Authored by the expert who managed and guided the team behind the South Africa Property Pack

Yes, the analysis of Johannesburg's property market is included in our pack

Johannesburg is one of the few major African cities where foreigners can buy and own residential property outright in their own name, with no government approval required.

This guide covers everything you need to know about buying property in Johannesburg as a foreigner in January 2026, from ownership rules to mortgages to taxes.

We constantly update this blog post to reflect current prices, regulations, and market conditions in Johannesburg.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Johannesburg.

Insights

- Foreigners in Johannesburg can typically only borrow up to 50% of the property value from local banks, meaning you need at least half the purchase price in cash from abroad.

- When you sell your Johannesburg property as a non-resident, SARS can withhold 7.5% to 10% of the sale price upfront as a tax holdback, which catches many sellers off guard.

- Buying property in Johannesburg does not give you any pathway to South African residency or citizenship, unlike some other countries with golden visa programs.

- Sectional title apartments in Johannesburg complexes often have body corporate rules that ban or restrict short-term rentals like Airbnb, so check before buying for rental income.

- Johannesburg mortgage rates for foreigners in January 2026 typically range from 10.5% to 13%, depending on your deposit size and documentation strength.

- The single biggest mistake foreigners make in Johannesburg is not properly documenting the source of their purchase funds, which later creates serious problems when trying to repatriate sale proceeds.

- Annual municipal property rates in Johannesburg for a home valued at R2 million run roughly R14,000 to R20,000 per year, paid monthly to the City of Johannesburg.

- Closing costs in Johannesburg for foreign buyers typically range from 4% to 10% of the purchase price, with transfer duty often being the largest single expense.

What can I legally buy and truly own as a foreigner in Johannesburg?

What property types can foreigners legally buy in Johannesburg right now?

In January 2026, foreigners in Johannesburg can legally buy the same residential property types as South African citizens, including freehold houses, sectional title apartments, townhouses in gated complexes, and homes in lifestyle or security estates.

The most important practical limitation is not about what you can buy, but rather how you pay for it and how you document the funds, since South African banks and conveyancers require strict compliance with anti-money laundering rules known as FICA.

This means you will need to provide your passport, proof of address, and clear evidence of where your purchase money comes from, especially if you are paying from a bank account outside South Africa.

If you buy a sectional title property like an apartment or townhouse in a complex, you should also know that the body corporate rules can restrict things like pets, renovations, and short-term rentals, so always read these rules before committing.

Finally, please note that our pack about the property market in Johannesburg is specifically tailored to foreigners.

Can I own land in my own name in Johannesburg right now?

Yes, foreign individuals can own land in their own name in Johannesburg, including the land underneath a freehold house, with the ownership registered directly in the South African Deeds Office system.

This applies to all standard residential land in Johannesburg, although if you buy a sectional title apartment or townhouse, you technically own your unit plus an undivided share in the common property rather than a specific piece of land.

Unlike some countries that require foreigners to use company structures or long-term leases, South Africa allows direct individual ownership, which makes the process simpler and your rights stronger.

As of 2026, what other key foreign-ownership rules or limits should I know in Johannesburg?

As of early 2026, the rules that most affect foreign buyers in Johannesburg are financial and compliance-based rather than ownership quotas, meaning you need to focus on FICA documentation, proper banking channels for non-residents, and having a clean paper trail for your funds.

Unlike countries such as Thailand or Mexico, Johannesburg and South Africa have no foreign ownership quota on apartments or condos, so you can buy in any building regardless of how many other foreign owners there are.

The main registration requirement is that your purchase must be lodged with the Deeds Office through a licensed conveyancer, and if you plan to earn rental income, you will likely need to register with SARS (the South African Revenue Service) for a tax number.

There have been no major recent regulatory changes specifically targeting foreign property buyers in Johannesburg as of the first half of 2026, though the general FICA compliance requirements have become stricter over the years for everyone.

What's the biggest ownership mistake foreigners make in Johannesburg right now?

The single biggest mistake foreigners make when buying property in Johannesburg is treating the purchase like a simple real estate deal instead of a regulated cross-border money trail, often by paying deposits from random accounts without proper documentation of the funds' origin.

If you make this mistake, you may find yourself unable to smoothly repatriate your money when you eventually sell the property, facing delays, extra paperwork, or even blocked transfers because the bank cannot verify that your original funds came from abroad.

