Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Johannesburg's property market is included in our pack

This blog post breaks down whether January 2026 is a smart time to buy property in Johannesburg, using fresh data and real market signals.

We look at current housing prices in Johannesburg, rental demand, buyer versus seller dynamics, and what local changes could shake things up.

We constantly update this article as new data comes in, so you always get the latest picture of the Johannesburg property market.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Johannesburg.

So, is now a good time?

As of early 2026, it's "rather yes" for buying property in Johannesburg, but your success depends heavily on choosing the right neighborhood and property type.

The strongest signal is that Johannesburg home prices are growing only around 3% to 6% per year, which barely beats inflation, meaning we're not in bubble territory.

Another strong signal is that rental demand remains solid, with rent increases outpacing inflation in well-located areas like Sandton, Rosebank, and Fourways.

Other positive signs include the recent interest rate cuts making mortgages more affordable, stable transaction volumes, and no signs of panic selling across the city.

The best strategy is to target secure estates or well-managed complexes in areas like Bryanston, Waterfall, or Parkhurst, plan to hold for at least 5 years, and consider renting out to benefit from strong tenant demand.

This is not financial or investment advice, we don't know your personal situation, and you should always do your own research before making any property decisions.

Is it smart to buy now in Johannesburg, or should I wait as of 2026?

Do real estate prices look too high in Johannesburg as of 2026?

As of early 2026, Johannesburg property prices appear roughly in line with fundamentals, growing at about 3% to 6% nominally per year, which translates to nearly flat growth in real terms once you subtract inflation running in the mid-3% range.

One clear on-the-ground signal is that time-on-market for Johannesburg listings sits in the "weeks to a few months" range rather than snapping up instantly, suggesting prices are not so low that buyers are scrambling, but also not so high that everything sits unsold.

Another signal worth noting is that transaction values are rising while sales volumes remain flat, which typically means the market is normalizing rather than overheating or crashing.

You can also read our latest update regarding the housing prices in Johannesburg.

Does a property price drop look likely in Johannesburg as of 2026?

As of early 2026, the likelihood of a meaningful property price drop in Johannesburg over the next 12 months appears low, mostly because inflation is contained and interest rates have been easing rather than spiking.

A plausible range for Johannesburg property prices over the next year is flat to down 3% in weaker submarkets like older high-levy apartments, while stronger nodes could see flat to modest gains.

The single most important factor that could trigger a price drop in Johannesburg would be a sudden spike in interest rates, which would squeeze affordability and potentially force some owners to sell.

However, this rate shock scenario looks unlikely in the near term, as the South African Reserve Bank has been on a cutting path and inflation remains within target, making aggressive hikes improbable.

Finally, please note that we cover the price trends for next year in our pack about the property market in Johannesburg.

Could property prices jump again in Johannesburg as of 2026?

As of early 2026, the likelihood of a renewed price surge across all of Johannesburg is medium, but specific high-demand areas like Sandton, Fourways, and Waterfall could see stronger gains if conditions align.

A plausible upside scenario for the best Johannesburg submarkets is 6% to 10% nominal annual growth, while the broader city would likely stay closer to mid-single digits.

The single biggest demand-side trigger that could push Johannesburg prices higher is faster and deeper interest rate cuts than households currently expect, which would boost buying power and draw more buyers into the market.

Please also note that we regularly publish and update real estate price forecasts for Johannesburg here.

Are we in a buyer or a seller market in Johannesburg as of 2026?

As of early 2026, Johannesburg sits in a balanced to mildly buyer-leaning market overall, though this varies sharply by neighborhood, with secure estates leaning toward sellers while high-supply apartment areas favor buyers.

Time-on-market in Johannesburg currently runs from a few weeks to several months depending on the property, which typically indicates that neither buyers nor sellers have overwhelming leverage, so both sides can negotiate.

While we don't have a single price-reduction percentage for all Johannesburg listings, the pattern of values rising while volumes stay flat suggests sellers are holding firm on price, but not always getting quick sales, which again points to balanced conditions.

