Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Cape Town's property market is included in our pack

Cape Town is one of the most attractive property markets in Africa for foreign buyers, but it also comes with real risks that catch many people off guard.

From fake agents to hidden municipal debts, the traps are specific to how South Africa's property system works.

We constantly update this blog post to reflect the latest scams, grey areas, and insider knowledge you need.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Cape Town.

How risky is buying property in Cape Town as a foreigner in 2026?

Can foreigners legally own properties in Cape Town in 2026?

As of early 2026, foreigners can legally buy and own residential property in Cape Town without any nationality-based restrictions on direct ownership.

The main condition that applies to foreign buyers in Cape Town is that you must go through the standard legal transfer process, including identity verification, anti-money laundering checks, and registration at the Deeds Registry.

Since direct ownership is allowed, most foreigners simply buy in their own name, though some use companies or trusts for estate planning reasons, not because the law requires it.

What buyer rights do foreigners actually have in Cape Town in 2026?

As of early 2026, foreign buyers in Cape Town have essentially the same legal rights as local buyers once they become the registered owner of a property.

If a seller breaches a contract in Cape Town, you can enforce your rights through South African courts, and your conveyancer can help you pursue remedies like specific performance or damages.

The most common mistake foreigners make is assuming that a signed offer to purchase or a "title deed copy" sent by email means they own the property, when in fact ownership only exists once transfer is registered at the Deeds Office.

How strong is contract enforcement in Cape Town right now?

Contract enforcement for real estate in Cape Town is reasonably reliable, with functioning courts and a solid title registry, though it is slower and less predictable than in countries like the UK, Germany, or Australia.

The main weakness foreigners should know about is that if something goes wrong after you have paid money, recovering it through litigation can take years and cost significantly, so prevention through proper due diligence is far more effective than relying on courts.

By the way, we detail all the documents you need and what they mean in our property pack covering Cape Town.

Buying real estate in Cape Town can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Which scams target foreign buyers in Cape Town right now?

Are scams against foreigners common in Cape Town right now?

Real estate scams targeting foreigners in Cape Town are common enough that you should assume you will encounter at least one suspicious situation during your property search, especially in high-demand areas like the Atlantic Seaboard and City Bowl.

The type of transaction most frequently targeted by scammers in Cape Town is the remote purchase, where the buyer is overseas and relies heavily on emails, WhatsApp messages, and agents they have never met in person.

The profile of foreign buyer most commonly targeted is someone who is emotionally committed to a property, under time pressure, and unfamiliar with how South African paperwork and registries actually work.

The single biggest warning sign that a deal may be a scam in Cape Town is pressure to pay money quickly into a personal bank account rather than a regulated trust account controlled by a conveyancer.

What are the top three scams foreigners face in Cape Town right now?

The top three scams foreigners face in Cape Town are fake or unlicensed agents who collect deposits and disappear, sellers who do not actually own the property or lack legal authority to sell, and off-plan or luxury deals structured to bypass normal protections so your money vanishes.

The most common scam typically unfolds like this: you find a property online, an "agent" contacts you with slick marketing, creates urgency by saying another buyer is interested, asks for a holding deposit into a personal account, and then becomes unreachable after you pay.

The single most effective protection against each scam is to verify the agent's Fidelity Fund Certificate with the PPRA before paying anything, confirm ownership through the Deeds Registry before signing, and ensure all deposits go into a conveyancer-controlled trust account.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How do I verify the seller and ownership in Cape Town without getting fooled?

How do I confirm the seller is the real owner in Cape Town?

The standard verification process in Cape Town is to have your conveyancer obtain an official deeds search from the Deeds Registry, which shows the registered owner's name and any conditions on the title.

The official document foreigners should check is the title deed registered at the South African Deeds Registry, not a PDF copy sent by the seller or agent.

The most common trick fake sellers use in Cape Town is presenting a convincing photocopy of a title deed or using a forged power of attorney, which happens often enough that you should never trust documents unless your conveyancer obtains them directly from official sources.

Where do I check liens or mortgages on a property in Cape Town?

The official registry where you check liens or mortgages on a property in Cape Town is the Deeds Registry, where mortgage bonds and most encumbrances are recorded against the title.

When checking for liens in Cape Town, you should request information on any registered mortgage bonds, interdicts, servitudes, and restrictive conditions attached to the property.

The type of encumbrance most commonly missed by foreign buyers in Cape Town is outstanding municipal debt, which is why you must also obtain a rates clearance certificate from the City of Cape Town before transfer can proceed.