Other classic pitfalls in Johannesburg include buying a sectional title property without reading the body corporate rules and levy financials, not confirming that arrear rates and levies will be cleared before transfer, and underestimating the importance of using a non-resident banking channel from the start.

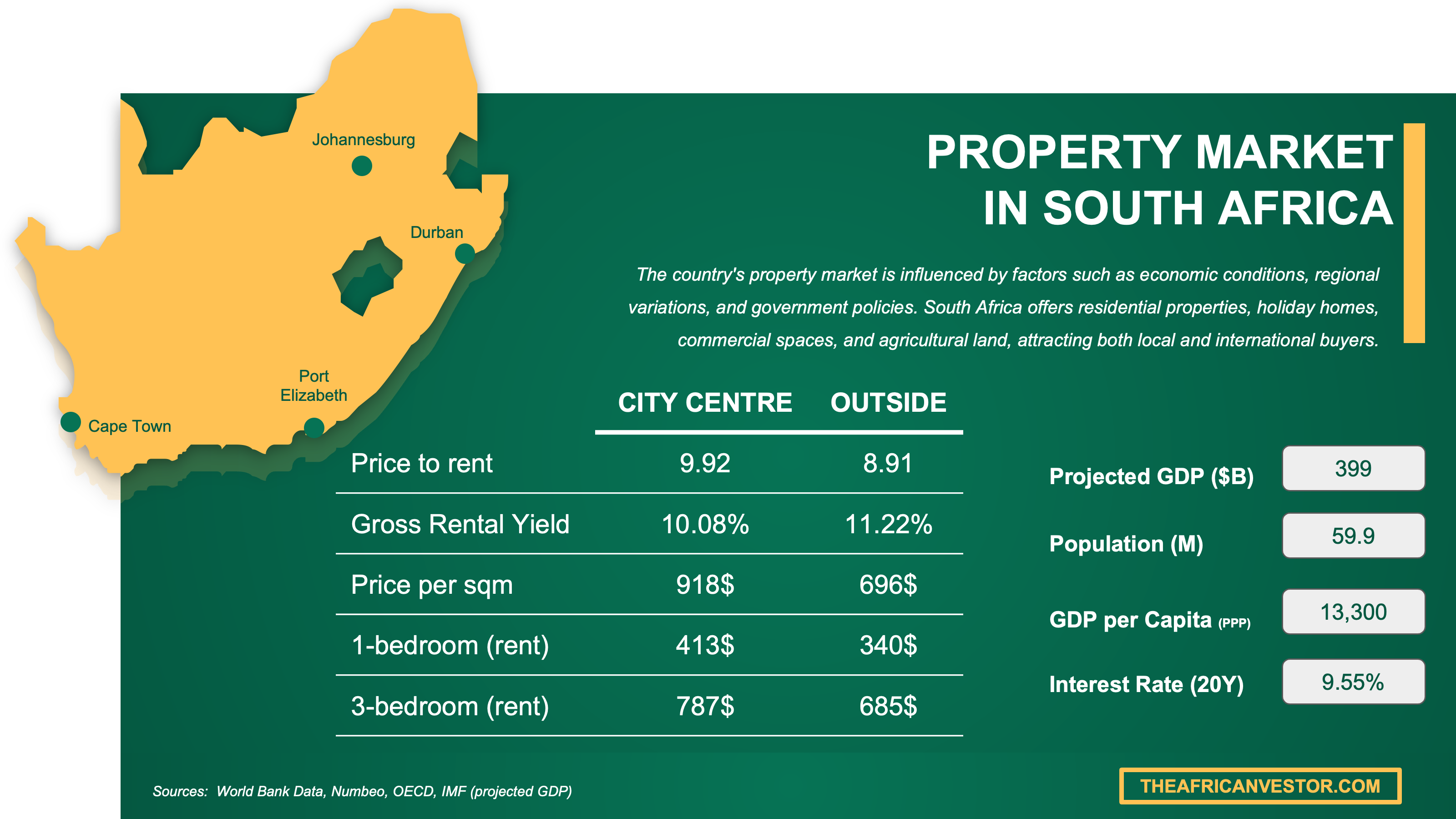

We have made this infographic to give you a quick and clear snapshot of the property market in South Africa. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which visa or residency status changes what I can do in Johannesburg?

Do I need a specific visa to buy property in Johannesburg right now?

You do not need a special property buyer visa to purchase residential property in Johannesburg, and many foreigners successfully buy while visiting on a tourist visa or even while living abroad without any South African visa at all.