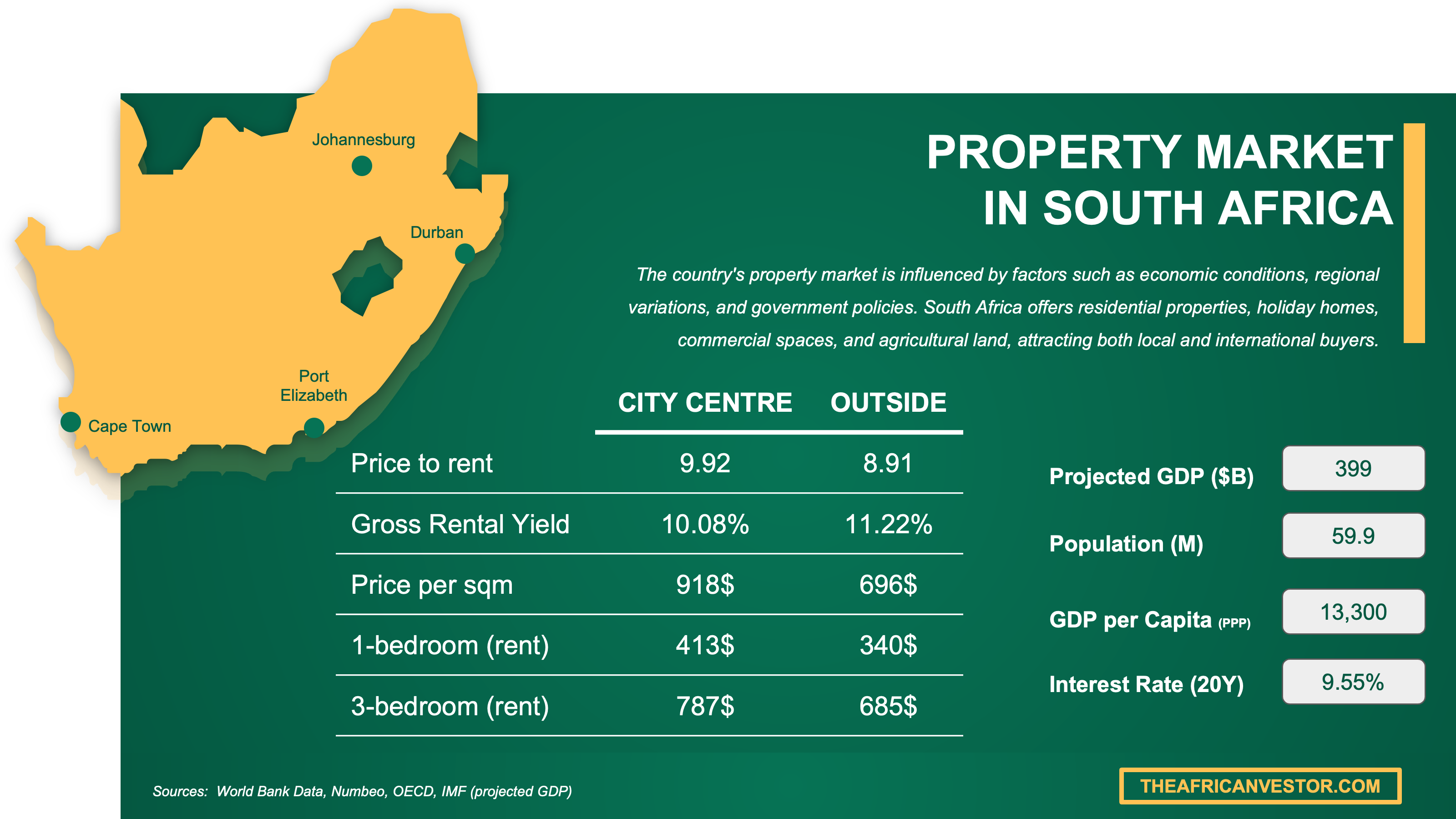

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Are homes overpriced, or fairly priced in Johannesburg as of 2026?

Are homes overpriced versus rents or versus incomes in Johannesburg as of 2026?