It's one of the aspects we cover in our our pack about the real estate market in Cape Town.

How do I spot forged documents in Cape Town right now?

The most common type of forged document in Cape Town property scams is a fake title deed or a fraudulent power of attorney, and while sophisticated forgeries are not extremely common, they happen often enough that you should never rely on documents sent directly by sellers or agents.

Red flags that indicate a document may be forged in Cape Town include inconsistencies in formatting, missing official stamps or reference numbers, reluctance from the seller to allow independent verification, and pressure to move quickly before you can check.

The official verification method you should use in Cape Town is to have your conveyancer obtain all critical documents directly from the Deeds Registry or relevant government office, rather than accepting any document provided by the other party.

Get the full checklist for your due diligence in Cape Town

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What "grey-area" practices should I watch for in Cape Town?

What hidden costs surprise foreigners when buying a property in Cape Town?

The three most common hidden costs foreigners overlook in Cape Town are transfer duty (which can be 8% or more of the purchase price for properties above R2.5 million, roughly $140,000 or €130,000), conveyancing and Deeds Office fees (typically R30,000 to R80,000, or $1,700 to $4,500 / €1,500 to €4,000), and municipal rates clearance requirements that may require settling outstanding debts before transfer.

The hidden cost most often deliberately concealed by sellers or agents in Cape Town is upcoming special levies in sectional title properties, which sometimes happens when a body corporate has approved major maintenance work that the buyer only discovers after taking ownership.

If you want to go into more details, we also have a blog article detailing all the property taxes and fees in Cape Town.

Are "cash under the table" requests common in Cape Town right now?

Requests for undeclared cash payments in Cape Town property transactions are not the norm, but they do happen, particularly when sellers want to reduce their declared sale price for tax reasons.

The typical reason sellers give for requesting undeclared cash in Cape Town is to lower the official purchase price and reduce transfer duty or capital gains tax on their side.

If you agree to an undeclared cash payment in Cape Town, you face serious legal risks including difficulty proving how much you actually paid if there is a dispute, problems repatriating funds later because your paper trail will not match, and potential liability for tax evasion.

Are side agreements used to bypass rules in Cape Town right now?

Side agreements that bypass official rules are not extremely common in Cape Town, but they happen often enough that you need to watch for them, especially involving fixtures, rental guarantees, or promises to fix defects after transfer.

The most common type of side agreement in Cape Town is a verbal or WhatsApp promise about something not written in the official offer to purchase, such as furniture being included, a renovation being completed, or a body corporate approval being obtained.

If a side agreement is discovered by authorities or becomes relevant in a dispute in Cape Town, you may find it is unenforceable, leaving you with no legal recourse for whatever was promised outside the formal contract.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

Can I trust real estate agents in Cape Town in 2026?

Are real estate agents regulated in Cape Town in 2026?

As of early 2026, real estate agents in Cape Town are regulated under the Property Practitioners Regulatory Authority (PPRA), which replaced the old Estate Agency Affairs Board.

A legitimate real estate agent in Cape Town should have a valid Fidelity Fund Certificate (FFC) issued by the PPRA, which proves they are registered and that consumer protection mechanisms apply to transactions they handle.

Foreigners can verify whether an agent is properly licensed by asking for their FFC number and checking it directly with the PPRA, or by contacting the PPRA to confirm the agent's registration status.

Please note that we have a list of contacts for you in our property pack about Cape Town.

What agent fee percentage is normal in Cape Town in 2026?

As of early 2026, the normal agent fee percentage in Cape Town is around 5% to 7.5% of the sale price, plus VAT, though there is no legally fixed rate.

The typical range that covers most transactions in Cape Town is 5% to 7.5% plus VAT, with 6% plus VAT being a common midpoint for planning purposes.

In Cape Town, the seller typically pays the agent fee, though buyers should understand that this cost is often factored into the asking price they ultimately pay.

Get the full checklist for your due diligence in Cape Town

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What due diligence actually prevents disasters in Cape Town?

What structural inspection is standard in Cape Town right now?

The standard structural inspection process in Cape Town is to hire an independent home inspector before finalizing your purchase, though this is not legally required for most resale properties.

A qualified inspector in Cape Town should check the foundation, roof structure, walls for cracks or damp, plumbing, electrical systems, and any signs of water damage or pest infestation.

The type of professional qualified to perform structural inspections in Cape Town is a registered home inspector or a structural engineer, and for electrical systems you need a certificate from a registered electrician.

