R2,000 to R4,000 (roughly $108 to $216, or €100 to €200) for a modest freehold home, up to R8,000 to R15,000 or more ($430 to $810, or €400 to €750) for a larger sectional title apartment in a building with high levies and services.

The monthly cost that tends to vary the most in Cape Town is body corporate levies, which can range from a few hundred rand in small complexes to R5,000 or more in luxury buildings with extensive amenities, pools, security, and staff.

You can see how this budget affect your gross and rental yields in Cape Town here.

What is the annual property tax amount in Cape Town in 2026?

As of early 2026, the annual property tax (called municipal rates) in Cape Town is calculated by multiplying your property's municipal valuation by approximately 0.007159 (the residential rate-in-the-rand), so a property valued at R3,000,000 (roughly $162,000 or €150,000) would pay about R21,480 per year (approximately $1,160 or €1,075).

The realistic low-to-high range for annual property taxes in Cape Town is about R7,000 to R10,000 per year (roughly $380 to $540, or €350 to €500) for a property valued around R1,000,000, up to R50,000 to R72,000 or more ($2,700 to $3,900, or €2,500 to €3,600) for properties valued at R7,000,000 to R10,000,000.

Property tax in Cape Town is calculated based on the municipal valuation of your property (not the market price you paid), multiplied by the residential rate-in-the-rand set in the City's annual budget, which can change each year.

There are some exemptions and reductions available for certain property owners in Cape Town, including rebates for pensioners and people with disabilities, though these have specific eligibility criteria and application requirements through the City of Cape Town.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

If I rent it out, what extra taxes and fees apply in Cape Town in 2026?

What tax rate applies to rental income in Cape Town in 2026?

As of early 2026, rental income in Cape Town is taxed as ordinary personal income at your marginal SARS tax rate, which for most working professionals and foreign investors means a rate somewhere between 26% and 45% depending on your total taxable income.

Landlords in Cape Town can deduct expenses from rental income taxes, including costs like property repairs and maintenance, letting agent fees, insurance premiums, some finance costs (interest on a bond), and other expenses directly incurred in producing the rental income.

The realistic effective tax rate range after deductions for typical landlords in Cape Town is often significantly lower than the marginal rate, potentially dropping to 15% to 30% of gross rental income depending on how many legitimate expenses you can claim.

Foreign property owners generally pay the same rental income tax rates as South African residents, though you may need to register as a taxpayer with SARS and should check whether a tax treaty between South Africa and your home country affects your overall tax position.

Do I pay tax on short-term rentals in Cape Town in 2026?

As of early 2026, income from short-term rentals in Cape Town (such as Airbnb or holiday lets) is taxable as personal income, just like long-term rental income, and must be declared to SARS.

Short-term rental income in Cape Town is generally taxed the same way as long-term rental income (at your marginal rate, with deductible expenses), but if your short-term rental business exceeds R1,000,000 in taxable supplies per year, you must register for VAT and charge the 15% VAT rate on bookings.

If you want to optimize your rental strategy, you can read our complete guide on how to buy and rent out in Cape Town.

Get to know the market before buying a property in Cape Town

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

If I sell later, what taxes and fees will I pay in Cape Town in 2026?

What's the total cost of selling as a % of price in Cape Town in 2026?

As of early 2026, the total cost of selling a property in Cape Town typically ranges from about 6% to 10% or more of the sale price before any capital gains tax, with the largest chunk going to estate agent commission.

The realistic low-to-high percentage range for total selling costs in Cape Town is about 5% to 7% on the low end (when you negotiate a good commission rate and have minimal other costs) and 10% to 12% or more on the high end when factoring in compliance certificate work, bond cancellation, and other expenses.

The specific cost categories that typically make up that total in Cape Town include estate agent commission (usually the biggest item), compliance certificates and any required repairs, bond cancellation fees if you have a mortgage, conveyancing administration, and potentially capital gains tax on any profit.

The single largest contributor to selling expenses in Cape Town is almost always the estate agent commission, which at 5% to 7.5% plus 15% VAT can easily represent 6% to 8.5% of the sale price on its own.

What capital gains tax applies when selling in Cape Town in 2026?

As of early 2026, capital gains tax in Cape Town works by including 40% of your net capital gain in your taxable income (for individuals), which is then taxed at your marginal rate, producing an effective CGT rate of up to about 18% at the top tax bracket.

Exemptions to capital gains tax available in Cape Town include the primary residence exclusion (which disregards a substantial portion of the gain if you lived in the property as your main home), annual exclusions, and the higher exclusion available in the year of death.

Foreigners do not pay extra capital gains tax rates when selling property in Cape Town, but non-resident sellers trigger a withholding mechanism where the buyer must withhold 7.5% of the sale price (for individuals) if the property sells for more than R2,000,000 and pay it to SARS on the seller's behalf.

Capital gain in Cape Town is calculated as the sale price minus your base cost, which includes the original purchase price plus certain allowable costs like transfer duty paid, improvement costs, and selling expenses, potentially adjusted for other factors.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Cape Town, we always rely on the strongest methodology we can ... and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| SARS Transfer Duty | SARS is South Africa's official tax authority for transfer duty rules. | We used it to anchor what transfer duty is and when it applies. We then paired it with budget sources to estimate buyer cash budgets. |

| SARS VAT | SARS is the primary source for South Africa's VAT rate. | We used it to confirm the 15% VAT rate and R1m registration threshold. We used it to explain when VAT applies instead of transfer duty. |

| LSSA Conveyancing Fee Guidelines | LSSA guidelines are the industry benchmark for conveyancing tariffs. | We used it to estimate conveyancer fees on a sliding scale by price band. We used it to triangulate minimum and maximum buyer closing budgets. |

| Deeds Office Fees Schedule | This is the official fee schedule for deeds registry transactions. | We used it to anchor the non-negotiable government deeds fees for transfers. We used it to keep our closing-cost ranges realistic. |

| City of Cape Town 2025/26 Budget | This is the City's official publication showing municipal rates. | We used it to get the residential rate-in-the-rand for property tax calculations. We used it to make the owner-cost section Cape Town-specific. |

| Nedbank Home Loans Pricing Guide | It's a primary bank document with the fees buyers actually pay. | We used it to put concrete numbers on initiation fees and service fees. We used it to make the bond costs section actionable. |

| SARS Capital Gains Tax | SARS is the official source for CGT rules in South Africa. | We used it to ground the CGT section and avoid relying on secondary sources. We paired it with the KPMG guide for practical inclusion rates. |

| KPMG Budget Tax Guide 2025/26 | KPMG's guide is a transparent, citable summary of official budget rates. | We used it to state the CGT inclusion rate and key exemptions. We used it only to summarize, not to replace SARS as the authority. |

| SARS Tax on Rental Income | This is SARS' plain-language guidance specifically for landlords. | We used it to confirm rental receipts are taxable and what counts as income. We used it to frame what you can typically deduct. |

| RE/MAX South Africa | RE/MAX is a major national brokerage useful for market practice. | We used it as a cross-check for typical commission ranges. We used it only as secondary market context, not as a tax authority. |

| Financial Intelligence Centre Act | This is the core law that drives FICA checks in property transactions. | We used it to justify why foreign buyers face extra document steps and costs. We used it to flag timing and courier costs that surprise foreigners. |

| SARS Non-Resident Seller Withholding | SARS explains the withholding mechanism on non-resident sales. | We used it to state the exact withholding percentages and R2m trigger. We used it to explain the surprise risk when buying from non-residents. |

Get fresh and reliable information about the market in Cape Town

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Related blog posts