As of early 2026, Johannesburg homes appear roughly fairly priced to mildly high when compared to rents and incomes, with no signs of the extreme overpricing you see in bubble markets.

Johannesburg's price-to-rent ratio suggests that buying can make sense for those who plan to hold long-term, especially since rental growth has been outpacing inflation, meaning landlords can raise rents without losing tenants in good areas.

On the price-to-income side, South Africa's high unemployment and income constraints mean upper-end "nice-to-have" properties can sit longer, while affordable and secure homes in areas like Randburg or Midrand tend to sell because they match what buyers can actually afford.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in Johannesburg.

Are home prices above the long-term average in Johannesburg as of 2026?

As of early 2026, Johannesburg property prices appear to be around their long-term "fair" band in real terms, not at a historic extreme, because recent growth has been moderate and inflation has been contained.

Over the past 12 months, Johannesburg home prices have grown roughly 3% to 6% nominally, which is in line with or slightly below the pre-pandemic long-run pace, suggesting no unusual acceleration.

When adjusted for inflation, Johannesburg prices are not significantly above prior cycle peaks, meaning buyers today are not paying a dramatic premium compared to what the market has historically supported.

Get fresh and reliable information about the market in Johannesburg

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What local changes could move prices in Johannesburg as of 2026?

Are big infrastructure projects coming to Johannesburg as of 2026?

As of early 2026, the biggest infrastructure project with potential price impact in Johannesburg is the Gautrain expansion, with the Gauteng government committing around R120 billion to extend the network to areas like Fourways and potentially Soweto.

The timeline for this Gautrain expansion remains uncertain, with planning and funding discussions ongoing, and actual construction and delivery likely stretching over several years, so near-term price effects will depend more on announcements than completed stations.

For the latest updates on the local projects, you can read our property market analysis about Johannesburg here.

Are zoning or building rules changing in Johannesburg as of 2026?

As of early 2026, the most discussed zoning direction in Johannesburg is continued densification, with the City's Integrated Development Plan emphasizing spatial planning and development management in targeted growth corridors.

As of early 2026, these zoning discussions have not translated into major enacted rule changes that would immediately move prices, but if densification accelerates, it could increase apartment supply in areas like Sandton and Rosebank while potentially reducing land values for low-density plots.

The areas most likely to feel zoning effects in Johannesburg are the urban cores and transit-adjacent corridors, where the city is most focused on allowing higher-density development.

Are foreign-buyer or mortgage rules changing in Johannesburg as of 2026?

As of early 2026, there are no major foreign-buyer restrictions being introduced in Johannesburg, and the biggest rule-like change affecting buyers is the interest rate cycle itself, which has been moving in a favorable direction with recent cuts.

South Africa does not currently operate like markets that ban or heavily tax foreign buyers, so the main constraint for non-residents buying in Johannesburg is typically bank deposit requirements and compliance, which vary by lender and residency status.

On the mortgage side, the South African Reserve Bank's rate decisions remain the key variable, and with the recent easing trend, buyers in Johannesburg are seeing improved affordability compared to the higher-rate environment of previous years.

You can also read our latest update about mortgage and interest rates in South Africa.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Will it be easy to find tenants in Johannesburg as of 2026?

Is the renter pool growing faster than new supply in Johannesburg as of 2026?

As of early 2026, renter demand in Johannesburg appears to be keeping pace with or slightly exceeding new rental supply in most well-located nodes, though specific apartment clusters can still be oversupplied.

The strongest signal of renter demand in Johannesburg is that tenant payment performance remains solid, with around 80% or more of formal tenants in good standing, meaning the renter base is strained but still functioning.

On the supply side, Stats SA building data shows periods where residential building plans have declined rather than surged, which suggests that new rental stock is not flooding the Johannesburg market everywhere at once.

Are days-on-market for rentals falling in Johannesburg as of 2026?

As of early 2026, while there is no single official "days-on-market for rentals" statistic for Johannesburg, the fact that rent increases are beating inflation suggests that letting times are stable or improving in the best areas rather than blowing out.

In high-demand Johannesburg rental areas like Sandton edges, Rosebank, and Fourways, properties let faster than in weaker areas with poor management or security issues, where vacancies can linger for months.