The most common administrative hurdle for buyers without local residency is not visa-related but rather the FICA compliance process, where banks and conveyancers require extensive documentation of your identity, address, and source of funds before they will process the transaction.

You do not strictly need a South African tax ID (SARS number) at the moment of making an offer, but you will likely need one if you apply for a mortgage, plan to rent out the property, or want smoother ongoing compliance with tax obligations.

The typical document set a foreign buyer must present in Johannesburg includes a valid passport, proof of residential address (often from your home country), marital status declaration, and detailed evidence of where your purchase funds originated.

Does buying property help me get residency and citizenship in Johannesburg in 2026?

As of early 2026, buying residential property in Johannesburg does not automatically give you residency or citizenship in South Africa, and there is no golden visa or investor visa program tied to real estate purchases.

If you want to live long-term in South Africa, you typically need to qualify through other pathways such as critical skills work visas, business or investment visas (which require job creation or substantial business investment beyond just buying a home), retirement visas for financially independent individuals, or family-based applications if you have South African relatives.

We give you all the details you need about the different pathways to get residency and citizenship in Johannesburg here.

Can I legally rent out property on my visa in Johannesburg right now?

Your visa status in South Africa does not directly affect your legal ability to rent out property you own in Johannesburg, since the right to collect rental income comes from your ownership of the property rather than your immigration status.

You do not need to live in South Africa to rent out your Johannesburg property, and many foreign owners manage their rentals from abroad using local letting agents to handle tenants, maintenance, and payments.

The most important things foreign landlords must know are that rental income from Johannesburg property is taxable by SARS regardless of where you live, that some sectional title complexes and estates have rules restricting or banning short-term rentals like Airbnb, and that when you eventually sell, SARS may withhold a percentage of the sale price as a tax advance.

We cover everything there is to know about buying and renting out in Johannesburg here.

Get fresh and reliable information about the market in Johannesburg

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

How does the buying process actually work step-by-step in Johannesburg?

What are the exact steps to buy property in Johannesburg right now?

The standard sequence to buy property in Johannesburg starts with finding a property, making an Offer to Purchase (OTP), having the seller appoint a conveyancer, completing FICA compliance documents, paying your deposit, arranging finance if needed, clearing municipal rates and levies, and finally registering the transfer at the Deeds Office.

You do not need to be physically present for most steps in a Johannesburg property purchase, since many foreigners sign documents via courier or secure digital workflows and grant a limited Power of Attorney to their conveyancer for the registration process.

The Offer to Purchase is the step that makes the deal legally binding in Johannesburg, as once both buyer and seller sign this contract, you are committed to the transaction unless a suspensive condition (like finance approval) is not met.

The typical timeline from accepted offer to final registration at the Deeds Office in Johannesburg ranges from about 8 to 12 weeks for a straightforward cash purchase, though mortgage-backed purchases or complex transfers can take longer.

We have a document entirely dedicated to the whole buying process our pack about properties in Johannesburg.

Is it mandatory to get a lawyer or a notary to buy a property in Johannesburg right now?

In Johannesburg, you must use a conveyancer (a specialist property attorney) to complete any property purchase, since South African law requires that transfers be lodged and registered through the Deeds Office by a qualified conveyancing attorney.

The key difference in Johannesburg is that the conveyancer handles the formal transfer and registration process, while a separate buyer's lawyer (which is optional) would review contracts, negotiate terms, and protect your interests during the deal, particularly useful for complex or remote purchases.

One key item to include in your conveyancer's scope is a full title deed search and confirmation that all municipal rates and body corporate levies will be cleared before transfer, since arrears can follow the property to the new owner.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in South Africa versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What checks should I run so I don't buy a problem property in Johannesburg?

How do I verify title and ownership history in Johannesburg right now?

The official authority to verify title and ownership history in Johannesburg is the Deeds Office (also accessible through DeedsWeb), where all property ownership is registered and where you can confirm the current owner and any conditions on the title.

The key document you should request is the current title deed, which your conveyancer can obtain and which shows the registered owner, the property description, and any endorsements or restrictions affecting the property.

A realistic look-back period for ownership history checks in Johannesburg is typically 10 to 20 years, which helps you identify any unusual patterns like rapid flipping, disputes, or previous claims on the property.

A clear red flag that should stop or pause your purchase is finding unresolved disputes over ownership, unexpected servitudes or restrictions, or evidence that the property was sold under a cancelled or invalid deed.