The most common structural issues inspections reveal in Cape Town properties are damp and waterproofing failures due to the winter rainfall climate, salt-air corrosion on the Atlantic Seaboard, wind damage to roofs and windows, and hidden defects covered by fresh paint in quick-flip renovations.

How do I confirm exact boundaries in Cape Town?

The standard process for confirming exact property boundaries in Cape Town is to obtain the official Surveyor-General diagram and compare it to what you see on the ground.

The official document that shows the legal boundaries of a property in Cape Town is the SG diagram or cadastral information held by the Chief Surveyor General's office.

The most common boundary dispute affecting foreign buyers in Cape Town involves fences, walls, or driveways that do not match the official survey, especially in older suburbs where neighbors have informally shifted boundaries over decades.

The professional you should hire to physically verify boundaries on the ground in Cape Town is a registered land surveyor, who can confirm whether the physical markers match the official diagram.

What defects are commonly hidden in Cape Town right now?

The top three defects that sellers frequently conceal in Cape Town are damp and waterproofing problems masked by fresh paint (common), unpermitted building alterations that may cause future legal issues (sometimes happens), and poor financial health in sectional title schemes including undisclosed special levies (common in older buildings).

The inspection technique that helps uncover hidden defects in Cape Town is to visit the property during or after rain to check for leaks, request body corporate financials and AGM minutes for sectional title, and insist on an electrical compliance certificate as a condition of sale.