One common reason letting times fall in Johannesburg is structural under-supply of secure, well-managed units near jobs and transport, which keeps demand concentrated in a limited pool of desirable properties.

Are vacancies dropping in the best areas of Johannesburg as of 2026?

As of early 2026, vacancies in Johannesburg's best-performing rental areas like Sandton, Rosebank, Parkhurst, and Waterfall are likely low-to-moderate and improving, based on the fact that landlords there can push rents above inflation without losing tenants.

These top Johannesburg rental nodes typically have lower vacancy rates than the overall market, where problem buildings with poor maintenance or security can sit with chronically high vacancy regardless of the metro average.

One practical sign that the best areas are tightening first in Johannesburg is when landlords start receiving multiple applications within days of listing, or when tenants renew at higher rents rather than risk losing a well-located unit.

By the way, we've written a blog article detailing what are the current rent levels in Johannesburg.

Buying real estate in Johannesburg can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Am I buying into a tightening market in Johannesburg as of 2026?

Is for-sale inventory shrinking in Johannesburg as of 2026?

As of early 2026, we cannot point to a single official Johannesburg inventory count, but market indicators suggest that for-sale inventory is not severely shrinking citywide, though select segments like secure family homes in lifestyle suburbs are tightening.

Using market strength and time-on-market as proxies, Johannesburg appears to have a few months of effective supply in most areas, which is consistent with a balanced market rather than an acute shortage or a glut.

One reason inventory stays relatively stable in Johannesburg is that sellers are testing prices without desperation, while new listings continue at a measured pace, so you don't see the dramatic drops some other markets experience.

Are homes selling faster in Johannesburg as of 2026?

As of early 2026, well-priced Johannesburg homes in strong neighborhoods are selling in a matter of weeks to a couple of months, which represents stable to modestly improving speed compared to slower periods, though this is not a "sell in 48 hours" frenzy.

Year-over-year, median days-on-market in Johannesburg appears stable rather than dramatically shortening, with correctly priced properties in areas like Bryanston or Lonehill moving faster than overpriced stock or commodity apartments.

Are new listings slowing down in Johannesburg as of 2026?

As of early 2026, we estimate that new for-sale listings in Johannesburg are neither collapsing nor surging, with the pattern of stable transaction volumes suggesting sellers are entering the market at a measured pace.

Johannesburg typically sees seasonal listing patterns with more activity in spring and summer months, and current levels appear in line with normal cycles rather than unusually low.

Is new construction failing to keep up in Johannesburg as of 2026?

As of early 2026, new construction in Johannesburg is uneven rather than uniformly failing to keep up, with some corridors receiving plenty of new apartment units while family-home suburbs remain structurally scarce.

Stats SA data shows periods where residential building plans in Gauteng have declined year-over-year, suggesting a softer pipeline that is not aggressively adding stock across the board.

The biggest bottleneck limiting new construction in Johannesburg is often municipal capacity, including permitting delays and infrastructure constraints like electricity and water connections, rather than a single factor like land availability.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

Will it be easy to sell later in Johannesburg as of 2026?

Is resale liquidity strong enough in Johannesburg as of 2026?

As of early 2026, resale liquidity in Johannesburg is strong in the right nodes and property types, meaning well-priced homes in secure areas like Sandton, Rosebank, or Fourways typically sell within weeks to a few months.

Median days-on-market for resale homes in Johannesburg's liquid segments sits comfortably within a healthy benchmark, while aging sectional-title buildings with high levies or poor management can take much longer.

The property characteristic that most improves resale liquidity in Johannesburg is location within a secure estate or well-managed complex near good schools and amenities, which consistently attracts the largest pool of qualified buyers.

Is selling time getting longer in Johannesburg as of 2026?

As of early 2026, selling time in Johannesburg appears stable compared to last year, with indicators suggesting a market that is working but price-sensitive rather than dramatically slowing.

Current median days-on-market in Johannesburg likely ranges from a few weeks for the best properties to several months for average or overpriced listings, with most activity falling somewhere in between.