You will find here the list of classic mistakes people make when buying a property in Johannesburg.

How do I confirm there are no liens in Johannesburg right now?

The standard way to confirm there are no liens or encumbrances on a Johannesburg property is to have your conveyancer conduct a Deeds Office search, which reveals any registered mortgage bonds, and to require municipal and body corporate clearance certificates before transfer.

One common type of lien to specifically ask about in Johannesburg is outstanding municipal rates and service charges, since these arrears can attach to the property and become the new owner's problem if not cleared before transfer.

The best form of written proof showing lien status in Johannesburg is a combination of a clean Deeds Office search (showing no registered bonds or only bonds that will be cancelled on transfer) plus a municipal clearance certificate and, for sectional title properties, a body corporate levy clearance certificate.

How do I check zoning and permitted use in Johannesburg right now?

The authority to check zoning and permitted use in Johannesburg is the City of Johannesburg's town planning department, and your conveyancer can confirm the zoning classification as part of their due diligence on the property description.

The document that typically confirms zoning classification in Johannesburg is the property's zoning certificate or the approved town planning scheme map, which shows whether the property is zoned for residential use and any specific conditions.

A common zoning pitfall foreign buyers miss in Johannesburg is assuming that buying a sectional title apartment automatically gives you freedom to run short-term rentals or home businesses, when in reality the body corporate rules often function like zoning restrictions and can ban or limit such uses entirely.

Buying real estate in Johannesburg can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Can I get a mortgage as a foreigner in Johannesburg, and on what terms?

Do banks lend to foreigners for homes in Johannesburg in 2026?

As of early 2026, South African banks do lend to foreigners for homes in Johannesburg, though the terms are more conservative than what local residents receive, and approval depends heavily on your documentation and deposit size.

The realistic loan-to-value (LTV) range for foreign borrowers in Johannesburg is typically up to 50%, meaning you generally need to fund at least half the purchase price yourself from foreign-sourced funds.

The single most important eligibility factor determining whether a foreigner qualifies for a Johannesburg mortgage is the strength of your deposit and documentation, since banks want clear proof of income, a solid credit profile (even if from abroad), and a well-documented source of funds.

You can also read our latest update about mortgage and interest rates in South Africa.

Which banks are most foreigner-friendly in Johannesburg in 2026?

As of early 2026, the most foreigner-friendly banks for mortgages in Johannesburg are generally Standard Bank, FNB (First National Bank), and Nedbank, all of which have established non-resident banking channels and experience with foreign buyer transactions.

The most important feature that makes these banks more foreigner-friendly is that they have dedicated staff and processes specifically designed for non-resident clients, which means they understand the documentation requirements and can guide you through the compliance steps.

These banks will generally lend to non-residents without local residency, though the LTV is typically capped around 50% and you will need to demonstrate strong financials and a clear paper trail for your funds from abroad.

We actually have a specific document about how to get a mortgage as a foreigner in our pack covering real estate in Johannesburg.

What mortgage rates are foreigners offered in Johannesburg in 2026?

As of early 2026, mortgage rates for foreigners in Johannesburg typically range from about 10.5% to 13%, depending on your profile, with well-qualified buyers (large deposit, strong documentation) getting closer to prime rate and riskier profiles paying prime plus 1% to 2%.

South African mortgages are almost always variable-rate and linked to the prime lending rate, so there is generally no meaningful choice between fixed and variable options, and your rate will move whenever the Reserve Bank changes the repo rate.

We made this infographic to show you how property prices in South Africa compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What will taxes, fees, and ongoing costs look like in Johannesburg?

What are the total closing costs as a percent in Johannesburg in 2026?

The typical total closing cost for buying property in Johannesburg in 2026 ranges from about 4% to 10% of the purchase price, with cash buyers at the lower end and those taking out mortgages paying more due to bond registration fees.

For most standard transactions in Johannesburg, expect closing costs between 4% and 8% if paying cash, and between 6% and 10% if financing with a mortgage.

The specific fee categories that make up total closing costs in Johannesburg include transfer duty (a government tax), conveyancing and transfer attorney fees, Deeds Office registration fees, clearance certificates, and if applicable, bond registration attorney fees and bank initiation costs.

The single biggest contributor to closing costs in Johannesburg is usually transfer duty, which is calculated on a sliding scale based on the purchase price and can be a significant amount on higher-value properties.

If you want to go into more details, we also have a blog article detailing all the property taxes and fees in Johannesburg.