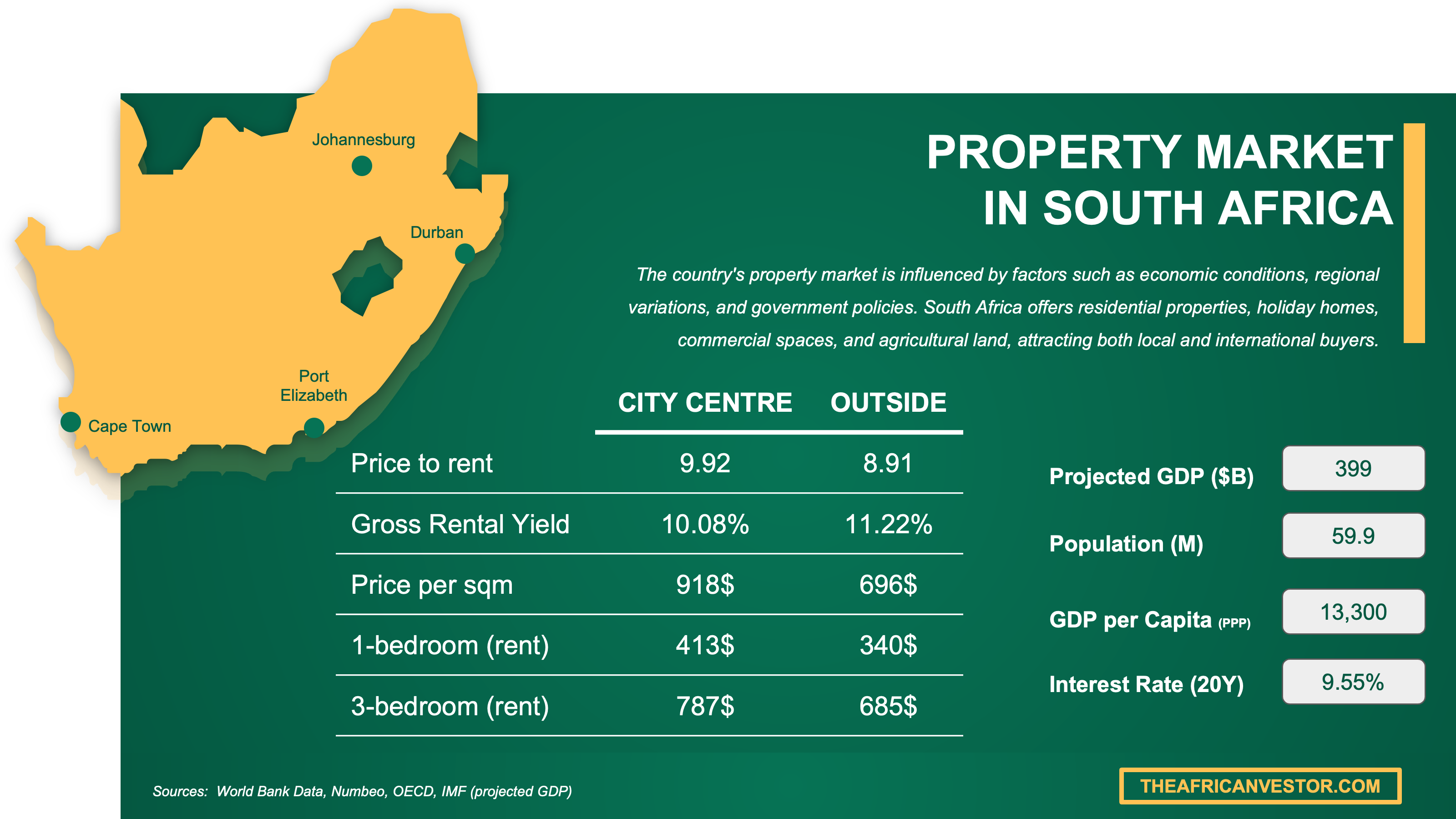

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

What insider lessons do foreigners share after buying in Cape Town?

What do foreigners say they did wrong in Cape Town right now?

The most common mistake foreigners say they made when buying property in Cape Town is trusting an agent's reputation or a property's appearance without independently verifying the agent's PPRA registration or the seller's ownership through official channels.

The top three regrets foreigners most frequently mention after buying in Cape Town are not insisting on a proper building inspection, underestimating the complexity and costs of sectional title schemes, and moving money before the paperwork was fully verified by a conveyancer.

The single piece of advice experienced foreign buyers most often give to newcomers in Cape Town is to appoint your own conveyancer early and route all verification and payments through them, rather than trusting documents or accounts provided by the seller or agent.

The mistake that cost foreigners the most money or stress in Cape Town was paying deposits into accounts not controlled by a conveyancer, which in some cases led to total loss of funds when deals fell apart or turned out to be scams.

What do locals do differently when buying in Cape Town right now?

The key difference in how locals approach buying property in Cape Town is that they treat the Deeds Registry as the only source of truth for ownership and are deeply skeptical of any document or promise that has not been verified through official channels.

A verification step locals routinely take that foreigners often skip in Cape Town is carefully reviewing body corporate financials, AGM minutes, and the maintenance reserve fund before buying sectional title, because locals know that scheme governance problems can turn a good apartment into a financial trap.

The local knowledge advantage that helps Cape Town residents get better deals is understanding that the city has extreme micro-markets, so the same suburb can have "gold" blocks and "problem" blocks depending on wind exposure, damp risk, short-term rental intensity, or body corporate quality, and locals know which streets to avoid.

Don't buy the wrong property, in the wrong area of Cape Town

Buying real estate is a significant investment. Don't rely solely on your intuition. Gather the right information to make the best decision.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Cape Town, we always rely on the strongest methodology we can ... and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Property Practitioners Regulatory Authority (PPRA) | The national regulator for real estate agents in South Africa. | We used it to explain agent regulation and what a Fidelity Fund Certificate means. We also used it to define what buyers should verify before paying any money. |

| South African Deeds Registry | The official registry for property ownership in South Africa. | We used it to explain how ownership is legally proven through registration. We also used it to guide verification of bonds, servitudes, and seller identity. |

| South African Revenue Service (SARS) | The tax authority and source of truth for transfer duty rates. | We used it to estimate the biggest upfront cost buyers face. We also used it to help buyers budget realistically for transaction expenses. |

| Community Schemes Ombud Service (CSOS) | The official ombud for sectional title and HOA disputes. | We used it to explain where buyers go when levy or trustee disputes arise. We also used it to highlight why scheme governance matters. |

| World Justice Project Rule of Law Index | A major international index measuring contract enforcement strength. | We used it to frame how reliable contract enforcement is in South Africa. We also used it to compare Cape Town's legal environment to other countries. |

| Lightstone Property | A recognized South African property data provider. | We used it to identify where foreign demand concentrates in Cape Town. We also used it to highlight which neighborhoods attract scam attempts. |

| Chief Surveyor General | The national authority for property boundaries and survey diagrams. | We used it to explain how buyers verify exact property boundaries. We also used it to show why fences are not reliable boundary markers. |

| Department of Employment and Labour | The source of official electrical installation regulations. | We used it to ground electrical compliance certificate requirements in law. We also used it to explain why compliance is a deal-critical item. |

| National Home Builders Registration Council (NHBRC) | The statutory body for new home building warranties. | We used it to explain what protection exists for new builds and off-plan purchases. We also used it to add a Cape Town-specific risk filter for developers. |

| City of Cape Town | The municipality responsible for rates clearance before transfer. | We used it to show that municipal clearance is mandatory, not optional. We also used it to explain what debts can delay property transfer. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Related blog posts