One clear reason selling time can lengthen in Johannesburg is when sellers overprice relative to what buyers can afford, especially in a market where high unemployment and affordability constraints limit the pool of qualified purchasers.

Is it realistic to exit with profit in Johannesburg as of 2026?

As of early 2026, the likelihood of selling with a profit in Johannesburg is medium if you hold for a typical period, with short-term flipping quite difficult given modest price growth, but 5 to 10 year holdings offering realistic upside.

The minimum holding period in Johannesburg that most often makes exiting with profit realistic is around 5 years, which gives enough time for price appreciation to cover transaction costs and outpace inflation.

Total round-trip costs in Johannesburg, including transfer duties, agent commissions, and legal fees for buying and selling, typically run around 10% to 13% of the property value, which is roughly R200,000 to R260,000 on a R2 million home (approximately $11,000 to $14,500 USD or 10,000 to 13,500 EUR).

The factor that most increases profit odds in Johannesburg is buying below market through negotiation, distress sales, or mispricing, combined with choosing an area with durable demand like secure estates near Sandton or good school zones.

Get the full checklist for your due diligence in Johannesburg

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Johannesburg, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| South African Reserve Bank (SARB) | It's the central bank's official source for policy and benchmark interest rates. | We used it to anchor mortgage-cost assumptions and repo/prime rate direction. We also framed "wait versus buy" scenarios around rate-cut or rate-hold possibilities. |

| Statistics South Africa (CPI) | It's South Africa's official inflation authority and publishes the CPI series. | We used it to convert nominal home-price growth into real, inflation-adjusted growth. We judged whether price gains are genuinely overheating or just keeping pace with inflation. |

| FNB Property Barometer | It's a long-running, widely cited bank research product with transparent indicators. | We used it for buyer versus seller signals, time-on-market, and national price-growth tempo. We compared freestanding versus sectional-title momentum. |

| SAIV/FNB Property Barometer PDF | It republishes bank research through a professional valuation body's site. | We used it as a stable, citable PDF reference for market strength and time-on-market. We cross-checked narrative claims against the original FNB post. |

| Lightstone (transaction data) | It's a major South African property-data firm tied to deeds-based analytics. | We used it to anchor what actually sells in terms of volumes versus values. We sanity-checked portal-based average price figures. |

| Absa Homeowner Sentiment Index | It's a major bank's published consumer property sentiment survey. | We used it to gauge buyer willingness and constraints like deposit pressure. We cross-checked it as a demand temperature reading against price and supply data. |

| TPN/MRI Software Rental Monitor | TPN is a major rental credit bureau dataset owner with large tenant coverage. | We used it to infer rental tightness through escalation versus CPI and tenant good standing. We judged whether finding tenants is getting easier or harder. |

| PayProp Rental Index | PayProp is a large rental payments platform publishing a long-running index. | We used it to triangulate rent growth and tenant affordability signals. We supported statements about tenant demand holding up. |

| Stats SA Building Statistics | It's the official pipeline indicator for building plans passed and completions. | We used it to assess whether new supply is ramping up or lagging in Gauteng. We grounded claims about construction catching up or falling behind. |

| City of Johannesburg IDP | It's the city's official plan and priorities for the fiscal year. | We used it to identify local catalysts and risks around infrastructure and service delivery. We kept local analysis Johannesburg-specific rather than generic. |

| National Treasury Budget Review | It's the government's core fiscal document with macro assumptions. | We used it to frame macro constraints on growth, debt, and public investment. We interpreted how national fiscal stance affects rates, jobs, and buyer confidence. |

| FRED (BIS Property Prices) | It republishes BIS housing price series with consistent time-series access. | We used it to sanity-check long-run South African home price direction. We kept Johannesburg analysis anchored to historical context. |

| Property24 Johannesburg Trends | It's a major national property portal with metro trend dashboards. | We used it as a market-facing cross-check for Johannesburg averages. We triangulated it with Lightstone, FNB, and Stats SA rather than treating it as sole truth. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Related blog posts

- What are the best areas to buy a property in property in Johannesburg?