Authored by the expert who managed and guided the team behind the South Africa Property Pack

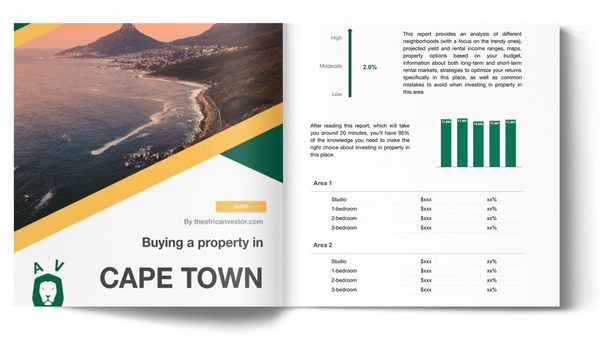

Yes, the analysis of Cape Town's property market is included in our pack

If you're considering moving to Cape Town or investing in property there, understanding the costs involved is crucial, especially when it comes to apartment maintenance fees.

What do these fees cover? How much should you expect to pay? Are there ways to reduce these costs?

In this article, we'll break down everything you need to know about apartment maintenance fees in Cape Town.

Actually, we know this market inside and out. We keep tabs on it regularly, and all our discoveries are reflected in the most recent version of the South Africa Property Pack

The Recurring Expenses When You Own an Apartment in Cape Town

Here is a detailed overview of the maintenance fees for an apartment in Cape Town.

- Levy Charges:

In Cape Town, apartment owners are required to pay levy charges, which cover the costs of maintaining common areas, building insurance, security, and amenities. These charges typically range from ZAR 15 to ZAR 50 per square meter per month, depending on the location, size, and facilities of the property. High-end properties with extensive amenities may incur higher levies.

- Utilities:

Utility costs in Cape Town include water, electricity, and sometimes gas. These are billed separately from levy charges. The average monthly utility bill for a two-bedroom apartment can range from ZAR 1,000 to ZAR 2,500, depending on usage and the season. Water restrictions and load shedding can also impact these costs.

- Special Levies:

Occasionally, apartment owners may be required to pay special levies for significant repairs or upgrades to the building. These are typically one-time charges and can vary widely based on the scope of the work required. It’s important to budget for these potential expenses.

- Property Rates and Taxes:

Property rates are municipal taxes based on the assessed value of the property. In Cape Town, these rates generally range from 0.6% to 1% of the property’s value annually. These taxes fund local services such as waste collection and road maintenance.

- Insurance:

While building insurance is typically covered by levy charges, owners may choose to take out additional insurance for their personal belongings and interior improvements. The cost of this insurance varies based on coverage levels and provider.

Maintenance fees in Cape Town can vary significantly based on the type of property. Luxury apartments with extensive amenities such as pools, gyms, and concierge services will generally have higher fees compared to more modest properties. Additionally, properties in prime locations such as the Waterfront or City Bowl tend to have higher levies due to the desirability and demand of these areas.

Don't lose money on your property in South Africa

100% of people who have lost money in South Africa have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What You Need to Know Before Buying a Property in Cape Town

What are the typical apartment maintenance fees in Cape Town?

Maintenance fees for apartments in Cape Town can vary significantly depending on the location and amenities offered.

On average, these fees range from ZAR 1,500 to ZAR 3,500 per month.

Luxury apartments with extensive facilities may have fees exceeding ZAR 5,000 monthly.

How are maintenance fees calculated for apartments in Cape Town?

Maintenance fees are typically calculated based on the size of the apartment and the shared facilities available in the building.

They often include costs for security, cleaning, landscaping, and general repairs.

Some buildings may also factor in the cost of utilities and insurance into the fees.

Are maintenance fees in Cape Town negotiable?

Generally, maintenance fees are not negotiable as they are set by the body corporate or homeowners' association.

These fees are determined based on the annual budget required to maintain the property and its facilities.

However, owners can participate in meetings to discuss and vote on budget allocations and fee adjustments.

Want to explore this further?

What is included in the maintenance fees for Cape Town apartments?

Maintenance fees typically cover the upkeep of common areas such as gardens, pools, and gyms.

They also include security services, building insurance, and sometimes water and electricity for shared spaces.

Additional services like pest control and waste management may also be included.

How often are maintenance fees reviewed or adjusted in Cape Town?

Maintenance fees are usually reviewed annually during the annual general meeting of the body corporate.

Adjustments are made based on the previous year's expenses and projected costs for the upcoming year.

Significant changes in fees require approval from the majority of the property owners.

Buying real estate in South Africa can be risky

An increasing number of foreign investors are showing interest in South Africa. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

What happens if I don't pay my maintenance fees on time?

Failure to pay maintenance fees on time can result in penalties or interest charges being added to your account.

The body corporate may also restrict access to certain facilities until the outstanding fees are settled.

In severe cases, legal action may be taken to recover the owed amounts.

How do maintenance fees in Cape Town compare to other South African cities?

Maintenance fees in Cape Town are generally higher than in other South African cities due to the city's high property values and demand for premium services.

For example, fees in Johannesburg might range from ZAR 1,000 to ZAR 2,500, which is typically lower than Cape Town.

However, the exact comparison depends on the specific location and amenities of the properties in question.

Can maintenance fees affect the resale value of an apartment in Cape Town?

High maintenance fees can potentially deter buyers, affecting the resale value of an apartment.

Prospective buyers often consider the total cost of ownership, including these fees, when evaluating a property.

Conversely, well-maintained properties with reasonable fees can enhance the appeal and value of an apartment.

Want to explore this further?

=> Is an apartment in Cape Town a good-long term investment?

Are there any tax implications related to maintenance fees in Cape Town?

Maintenance fees themselves are not tax-deductible for individual homeowners in South Africa.

However, if the property is rented out, these fees can be considered a deductible expense against rental income.

It's advisable to consult with a tax professional for specific guidance related to your situation.

Want to explore this further?

What percentage of the maintenance fees is typically allocated to a reserve fund?

In Cape Town, it is common for 10% to 20% of the maintenance fees to be allocated to a reserve fund.

This fund is used for major repairs and unexpected expenses that arise over time.

The exact percentage can vary based on the building's age and anticipated future needs.

How do special levies impact maintenance fees in Cape Town?

Special levies are additional charges imposed on top of regular maintenance fees to cover unexpected or large-scale expenses.

These can significantly increase the monthly cost for property owners, sometimes by 20% to 50% for the duration of the levy.

Special levies are typically approved by a majority vote of the property owners.

What should I consider when evaluating maintenance fees before purchasing an apartment in Cape Town?

It's important to review the financial statements of the body corporate to understand how fees are allocated and managed.

Consider the age and condition of the building, as older properties may require higher maintenance costs.

Also, assess the quality and necessity of the amenities provided, as these can significantly impact the fees.