What annual property tax should I budget in Johannesburg in 2026?

As of early 2026, annual property taxes (called municipal property rates) in Johannesburg for a standard owner-occupied home valued at around R2 million typically run roughly R14,000 to R20,000 per year (approximately $750 to $1,100 USD or €700 to €1,000 EUR), paid monthly to the City of Johannesburg.

Municipal property rates in Johannesburg are assessed based on a rate-in-the-rand applied to the municipal valuation of your property, with some thresholds and rebates potentially reducing the amount for certain property values or owner categories.

How is rental income taxed for foreigners in Johannesburg in 2026?

As of early 2026, rental income earned by foreigners from Johannesburg property is taxed as South African source income at progressive tax rates, with the effective rate depending on your total taxable income and allowable deductions for expenses like rates, bond interest, insurance, and repairs.

Foreign owners must register with SARS if earning rental income, file annual tax returns declaring their South African rental income, and should also be aware that when they eventually sell, SARS may withhold 7.5% to 10% of the sale proceeds as an advance payment toward any capital gains tax owed.

What insurance is common and how much in Johannesburg in 2026?

As of early 2026, annual buildings insurance premiums for a standard freehold home in Johannesburg typically range from about 0.1% to 0.3% of the building's replacement value per year (for a R3 million replacement value, roughly R3,000 to R9,000 or $160 to $500 USD or €150 to €450 EUR), with contents insurance adding more on top.

The most common type of property insurance coverage in Johannesburg is buildings insurance (covering the structure) combined with contents insurance (covering belongings inside), though for sectional title apartments the body corporate typically insures the building via levies and you only need contents cover.

The biggest factor that affects insurance premiums for the same property type in Johannesburg is location and security, since properties in higher-crime areas or without security features like alarms, electric fencing, or armed response subscriptions will pay significantly more than homes in secure estates or well-protected suburbs.

Get the full checklist for your due diligence in Johannesburg

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Johannesburg, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| South African Deeds Office | It's the official government registry for all property ownership in South Africa. | We used it to explain how ownership is recorded and verified in Johannesburg. We also used it to structure the title verification and lien-check guidance. |

| Sectional Titles Schemes Management Act | It's the official legislation governing apartment and townhouse complex ownership. | We used it to explain what you actually own in a sectional title property. We also used it to highlight body corporate rules and levy obligations. |

| South African Government Visa Portal | It's the official government service page for visa applications and requirements. | We used it to confirm that no special visa is needed to buy property. We also used it to explain visitor visa basics for buyers. |

| SA Government Permanent Residence Page | It's the official overview of permanent residency pathways in South Africa. | We used it to confirm that buying property does not grant residency. We also used it to outline the actual residency routes available. |

| SARS Non-Resident Tax Guidance | It's the official tax authority guidance specifically for non-residents. | We used it to explain how rental income is taxed for foreign owners. We also used it to describe allowable deductions and filing requirements. |

| SARS Withholding Guide for Non-Resident Sellers | It's SARS's official guide on the withholding tax when foreigners sell property. | We used it to warn buyers about the sale proceeds withholding requirement. We also used it to help foreigners plan for exit costs. |

| South African Reserve Bank Historical Rates | It's the central bank's official statistics page for key interest rates. | We used it to anchor the mortgage rate context for January 2026. We also used it to ensure our rate estimates reflect the real environment. |

| City of Johannesburg 2025/26 Rates and Tariffs | It's the municipality's official tariff document for property rates. | We used it to estimate annual municipal property rates for typical home values. We also used it to avoid guesswork on actual Johannesburg tax rates. |

| Standard Bank Non-Resident Banking | It's a primary bank source for non-resident account and lending information. | We used it to identify foreigner-friendly banking channels. We also used it to understand non-resident mortgage requirements. |

| FNB Lending Rates | It's a major South African bank's official rate publication page. | We used it to understand how banks quote prime-linked mortgages. We also used it to cross-check current lending rate levels. |

| Reuters SARB Rate Decision Coverage | Reuters is a top-tier news wire that accurately reports central bank decisions. | We used it to confirm the repo rate level going into January 2026. We also used it as a cross-check against official SARB data. |

| Department of Home Affairs Immigration Act | It's the official legislation text published by the immigration authority. | We used it to anchor the visa and residency discussion in actual law. We also used it to verify there are no nationality restrictions on ownership. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of South Africa. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Related blog posts